Brand Breakdown

Welcome to the Brand Breakdown series, a monthly deep dive into the marketing strategies of leading global brands.

We’ll be exploring the winning, and losing, strategies that are pushing the boundaries of traditional marketing through the lens of owned asset optimization (OAO), a new approach to building consumer connection.

Subscribe today for unique insights straight to your inbox, exploring how the world’s most recognizable brands are connecting with consumers.

US shoppers spent a record $16.4 billion online this Black Friday, according to Salesforce, a 9% increase over last year. Yet, despite record-breaking digital growth, in-store sales only grew 6.3%, the smallest increase since 2017.

So which was it? Was Black Friday all silver and gold or a lump of coal? What do these numbers mean for the future of Black Friday and consumer behavior?

In this 3-part edition of the Brand Breakdown, we’ll reveal which topics and brands are top of mind for consumers this holiday, which companies are earning the most attention, and how brands can move to the top of customers’ wishlists next year.

Black Friday is evolving

The days when panicked parents camped out overnight to score a Cabbage Patch Kid or brawled over doorbuster deals to save fifty bucks are over. Consumers have evolved, and marketers need to rethink their Black Friday strategies if they hope to connect.

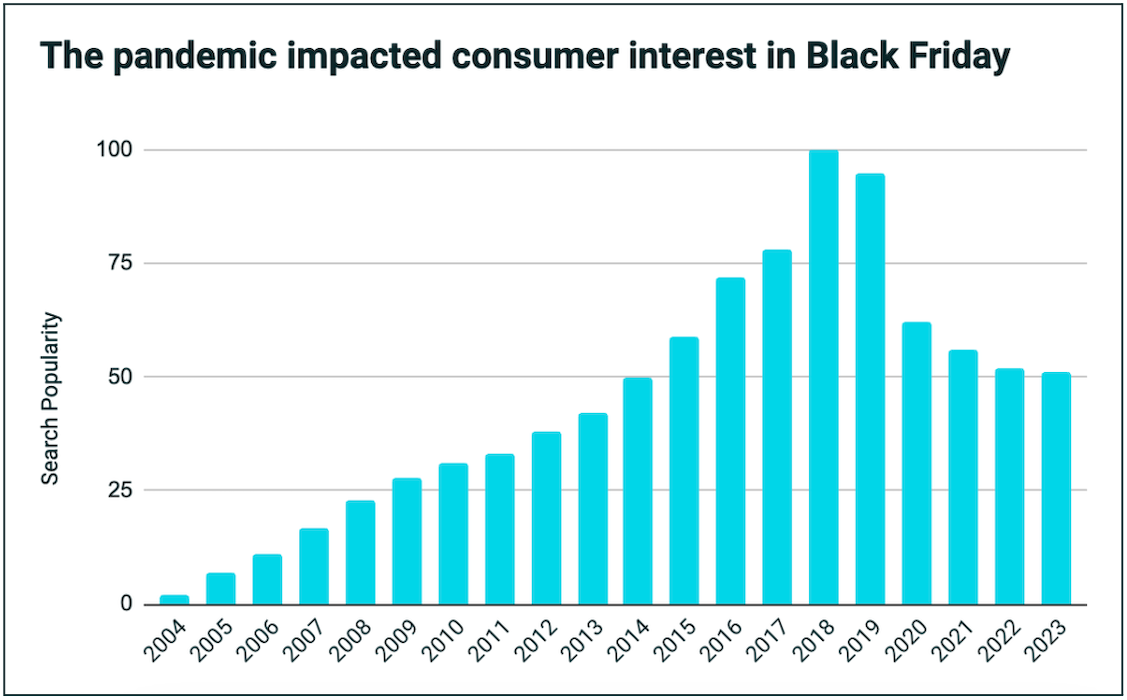

Don’t believe me? Head over to TikTok and search Black Friday. You’ll see thousands of videos about the lack of foot traffic and disappointing deals. If you’d rather hear straight from consumers, just look at Google Trends data for “Black Friday” search popularity over the years.

