Brand Breakdown Series

Welcome to the Brand Breakdown series, a monthly deep dive into the marketing strategies of leading global brands.

We’ll be exploring the winning, and losing, strategies that are pushing the boundaries of traditional marketing through the lens of owned asset optimization (OAO), a new approach to building consumer connection.

Subscribe today for unique insights straight to your inbox, exploring how the world’s most recognizable brands are connecting with consumers.

The global value of the electric vehicle (EV) market is projected to reach $1.58 trillion by 2030 with EVs accounting for more than two-thirds of global car sales by the end of the decade.

Although Tesla has a huge head start, traditional automakers are coming off the sidelines with plans to introduce 75 new EV ****** by 2030. Consumer adoption will accelerate as prices drop, battery technology improves, and charging infrastructure becomes ubiquitous.

In other words, electric vehicles aren’t a passing trend.

Yet, despite these positive signals, there are plenty of articles about sliding consumer demand, EVs sitting on lots, and production pauses.

So, is the EV market’s battery drained or fully charged?

The $1.8 trillion EV market at-a-glance

If auto brands want a slice of that $1.5 trillion pie, they’ll need to understand what’s driving consumer behavior so they can build loyal relationships in the years to come. Despite a projected slowdown in 2024, brands that authentically help consumers transition now will be positioned to win in the growing market long term.

High gas prices drive consumer interest in EVs

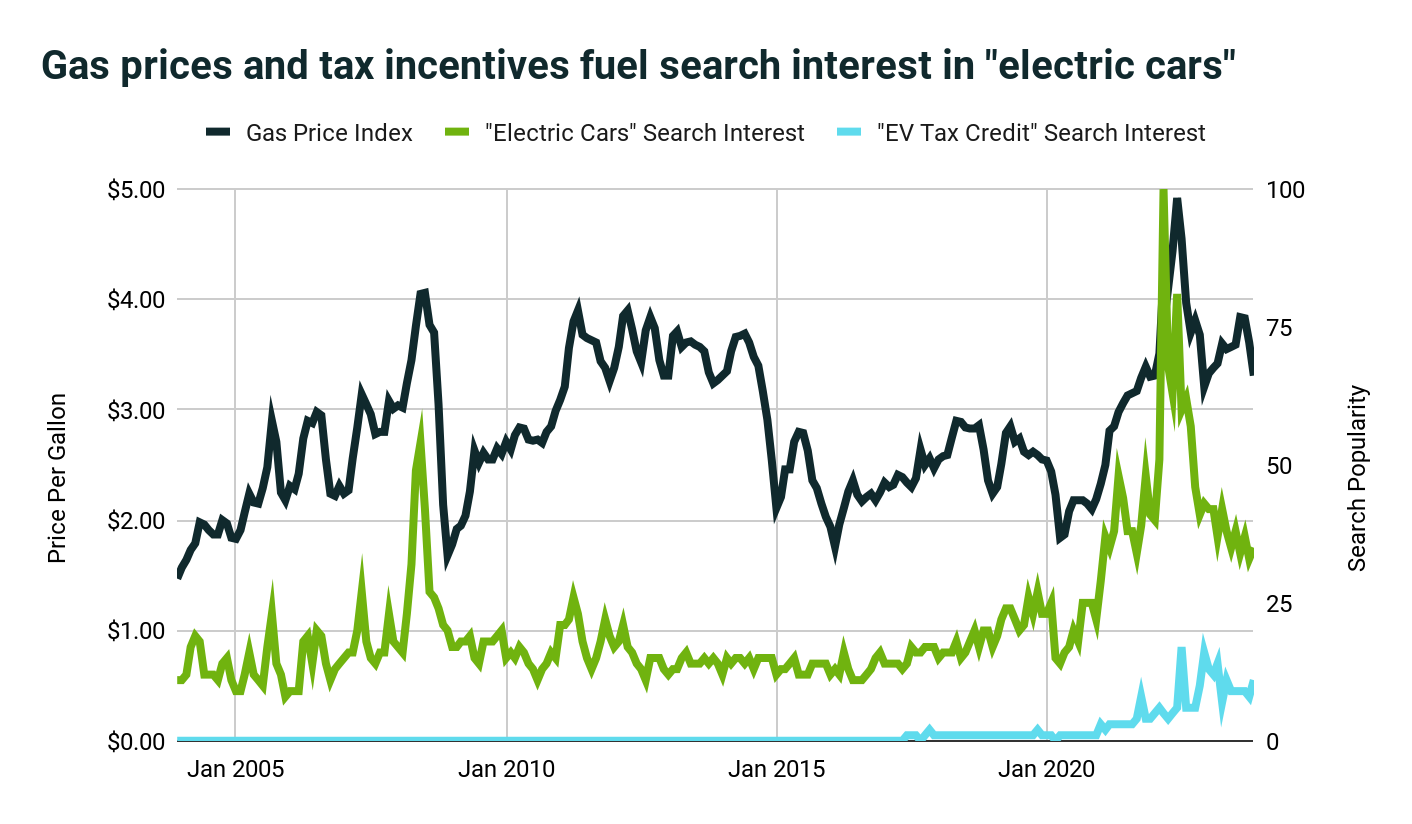

Consumer search data from Google Trends reveals the biggest drivers for electric vehicle searches are tied to our wallets.

The price at the pump is the single biggest motivator for electric vehicle searches. Each time gas prices spiked above $3 per gallon, consumers searched Google for electric vehicles. EV search popularity exploded in February 2022 when gasoline set a new record high of $4.22 before peaking at $4.92 per gallon in June 2022.

Although gasoline prices have decreased, EV search interest still remains high, supported by tax credits that make buying or leasing an EV more affordable.

Since saving money motivates consumers to consider EVs, analysts predict massive consumer adoption as electric vehicles become cheaper than combustion vehicles by 2026.

Tesla is still king, but it’s losing market share

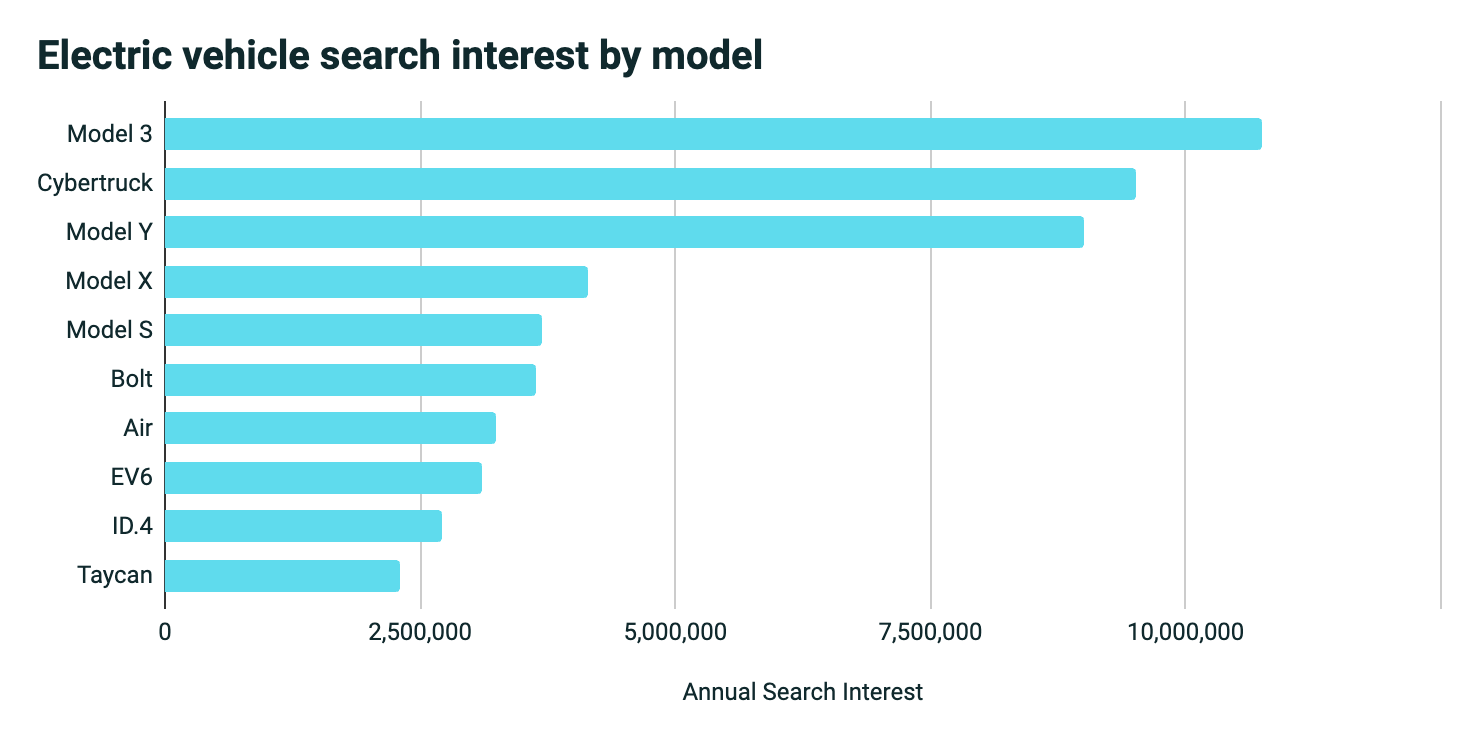

Tesla has been the EV category king for more than a decade, and in 2023 the Model Y was the best selling vehicle in the world. Looking at consumer search data, the top five most searched for electric vehicle ****** are all made by Tesla.

