Most people know that Amazon, Walmart and Instacart have paid search placements on their websites. However, you may not know about their involvement in programmatic, display, social media and Google Shopping.

It is crucial for PPC marketers to understand this because retail media (a.k.a. commerce media) is driving customers to retail sites that can transact multiple brands and items in a single transaction.

This is especially true at retailers that hold everyday essential items, providing a path to regular visits, both online and offline.

Elizabeth Marsten, VP of commerce strategic services at marketing firm Tinuiti, shared her insights on the 2023 retail media landscape and all the need-to-know essentials in her session at SMX Advanced.

Retail media is basically a type of paid search. Every business has some sort of paid search offering in which they are able to harvest existing demand.

However, retail media differs from paid search in the sense that it is split into two categories, onsite and offsite:

- Onsite

- Sponsored search (product ads)

- Display banners

- Browse, category pages

- Coupons

- Offers

- Offsite

- Programmatic display (ideally through a curated network)

- Social media

- Email / newsletters

- SMS / push notifications

- Google Shopping PLAs

- OTT

How does retail marketing work?

Retail marketing is rooted in first-party data that’s been collected by companies for the last three decades. This data has been enabling marketers to better understand customers, how they behave and molded the shape of what we know to be retail marketing.

- “Just think about how much, for example, Kroger knows about you if you are someone who buys groceries on a pretty regular basis from a Kroger. Maybe you started your loyalty card program with your phone number, which you still enter every time you check out. Whether or not that’s through an app or a self-checkout stand,” Marsten said.

- “At the checkout stand itself, you have been entering that phone number for probably a good 20 years maybe. So even when you were getting cash back in those early 2000s and you bought a pack of gum or a Twix, you entered that phone number just in case. Well, technically, that data is what has led us to much better-targeted advertising for things you might actually want.”

Get the daily newsletter search marketers rely on.

What do paid search marketers need to know?

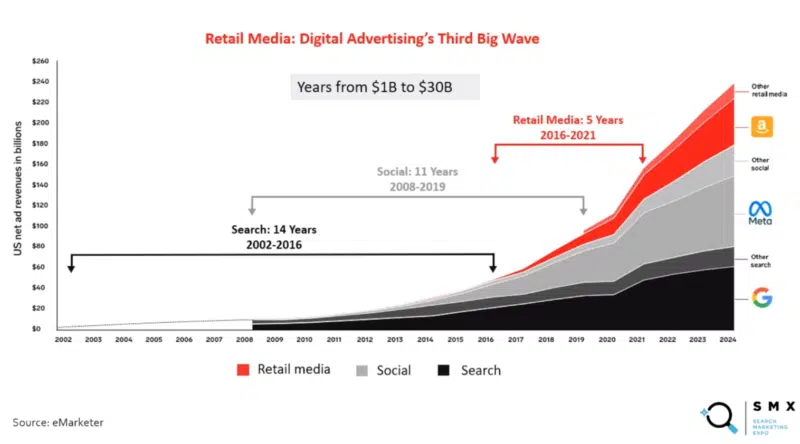

Marketers have been collecting data on consumers for 30 years and during that time, the industry has seen three big digital waves.

- The first big wave came in approximately 2002 when Google Ads started rolling out, along with similar products from companies like Microsoft and Yahoo. It took tech giants 14 years to reach $30 billion in advertising revenue.

- The second big wave started gaining traction in 2008 with the rise of social media. Brands like Meta, Twitter and Reddit took 11 years to achieve $30 billion in advertising revenue.

- The third wave began in 2016 with the arrival of retail media. This sector took just five years to hit the $30 billion goal.

Explaining why retail media has evolved so quickly, Marsten said:

- “If you worked for Google or Microsoft in the last 10 years or so, you probably have noticed that there aren’t a lot of big changes – for example, some of you may remember when Google renamed the Content Network to the Display Network. Those are pretty monumental changes that happen over time relative to digital advertising.

- “Now, when it comes to retail media, we are experiencing one of these every six months or so. So that is how fast things are coming up and changing and pivoting as we go on.”

Why in-store still matters

In store is still hugely important to retail media because this sector operates differently to D2C websites.

- “I care about in-store sales, I care about sales at the shelf and I care about sales at the self-checkout because I care about those digital touch points. “They tell us how we’re going to engage with the customer over and over again,” Marsten said

Marsten went on to talk about Walmart, which made $3 billion in advertising revenue last year. The company has huge retail media expansion plans in the future, and one significant advantage it has over competitors like Amazon its stores.

- “That’s 4,700 plus touch points in the United States alone. Think about how often folks go to get the essentials – I will be there every time outside and inside with my digital capabilities,” she said.

Retail marketers have the option of purchasing Google Shopping ads via Target Roundel, which appear in Google SERPs. Customers who click through will be taken to the target.com experience – but this is funded by you.

So you can essentially work with Target Roundel to boost in-store sales via Google searches in order to fill out your marketing budget. It’s a popular choice with many major retailers such as Best Buy and Home Depot, but there are details to consider:

- The product you’re selling must be in store.

- Run through Roundel so limited reporting mid-flight (monthly only).

- In store sales included.

- Could be complementary or competitive.

- “It does take a minute in terms of reporting. But you do get in store sales. If someone searches local inventory, then they go in the store and they buy it because they see online that it’s in stock, they just go in the store and buy it. And you will get credit for that. It is pretty cool. It is something that I would say keep an eye on in terms of capabilities and what it could be. I’m pretty excited about what their roadmap looks like for next year.”

Retail media has multiple connections to Microsoft, including:

- Hardware: In-store screens and Xbox

- Activation: Promote IQ, Microsoft Ads, Xander and Netflix

- Automation / Research: ChatGBT

- Insights: PowerBI

- Data: Azure / Project Oakes

- CDP: Dynamics 365 Customer Insights

Not to be outdone by Microsoft, retail media also works closely with Google in the following ways:

- Hardware: Pixel and Nest.

- Activation: DV360, YouTube, Google Ads and SA360.

- Automation / Research: Bard and Trends.

- Insights: Google Analytics and Looker.

- Data: Google Cloud and Pair.

- CDP: Customer Data Platforms and Google Cloud.

Commenting on retail media’s relationship with Google, Masrten added:

- “Similar to Microsoft, if you were a retailer and perhaps you had a Google stack, working with a whole bunch of different capabilities at Google, you can make it really easy for a brand to come in and activate across multiple channels or multiple platforms. But also, hopefully, eventually, we’ll get to a spot where insights can come forward in a way that is digestible and actionable. I would say we’re still working on that. This is a big wave and we’re still going!”

Key takeaways

Marsten concluded her talk by outlining the four key points she would like marketers to keep in mind when it comes to retail media:

- Lots of similar options: There are a lot of similarities in terms of who’s working with who.

- A bit jumbled: We’re still building out and there are similarities with Google and Microsoft regarding how they built out their capabilities.

- Stores. Stores. Stores: A lot of opportunity left to tie together. Think about how much money transacts through a store and potential capabilities from an in-store experience perspective.

- Watch the intersection of PPC (Google and Microsoft) and retail media for overlap: You better believe that they’re not going to be left out when it comes to retail media.

Source link : Searchengineland.com