The spectacle of Black Friday is losing popularity

The Pandemic showed consumers that they don’t need to fight crowds or sacrifice sleep to get a great deal. They can score the same bargains from the comfort of their couch while savoring last *****’s pumpkin pie.

But even though Black Friday has lost some of its sparkle, consumers are still willing to spend big if they can save big. Here’s a similar chart showing higher search popularity for “Black Friday deals” in 2023.

Self-gifting surges on Black Friday

According to Gallup, 64% of holiday shoppers planned to buy non-gift items for themselves or their homes. That’s why interest surges on Black Friday for items like dishwashers, coffeemakers, and vacuum cleaners.

Furthermore, Amazon revealed that 4 out of 17 of its best-selling items on Black Friday were beauty products, including moisturizers, serums, and teeth whiteners. And if we look at search data from popular cosmetics brands, we see a similar trend. In other words, consumers are strategically postponing non-gift purchases until Black Friday to get the best deals.

Two takeaways about changing consumer behavior

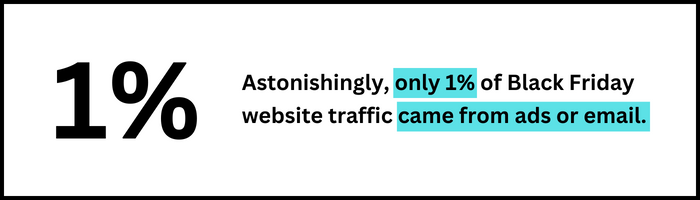

- Although the majority of consumers still shop in stores on Black Friday, online purchases are growing at a much faster pace — and those purchases aren’t coming from ads or emails. According to Salesforce, the vast majority of digital customers come through two sources: direct (41%), and search (29%). Astonishingly, only 1% of Black Friday website traffic came from either advertisements or email.

- Consumers aren’t just looking for deep discounts on random items anymore. They’re spending strategically by planning out big-ticket purchases they previously researched, or stocking up on their favorite items from the brands they ****. In other words, the brands that invest in long-term relationships are the ones that will win the biggest share of wallets on Black Friday.

Which topics are top of mind for consumers this year? Which brands control the decision-making process?

Unwrapping the secrets of successful holiday marketing

52 million people in the US will search for holiday gift ideas between November and December this year. These consumers have a need and they’re ready to buy, but they don’t know where to start. This presents the perfect opportunity for brands to guide them with helpful advice.

And I don’t just mean a category page with a list of products. But truly authentic, above and beyond, surprise and delight content.

Terakeet analyzed more than 1,000 keywords representing 52 million consumer searches, and we grouped them into the following six categories:

- Generic Gift Ideas

- Gifts for Men

- Gifts for Women

- Gifts for Kids

- Gifts for Others

- Gifts for Hobbies & Interests

The most popular gifting category was “generic gift ideas” with 14.3 million searches, which includes searches for gifts that didn’t specify a recipient or a theme. “Gifts for men” and “gifts for women” were nearly tied with 10.9 million and 10.7 million searches respectively. Those categories included any searches that specified a gender, and targeted adults. “Gifts for kids” was also popular. That category included searches for boys and ***** of various ages.