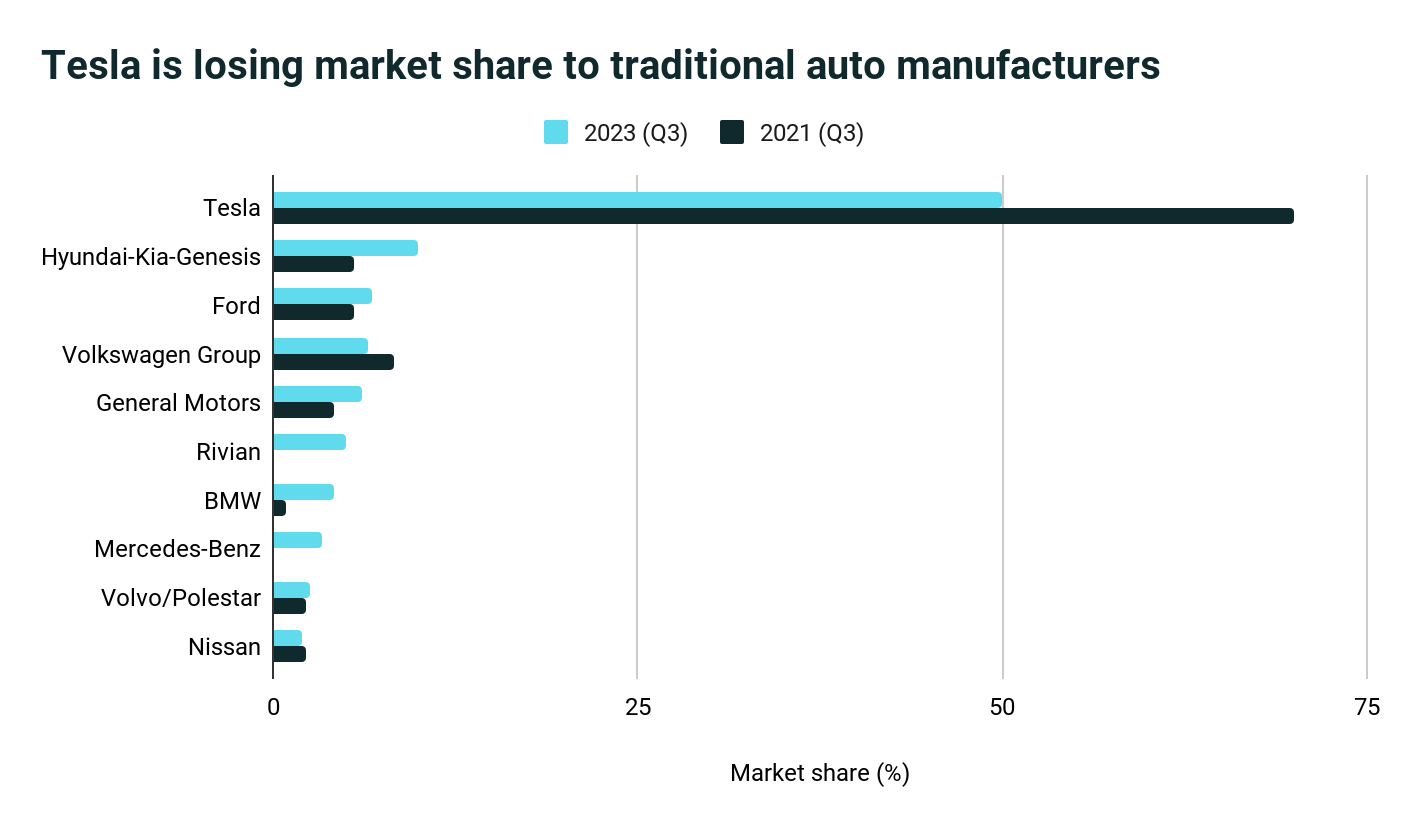

However, despite Tesla’s commanding lead, traditional auto manufacturers are chipping away at its share of the total addressable market (TAM). According to Kelley Blue Book, Tesla’s market share declined by 28.6% between 2021 and 2023 as new buyers and competitors entered the market. Furthermore, Bank of America estimates that Tesla’s share of the EV market will plummet to 18% by 2026.