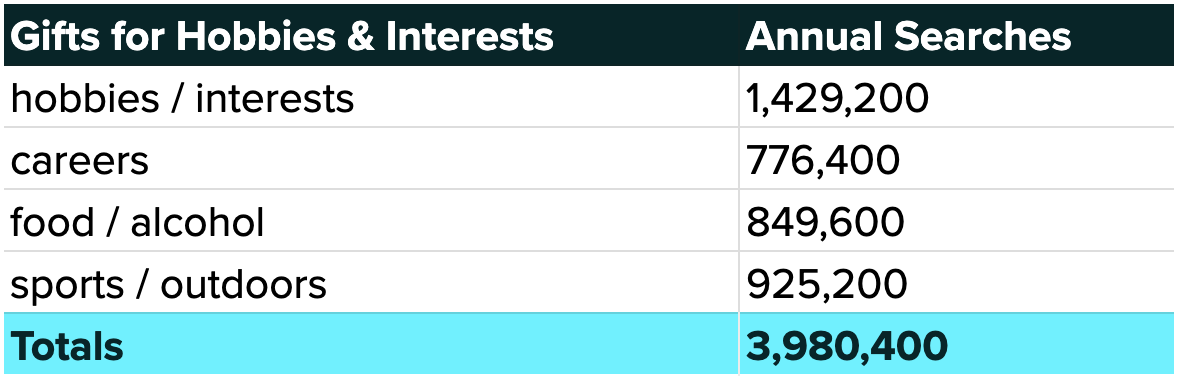

Although the “gifts for hobbies and interests” category is less popular, don’t ignore it. These searches are highly specific, so consumers are more likely to convert. Gifts in this group include interests like gardening, gaming, golf, crafting, foods, and careers.

Understanding the search landscape

As marketers, we often focus on quantitative metrics like market share, revenue, and traffic. But it’s just as important to understand the qualitative competitive landscape. What do consumers want, and who’s delivering the best answer?

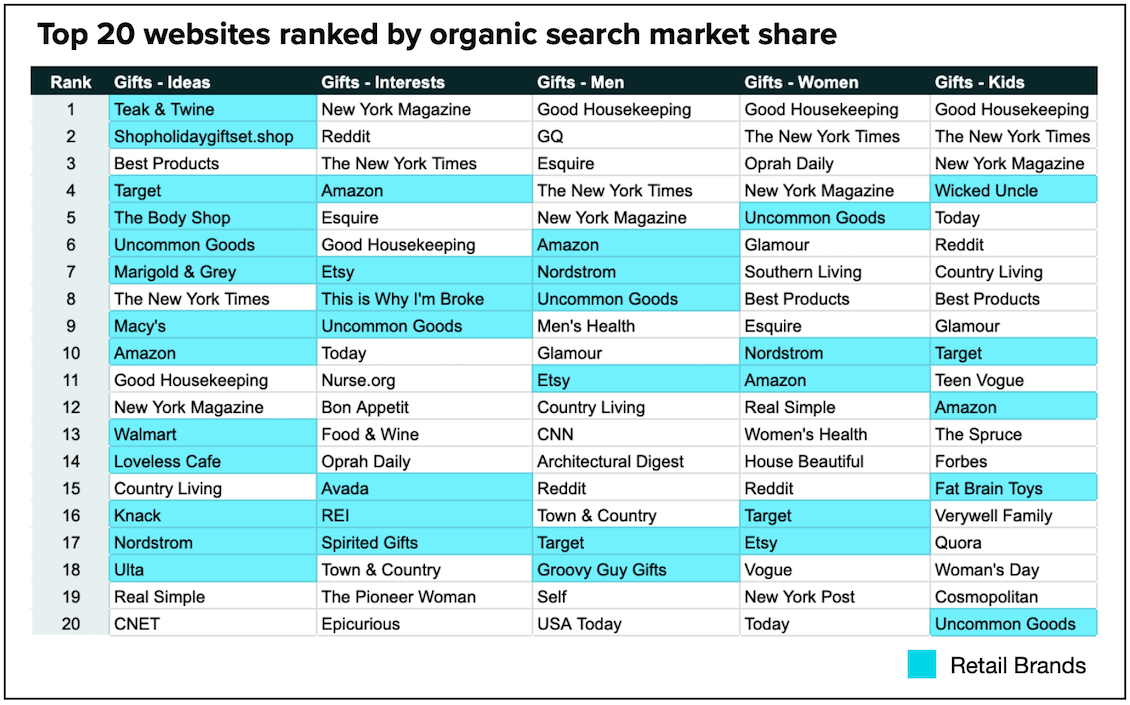

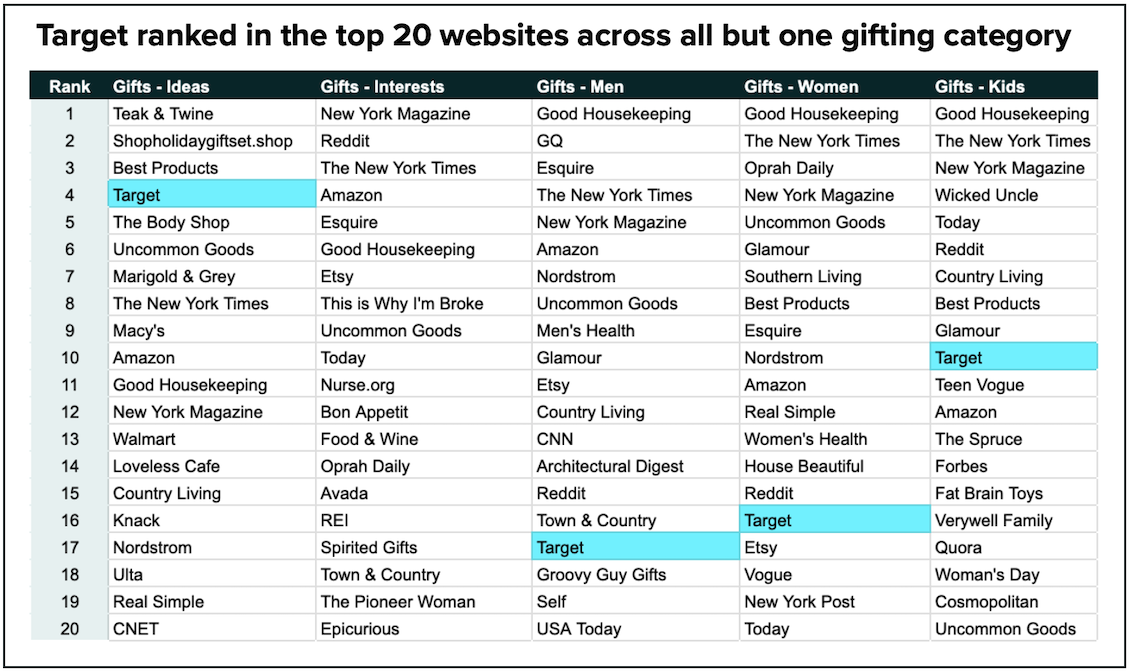

Let’s look at a map of the top 20 websites ranked by organic search market share across all five gift categories we analyzed.

Key takeaways from the gifting search landscape

- The generic gift ideas category is dominated by retail brand product pages.

- The hobbies and interests category includes an eclectic mix of media brands and retailers that specialize in niche areas like food, wine, careers, and outdoor activities.

- The gifts for men category has more media brands that publish content for men, such as GQ, Men’s Health, and Esquire. (Although it would probably make more sense to include gifts for women in a publication aimed at men).

- The gifts for women category contains more publications aimed at women, including Oprah Daily, Glamour, Women’s Health, and Vogue. (This echoes the problem we see in the men’s category).

- The winners in the gifts for kids category are, as expected, geared toward kids, including Teen Vogue, Wicked Uncle, and Fat Brain Toys.

- The top three websites across all but one category are media brands that publish long-form content, indicating that consumers find more value in comprehensive content than simple product lists.

Which brands are meeting consumers’ needs?

Terakeet classified each website in our analysis as either a media brand (long-form content publishers) or a retail brand (product sellers). Media brands control two-thirds of the organic search market share across the entire holiday gifting space.

Looking at the top 10 websites ranked by market share for all holiday gifting topics, we see the first three positions are dominated by media brands. In fact, Goodhousekeeping has nearly 3x more organic search market share than any retail brand.

Media brands outperform retailers in all but one category: generic gift ideas. In that category, brands dominate 8 out of the top 10 positions, with Teak & Twine taking the lead.