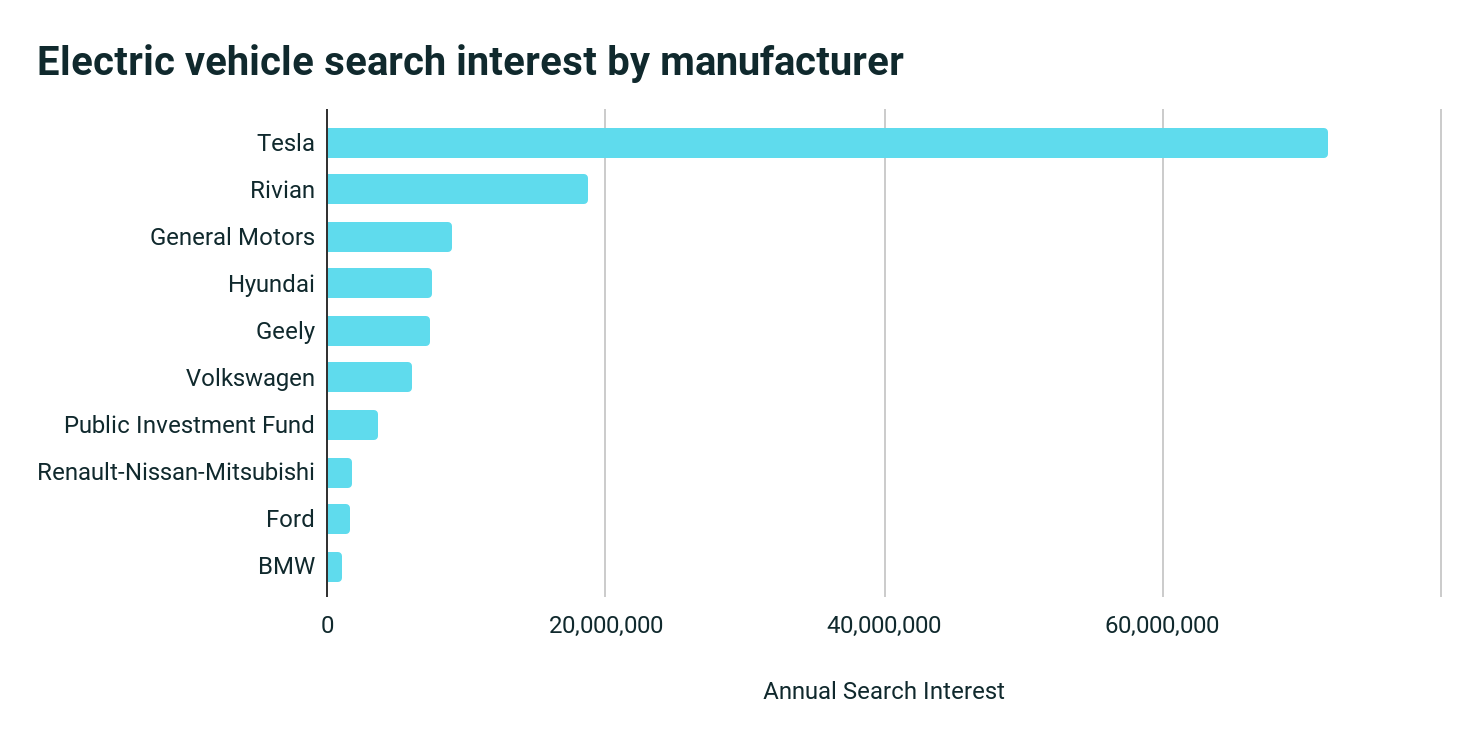

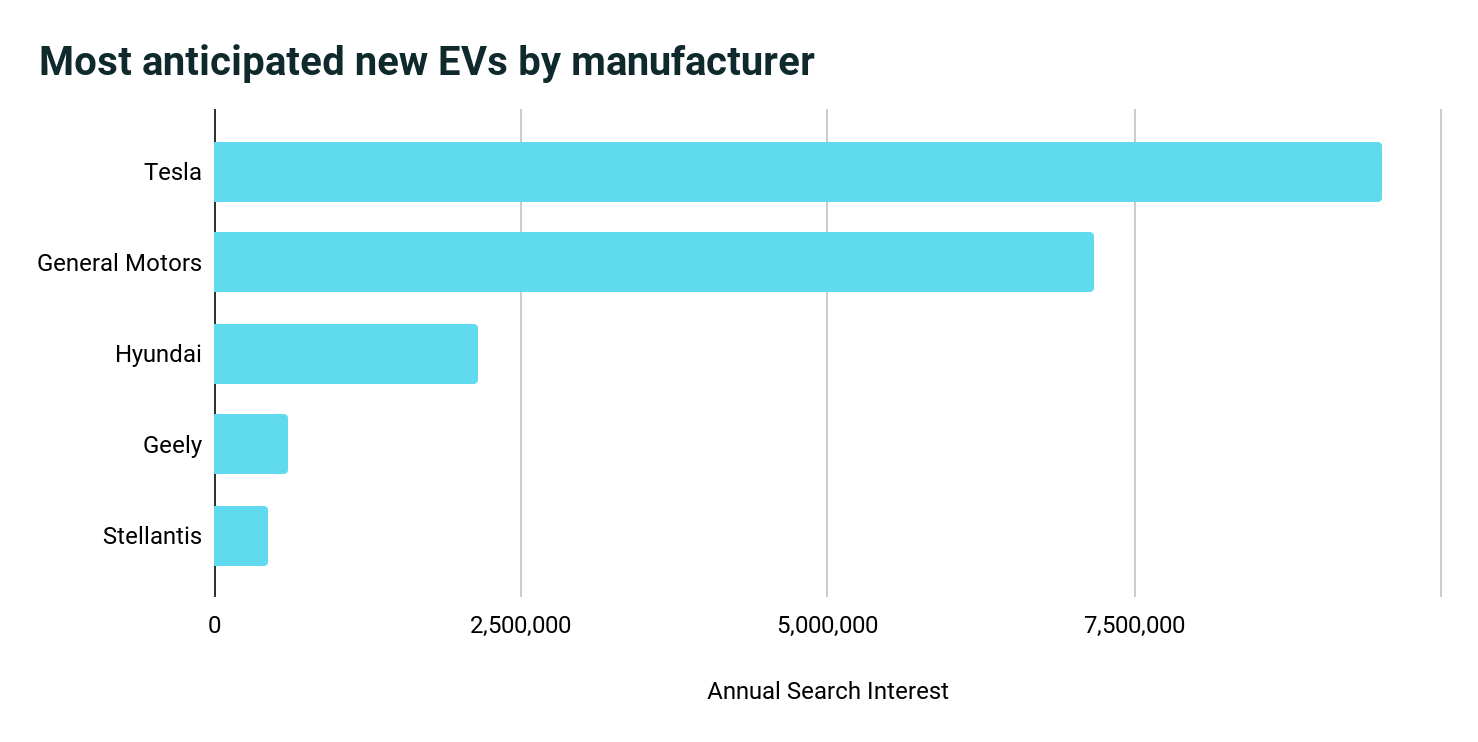

While sales are important to understand current market share, they don’t predict the future — especially with so many new ****** on the horizon. To understand where the market is headed, brands can analyze consumer search interest. If we analyze search data by manufacturer instead of by car model, Tesla’s lead begins to shrink.

The chart above reveals that, among traditional automakers, GM has the most search interest for its current and upcoming electric vehicle pipeline. Although Rivian has twice the search interest as GM, the EV brand could be facing significant headwinds in the next two years due to new competition in the electric truck segment.

Consumer search data signals anticipated ******

When consumers search on Google, they have an immediate need — a burning question that’s driving their behavior. If marketers tap into that curiosity, we can understand what consumers need, want, and feel, which could indicate how they’ll spend in the future.

Search interest (how often something is searched on Google and whether the trend is increasing) is one potential indicator of future sales performance. For example, if lots of folks are searching for Cybertruck and the trend is increasing, it’s likely the vehicle will sell well when it’s released.

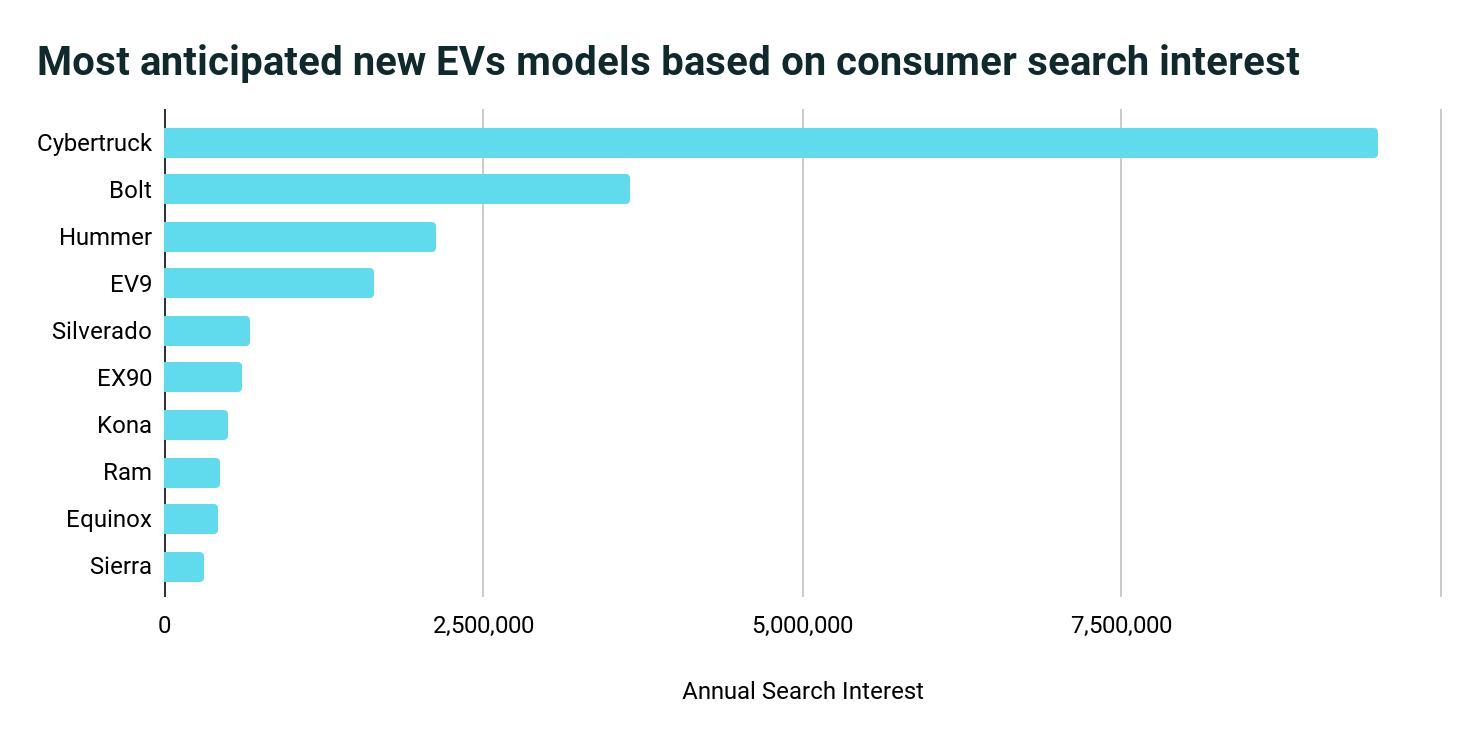

Let’s look at the most anticipated new EV ****** arriving between 2024 and 2026, ranked by search popularity. (We included the Chevy Bolt here because the current model was discontinued and will be relaunched as a new vehicle in the next few years).