Source: Terakeet

Surprisingly, Walmart only appeared in the top 20 in one category. And, although Amazon ranked in the top 20 in all five categories, its average rank was only 8.6.

In other words, this is anyone’s game to win with the right strategy.

Which retail brand will stuff consumers’ stockings next year? Target? Macy’s? Nordstrom? Or will ecommerce giants like Amazon and Etsy implement the winning strategy?

Target hits the bullseye with holiday marketing

Looking at the top 20 websites ranked by organic search market share across five gifting categories, you might have noticed that Target made nearly every list — and they could have swept the board clean.

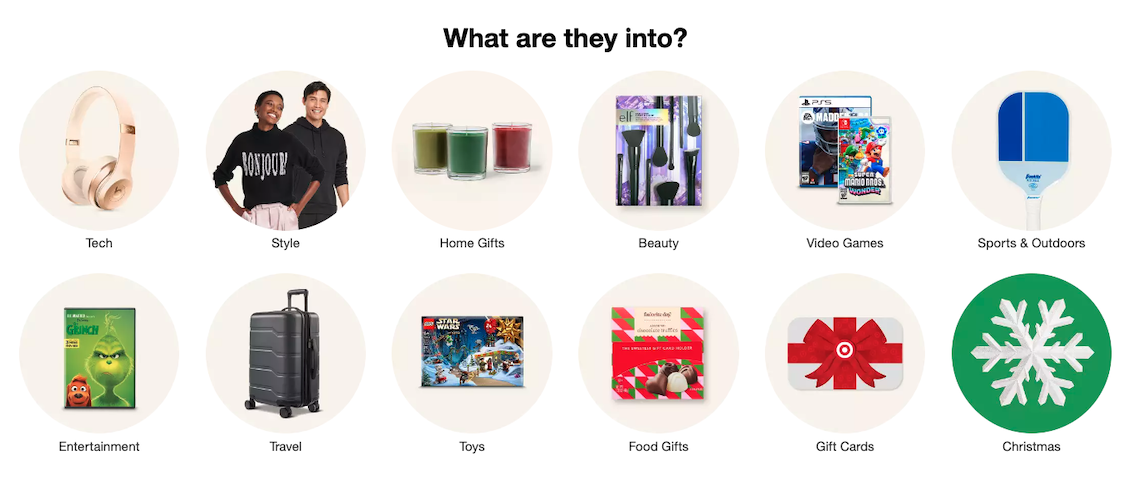

The categories above represent the most popular types of gifts consumers are searching for right now. And Target knows it. Just take a look at their Gifting Station.

Click on the “gifts for kids” button and you’ll be whisked away to toyland. Now, you can narrow down your search even further by age or price.

That solution is an excellent way to replicate ideal user experiences typically reserved for physical spaces, and it also reflects the way Target’s guests search in Google. In fact, 61% of the 9 million searches in the “holiday gifts for kids” category included an age variable.

Similarly, when Target customers shop for toys in physical stores, the aisles are generally organized by age. By synchronizing physical and digital shopping experiences, brand interactions feel more seamless and intuitive.

Target’s Gifting Station goes beyond gender and age, though. It also highlights many of the interests we looked at in the last email: gaming, sports, outdoors, careers, and food.

Looking for gifts for the foodie on your list? Select that category to shop for hand-picked products, or dive even deeper into a subcategory.

Interest-based gift guides are Target’s strongest opportunity to connect with passionate guests because they currently don’t show up in the top 20. These shoppers have high purchase intent due to the specificity of their searches, and Target has so many products that could meet consumer needs across these categories:

- gifts for book lovers

- gifts for gardeners

- gifts for coffee lovers

- gifts for golfers

- gifts for artists

- gifts for bakers

- gifts for music lovers

- gifts for chefs

- gifts for outdoorsmen

- gifts for tea lovers

Although interest-based gifts aren’t as popular as some of the other categories, there are still nearly 4 million shoppers searching for these types of gifts during the holiday season.