Half of the most anticipated EV ****** are trucks, which is bad news for Rivian because it means more competition. But this chart is great news for GM which makes five out of the top ten most anticipated new ******.

The data gets really interesting when we group the above ****** by manufacturer. GM jumps into second place, and Tesla’s advantage in terms of consumer search interest in new ****** shrinks even further.

How can General Motors capitalize on the opportunity to close the gap with Tesla? What topics are EV shoppers most interested in?

What consumers really care about in the EV market

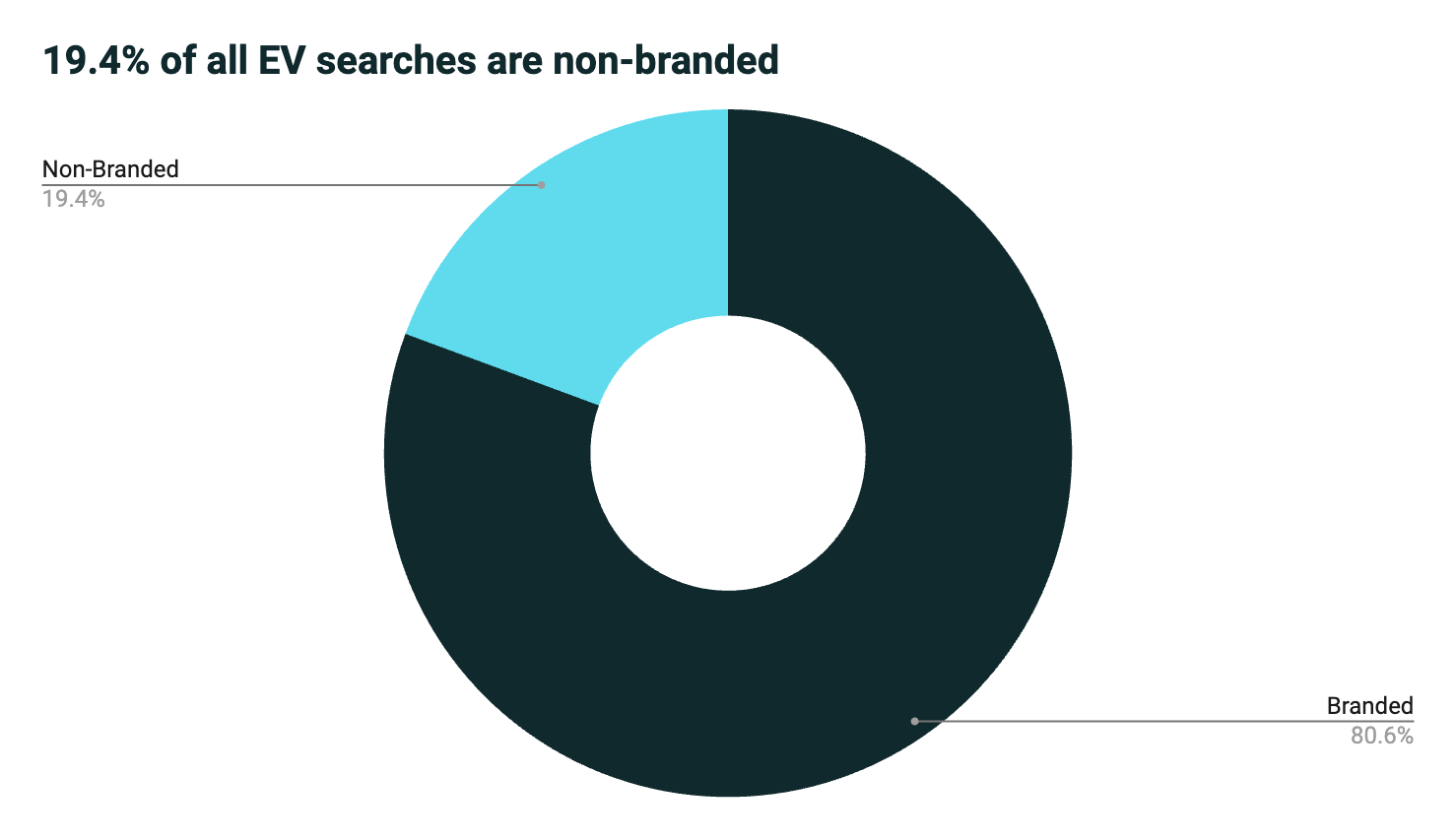

Americans searched for information about EVs more than 165 million times over the past 12 months. Among those searches, 19.4% were purely informational and did not mention a brand. That’s 31.9 million opportunities to connect with consumers along their journey towards electrification.

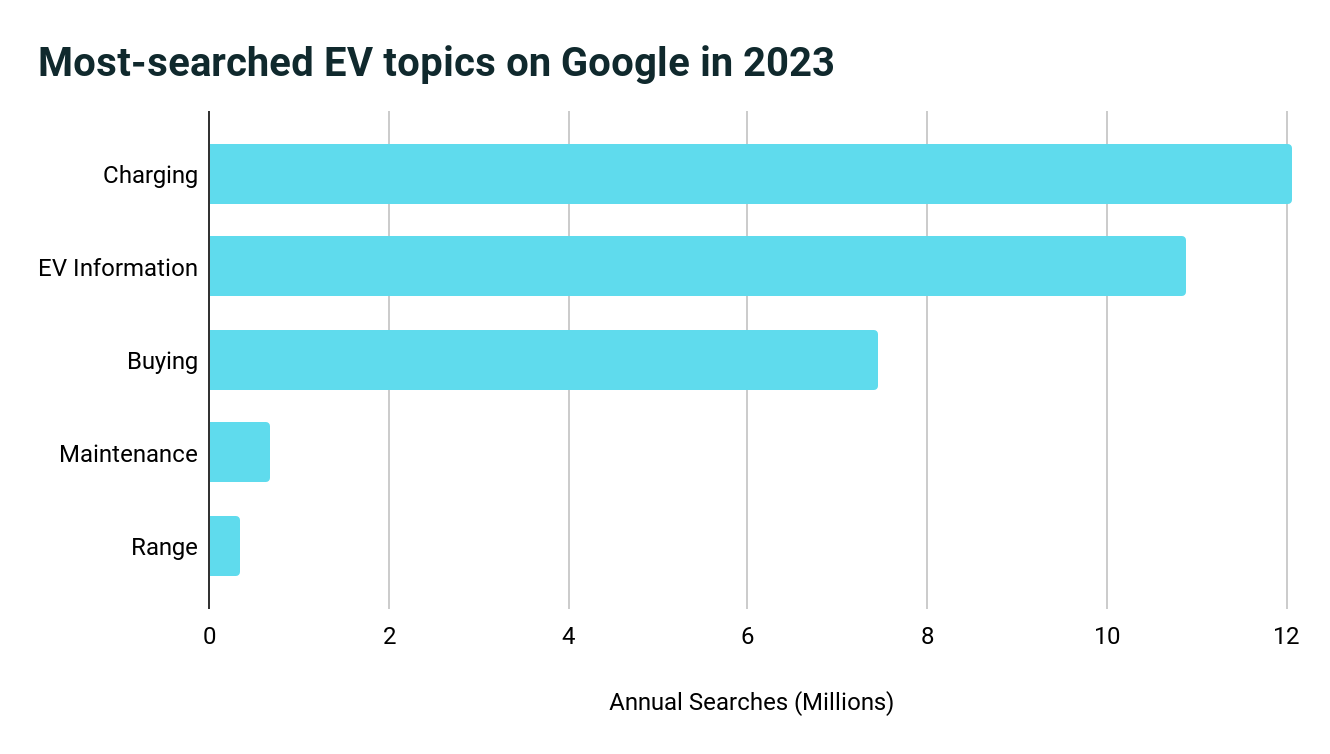

Terakeet segmented those 31 million non-branded searches into five categories to see which topics consumers care most about. And the results were surprising.

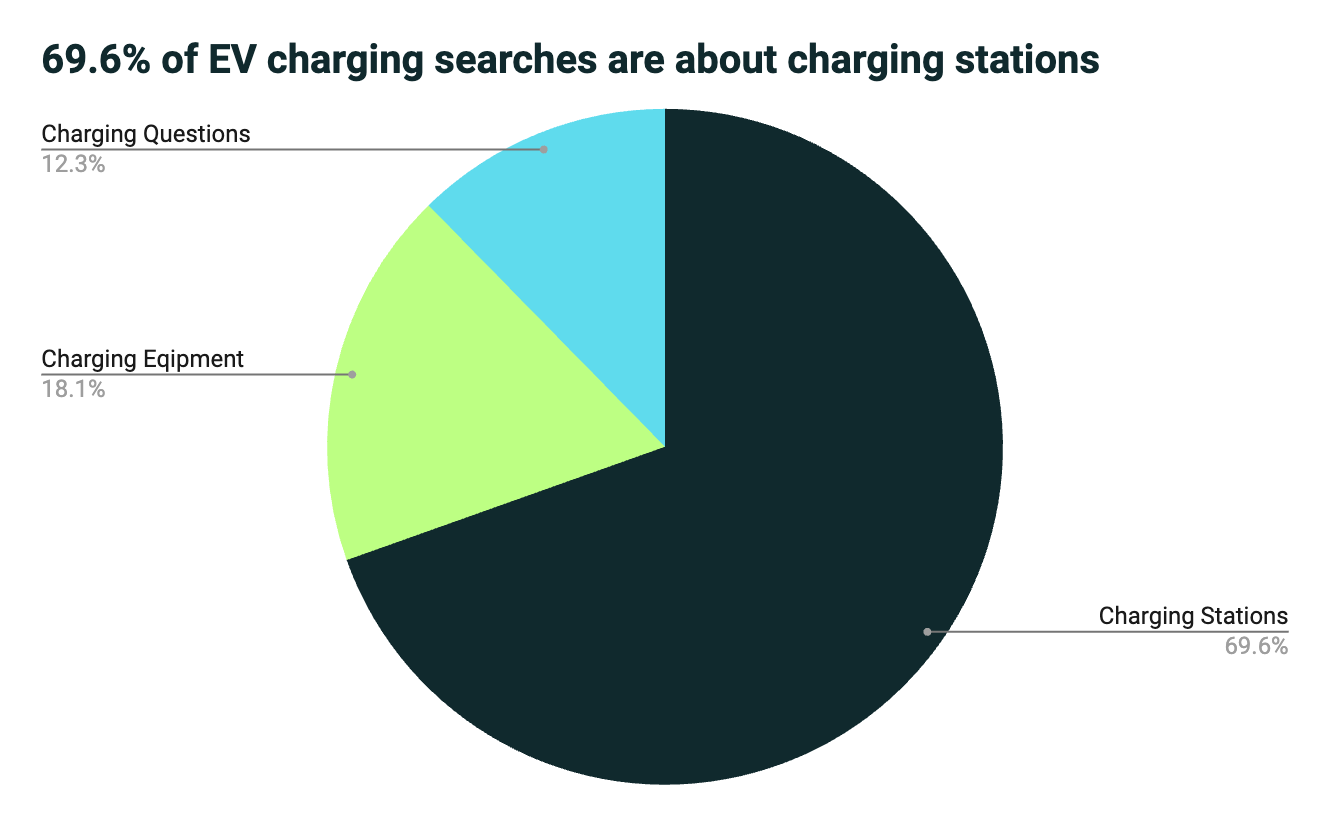

Most vehicle manufacturers are obsessed with range, but consumers rarely search for that topic on Google. Instead, they want to know about charging.

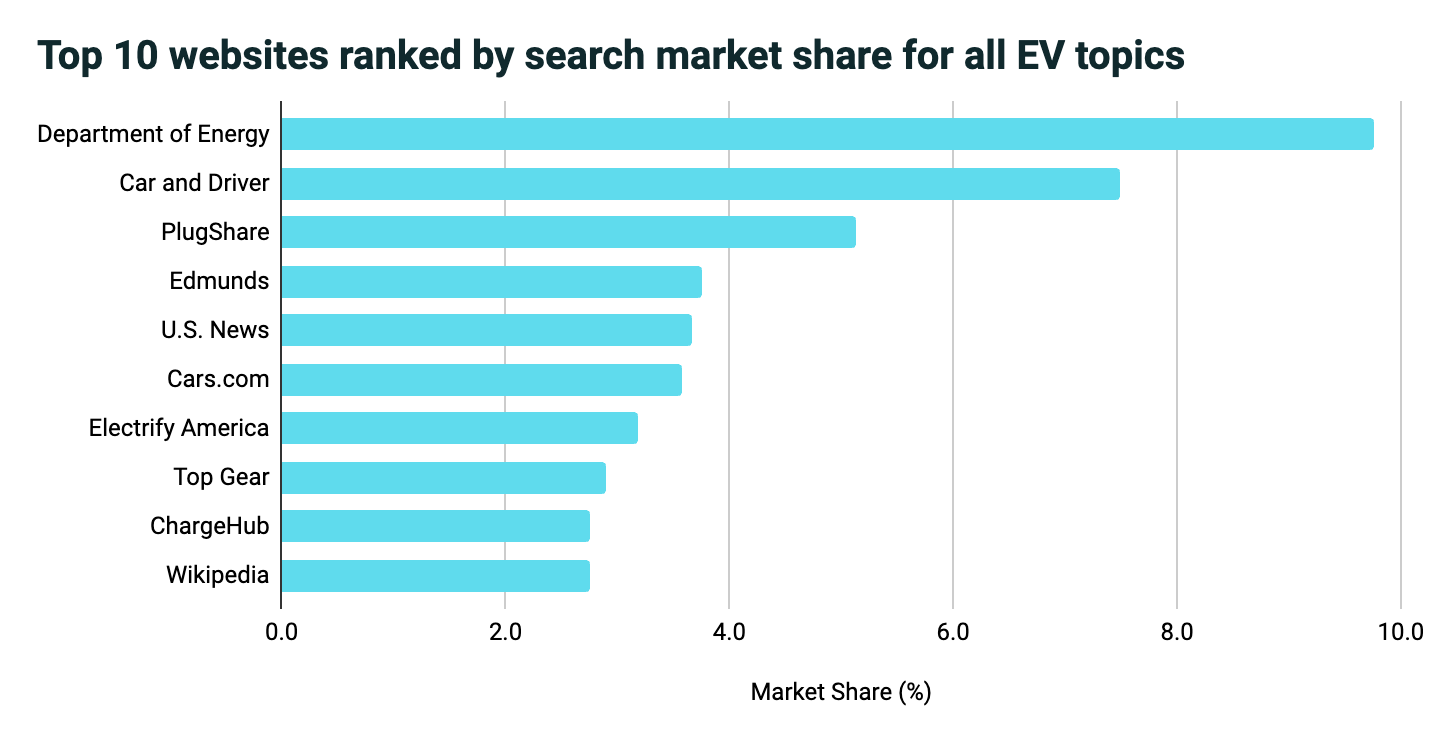

Which websites are meeting consumers’ needs across all non-branded EV categories?