Target clearly understands search popularity and customer experience. But our research shows that consumers want more than product lists. They want advice.

How can Target tap into its brand purpose to foster deeper connections with its guests?

Activating brand purpose to connect with guests

Marketing is most impactful when it originates from a brand’s purpose. Here’s how Target articulates its purpose:

“To help all families discover the joy of everyday life. That’s our purpose. Our mission. The promise of surprises, fun, ease, and inspiration at every turn, no matter when, where, or how you shop.”

That’s a powerful purpose, and it’s clear Target takes it seriously based on all the different shopping experiences it offers, including physical stores with self-checkout or cashier checkout, as well as online shopping through the app or website with shipping, curbside pickup, or in-store pickup.

There truly is something special and inviting about shopping in Target stores. But some of that hospitality fades away online, so Target must find new ways to surprise and delight its digital customers to foster that same level of connection. This is particularly important since online shopping is becoming more popular during the holidays.

How can Target offer surprises, fun, ease, and inspiration to its digital guests?

Connecting through content

Marketing is becoming less about big, brand-driven moments that are often delivered through interruptive advertising, and more about meeting consumers in their moments of need, whether that’s a recommendation for gifts, housewares, or what to make for dinner.

Let’s look at an example.

In our first email, we highlighted the spike in search interest around vacuum cleaners during the holiday season. Consumers don’t just buy whichever vacuum is cheapest on Black Friday. They begin researching weeks before they make a final decision. Then, they hold off on the purchase until they get the best deal.

Currently, the decision-making process — and ultimately the final sale — is controlled by third party content creators, affiliates, and media brands that offer in-depth advice on what to buy, not just a list of products.

Imagine if affiliate marketers camped out in Target parking lots recommending products based on referral fees rather than whether Target carried the products. Not only would those individuals be servicing Target’s guests, they would also be dictating which products Target would need to stock based on their recommendations.

That’s exactly what’s happening right now online.

Instead of letting media brands and affiliates answer consumer questions about gifts, vacuums, coffee makers, TVs, or any other product, Target could publish content that authentically informs, inspires, and guides its guests, regardless of the product category.

This strategy has many benefits.

- Invites more shoppers into Target’s ecosystem sooner, and keeps them there longer

- Builds trust and adds value to customer relationships

- Gives Target more control over which products are purchased

- Improves inventory management and open-to-buy (OTB) planning

- Improves cash flow by reducing turn times

- Reduces markdowns from items that don’t sell, which improves profitability and gross margin return on investment (GMROI)

A content strategy of that magnitude extends far beyond holiday gift guides. Target could have sections for each of its most important business segments:

- Home Decor: Helping families design a more joyful, inviting home

- Cooking: All the tools and ingredients to feed your family

- Stay Well: Everything you need to keep your family healthy

- Entertainment: Books, movies, and games to bring people together

- Etc.

Target knows that its guests expect more — it’s in their brand promise: “Expect more. Pay less.”

Embracing reception marketing to engage empowered consumers

To truly deliver on that promise, Target could create content hubs centered around important product categories. The goal of those hubs would be to connect with consumers early and often throughout the customer journey, build trust, deliver unexpected value, and amplify brand preference.

Target’s marketing team could also leverage online content to create in-store product guides presented as signage or digital kiosks, giving guests a more unified and cohesive brand experience no matter how they shop.

The marketing team could also take advantage of a firehose of customer data generated by online users who navigate various pieces of content and product pages. This first-party data about consumer behavior and interests will be invaluable when third-party cookies go away in 2024.

Today’s consumer is in the driver’s seat, and they want to engage with brands on their own terms. To reach these empowered consumers, brands are shifting away from the old permission marketing model and embracing reception marketing — listening to their consumers’ needs and meeting them online with unique, valuable answers and content.

Owned Asset Optimization (OAO) | The Foundational Guide

May 1, 2023

Read Article