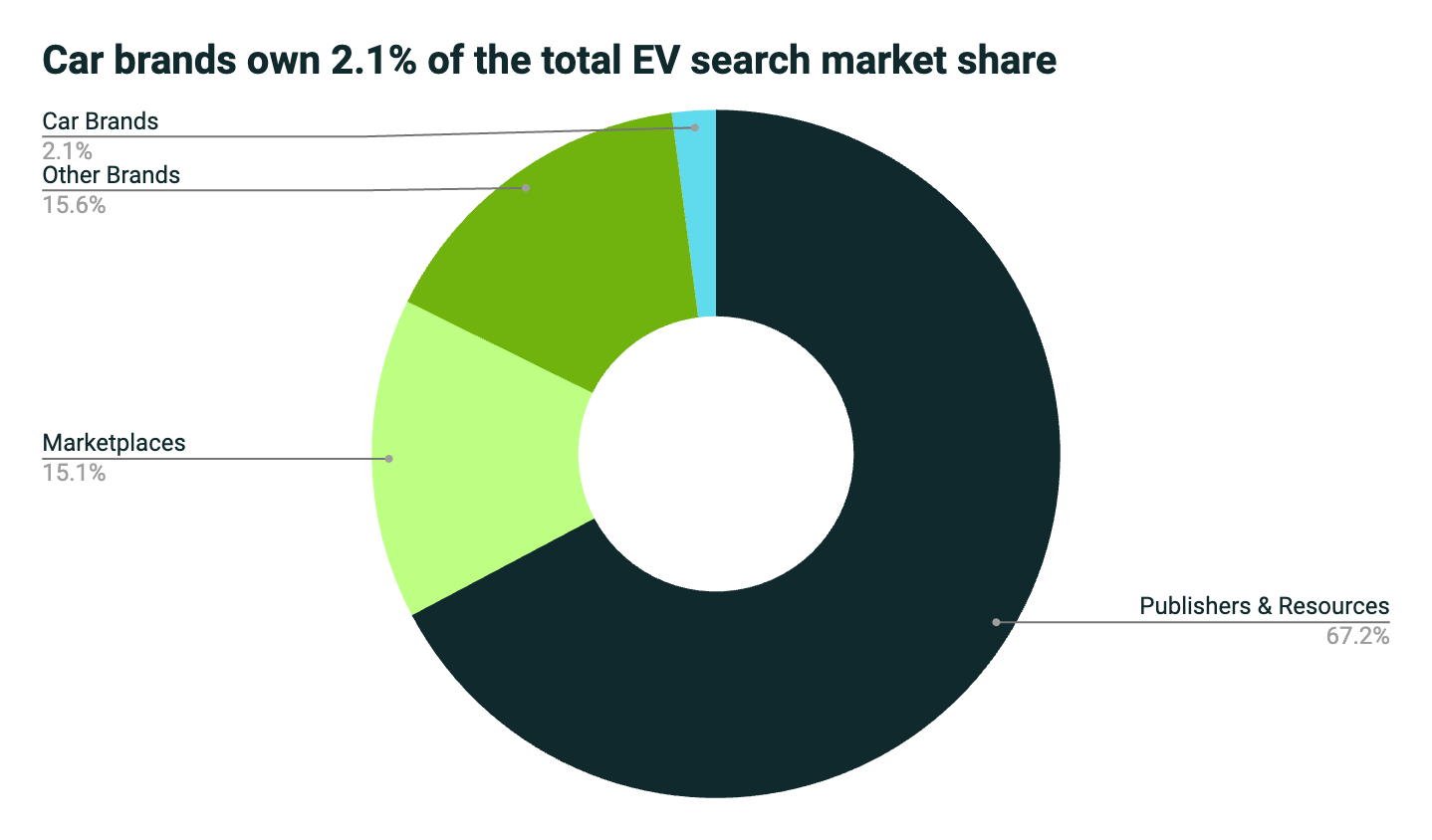

It’s shocking that not a single car manufacturer makes the top ten websites ranked by organic search market share. In fact, only two manufacturers, Tesla and Rivian, show up in the top 30 websites.

More than 82% of the total organic search market share is held by publishers and resources, or marketplaces. Car brands only earned 2.1% of the organic search market share.

Why consumers care more about charging than range

Most EV marketing materials highlight a vehicle’s EPA range instead of the miles per gallon (MPG) data you see for combustion engines. Although range is important — especially on long road trips — it’s not what consumers care most about.

That’s because the average American only drives about 37 miles per day, and most EVs on the market have well over 200 miles of EPA estimated range. So if you juice up at home every *****, you’ll never need to worry about running out of power during normal daily use.

But charging is unfamiliar territory for drivers, so they have plenty of questions about how it works. The three most pressing questions included charging station locations, home charging equipment, and general questions about costs and time to charge.

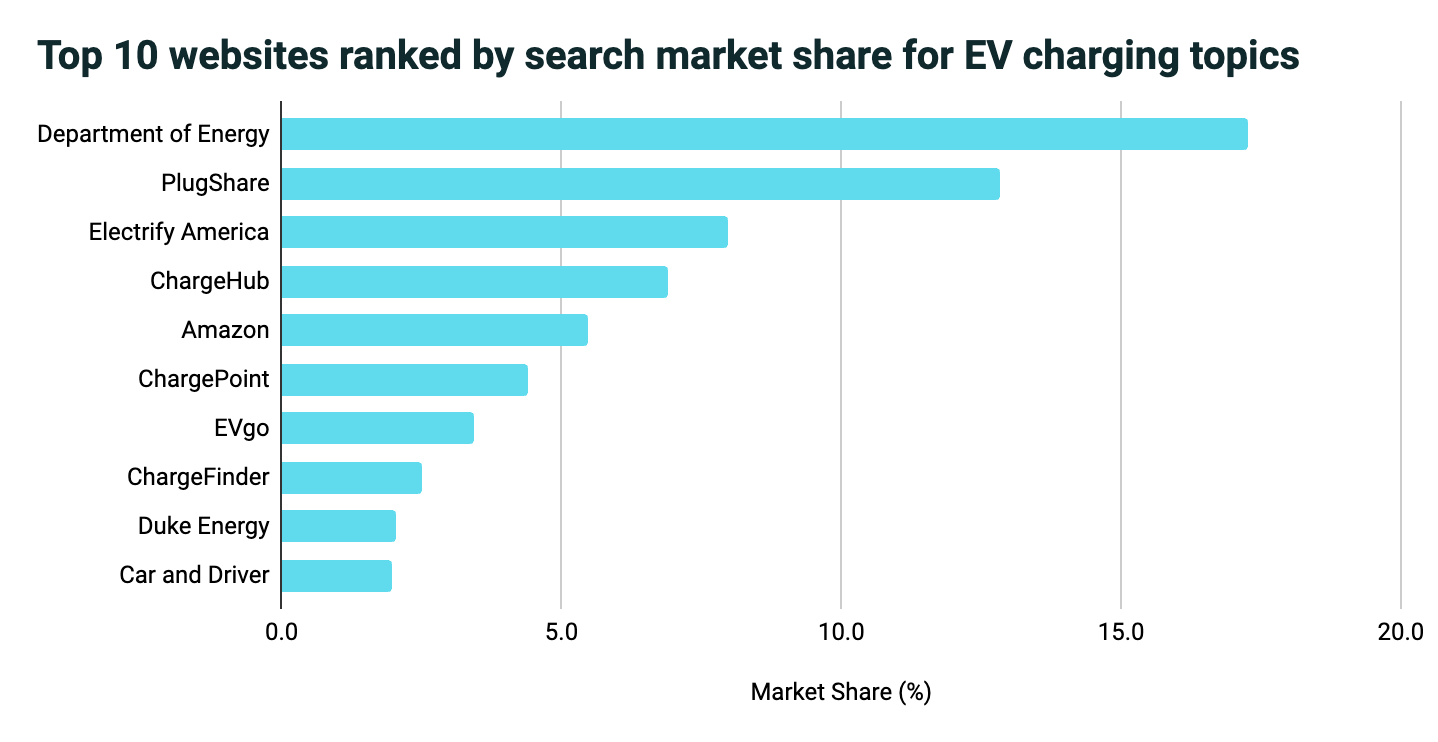

It’s not surprising that charging brands dominate this category, controlling six of the top ten positions.

Source: Terakeet

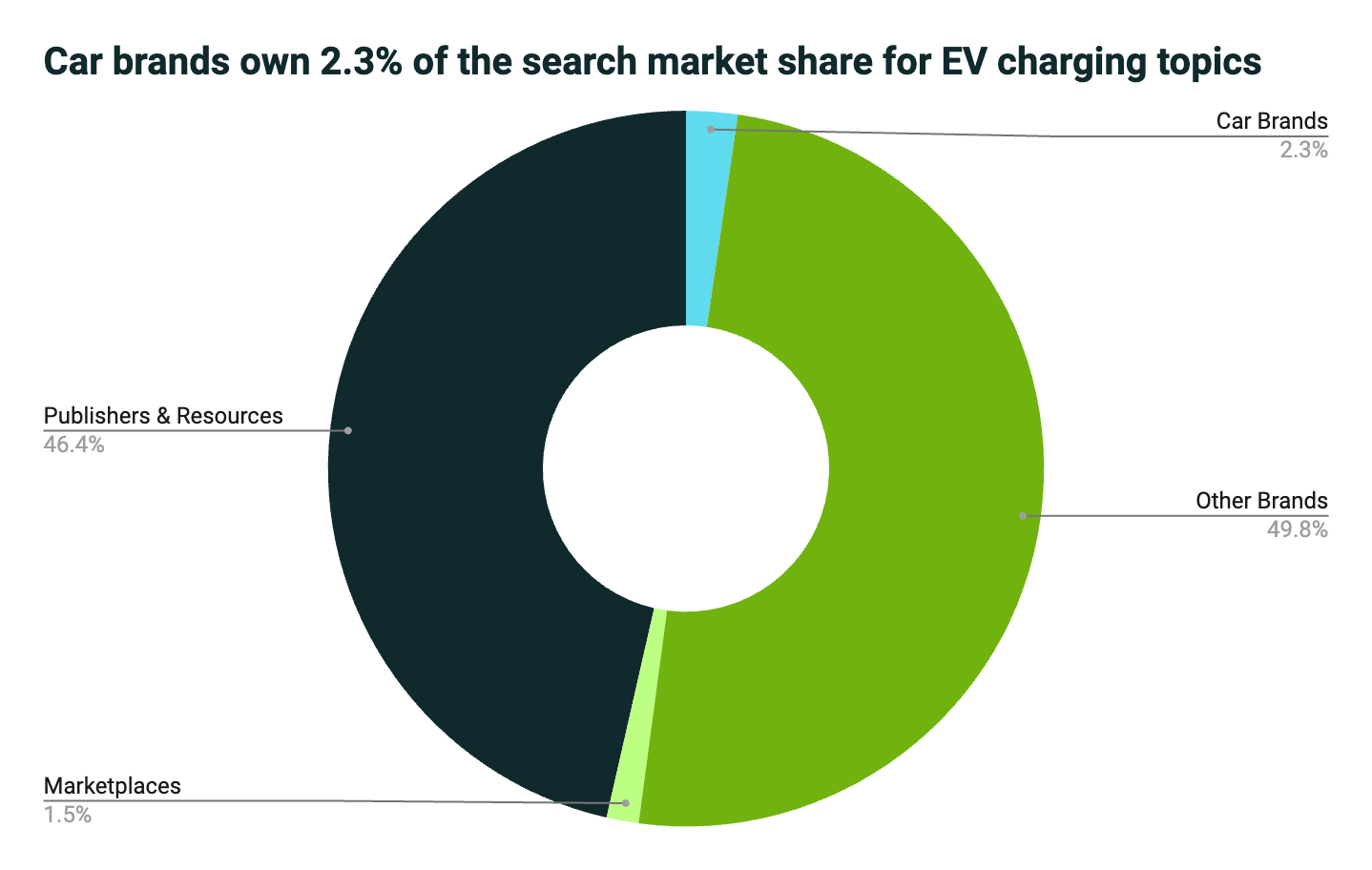

Once again, car manufacturers are invisible to consumers seeking answers because they’re solely focused on selling vehicles. In fact, not a single car manufacturer shows up in the top 20 websites ranked by search market share, and automakers hold about 2.3%

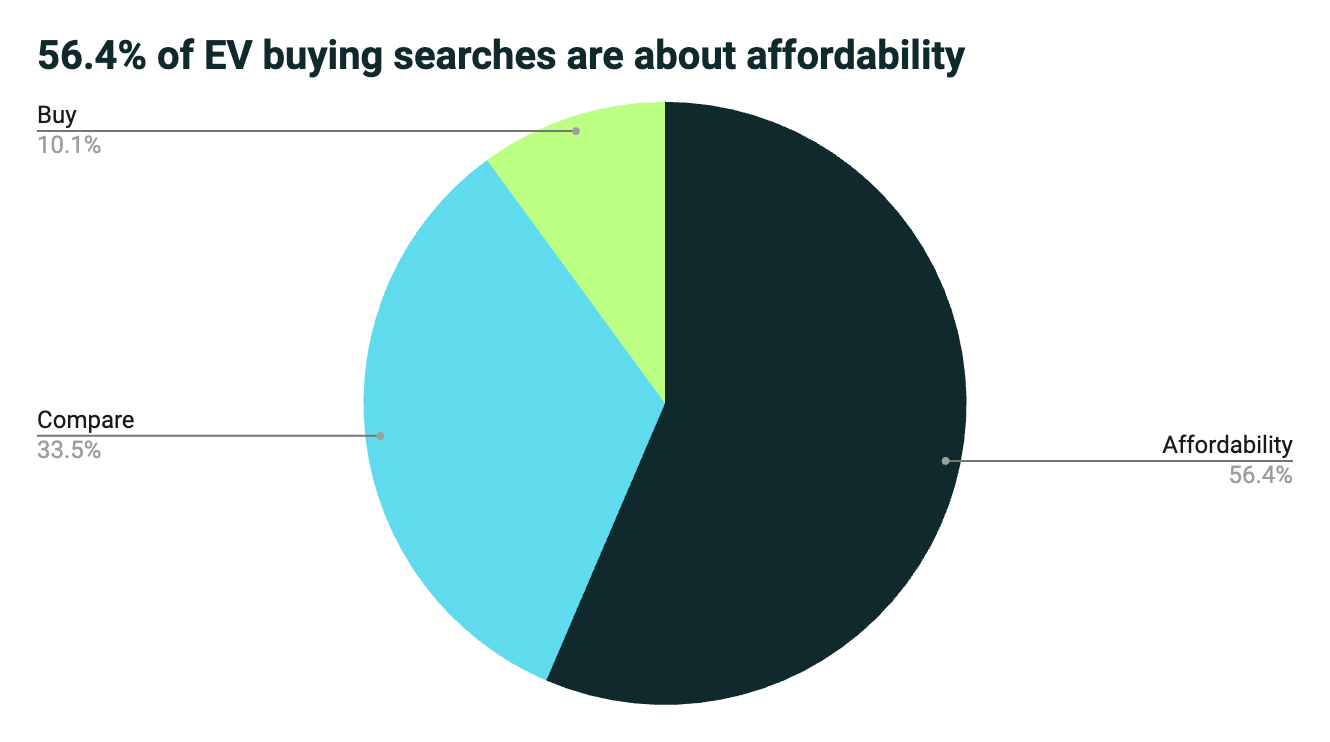

The EV buying category is driven by affordability

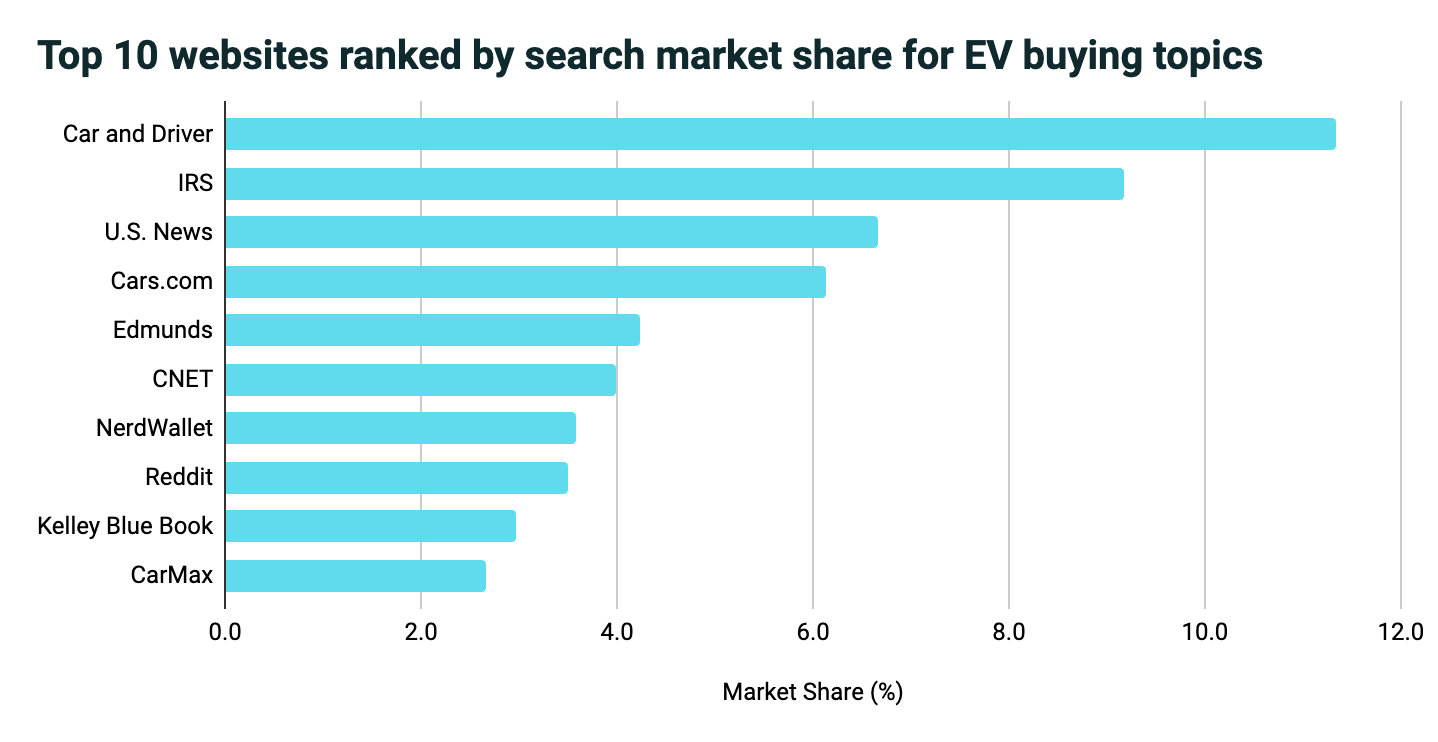

After consumers research general EV and charging topics, they begin to move deeper into the funnel and their intent shifts towards purchasing. In this category, consumers want to know about affordability, which EVs are the best, and where to buy cheap EVs.

The IRS leads this category as a trusted publisher of resources about EV tax rebates.

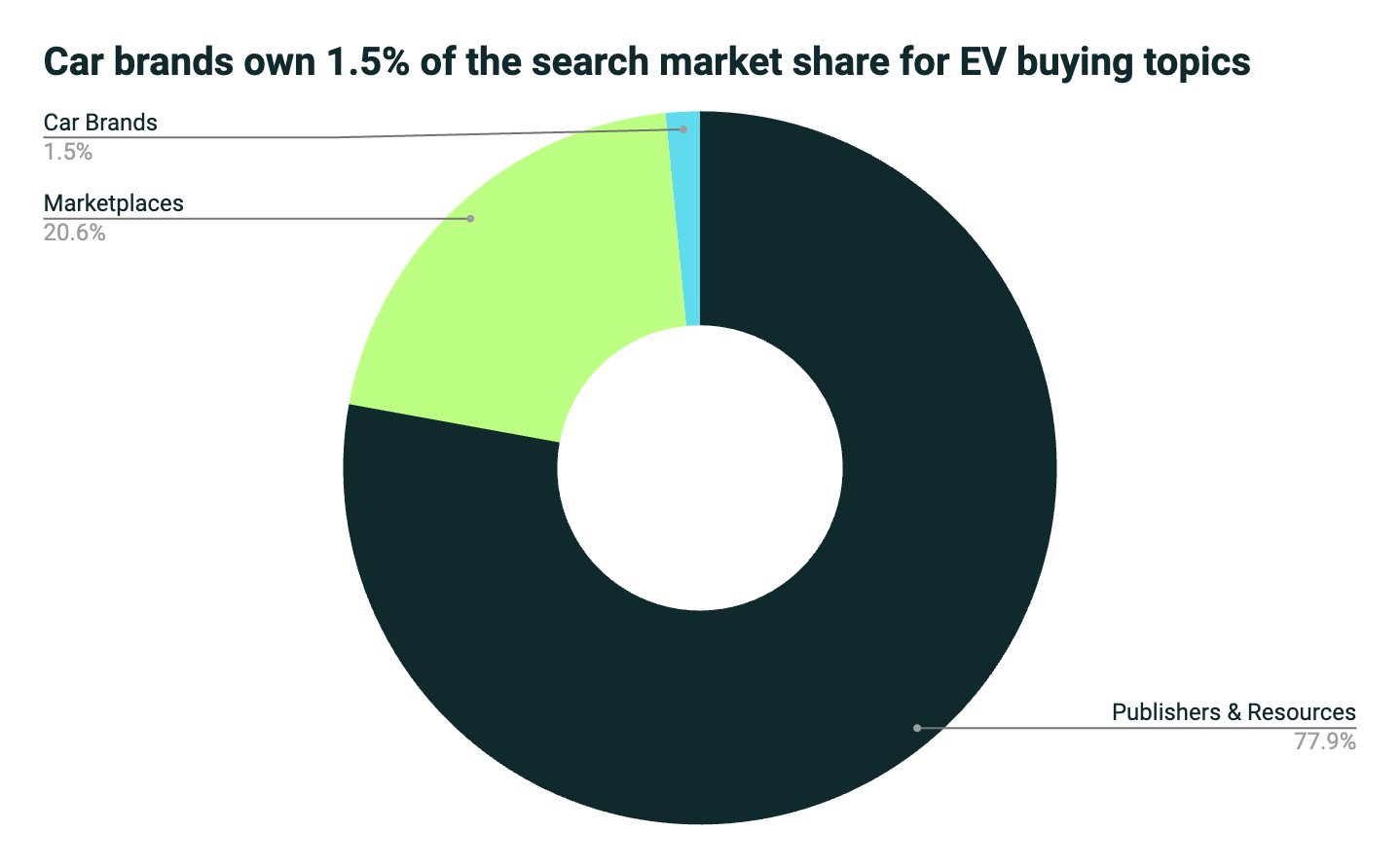

Publishers and marketplaces control an astonishing 98.5% of the organic search market share in the EV buying category, with automakers only showing up 1.5% of the time in organic search.

As electric vehicles become cheaper, better, and easier to charge, consumers will flood the marketplace. But taking on Tesla to be the market leader in EVs will mean understanding consumers and meeting them in their moments of need at every stage of their buying journey.

Can General Motors be the one auto brand that steps forward to guide consumers as they transition from combustion to electric? How can GM marketers leverage search data to connect with consumers when they’re most receptive?

Reaching 101.8 million customers with OAO

Switching from an internal combustion engine (ICE) to an electric vehicle isn’t like switching from an SUV to a minivan, or from a Ford to a Chevy. Consumers have lots of questions:

- Where can I charge my EV?

- How much does it cost to charge, and long does it take?

- What’s the difference between EVs and hybrids?

- Is it better to buy or lease an EV?

- Which vehicles qualify for the EV tax credit?

- Is insurance more expensive for EVs?

With an average brand loyalty rate of 50.6% in the auto industry, the opportunity for General Motors to connect with consumers in the EV market is massive. In the last 12 months, there were 31.4 million non-branded EV searches and 9 million searches for EVs made by GM.

Americans also searched for information about auto lending more than 61.5 million times each year, including payment calculators, interest rates, lease vs buy, and how to prequalify.

Collectively, that’s 101.8 million potential touch points with the GM brand through organic search to guide decisions and build trust.

The brands that show up in Google Search to answer these questions ultimately control the buying journey. Right now, the brands showing up are vehicle marketplaces and content publishers rather than automakers. Websites like Car and Driver, Top Gear, Bankrate and NerdWallet are influencing consumer decisions while automakers are sitting on the sidelines.

That’s because car companies still think like salespeople. But to reach new EV customers, they need to think differently. They need to think like publishers.

GM could launch a media brand to capture the search market share it deserves. By investing in its owned assets, GM could help consumers navigate the EV transition, build awareness and affinity for its many sub brands, and pre-qualify them for auto loans.

Owned Asset Optimization (OAO) | The Foundational Guide

May 1, 2023

Read Article

How GM Financial can drive EV adoption for General Motors

GM Financial originates $50 billion in loans each year for about 1 million GM customers. It’s the top captive in terms of loyalty, outperforms the industry in delinquencies, and its customer base is 80% prime.

In other words, new customers are incredibly valuable because they drive predictable, safe, long-term revenue for the company.

Furthermore, GM Financial can reach potential customers across the company’s entire portfolio of brands informing them on a range of topics from EVs, to financing, to auto insurance, and so much more. In other words, GM Financial has the authority and expertise to authentically connect with consumers and guide them through the entire auto buying journey online.

And the leadership team is already bought in. Susan Sheffield, CFO of GM Financial, says the best way to improve the value of marketing to the enterprise is through digital. “Digital marketing is really how we’re going to move forward creating that customer interaction.”

Most captured finance companies in the automotive industry have bare bones websites that primarily focus on getting loans. As a result, they’re missing out on helping nearly 100 million Americans seeking information.

GM Financial is doing things differently. The brand has a valuable resources section that features budgeting tools, downloadable guides, and articles that answer important questions.

In addition to their primary website, they also launched a secondary blog called “KEYS by GM Financial” which offers free finance courses for the most important life decisions.

This strategy shows that GM Financial is thinking bigger than its competitors, and the leadership sees the value in publishing content that connects with consumers in their moments of need.

And there’s still so much opportunity to meet tens of millions of unserved consumer needs.

If GM Financial invests in an owned asset optimization (OAO) strategy, it can align its content strategy across its entire portfolio of brands and transform into a digital publishing powerhouse.

Final thoughts

By thinking bigger and more holistically, the marketing team will eliminate silos and dead ends in the customer journey that third party publishers could hijack. OAO also ensures that every piece of content answers a real-time customer need, is optimized to maximize audience reach and engagement, and ultimately drives revenue through prequalifications that lead to sales of GM vehicles.

Today’s consumer is in the driver’s seat, and they want to engage with brands on their own terms. To reach these empowered consumers, leading brands like GM Financial must shift away from the old permission marketing model and embrace reception marketing — listening to their consumers’ needs, and meeting them online with unique, valuable answers and content.