What Is a Competitive Matrix?

A competitive matrix is a tool that helps you visually compare your company against competitors. To see how you stack up.

It typically features a grid or table that lists your brand and key competitors on one axis. And important market factors on the other.

There are many types of competitive matrices that show data in different ways.

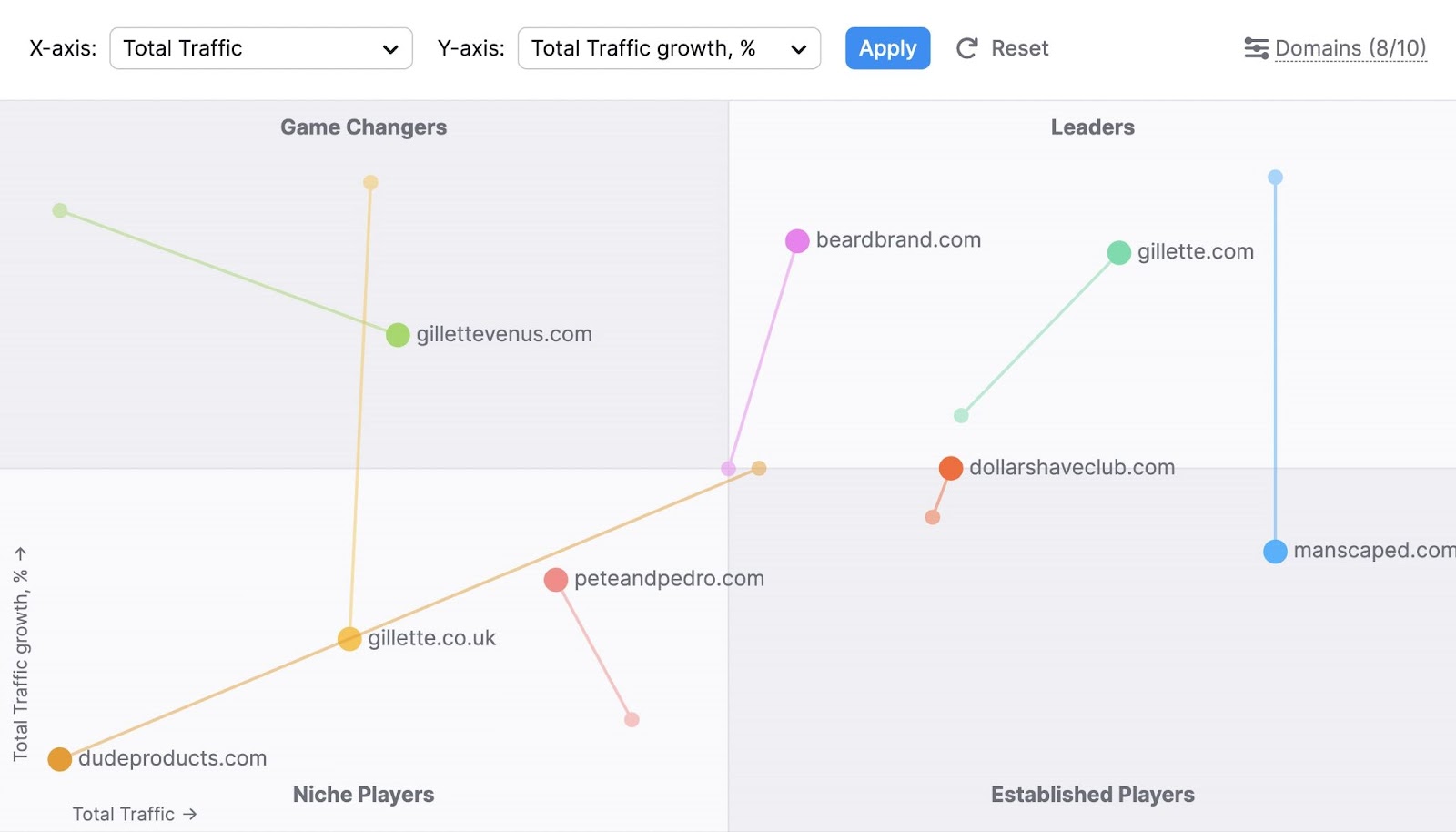

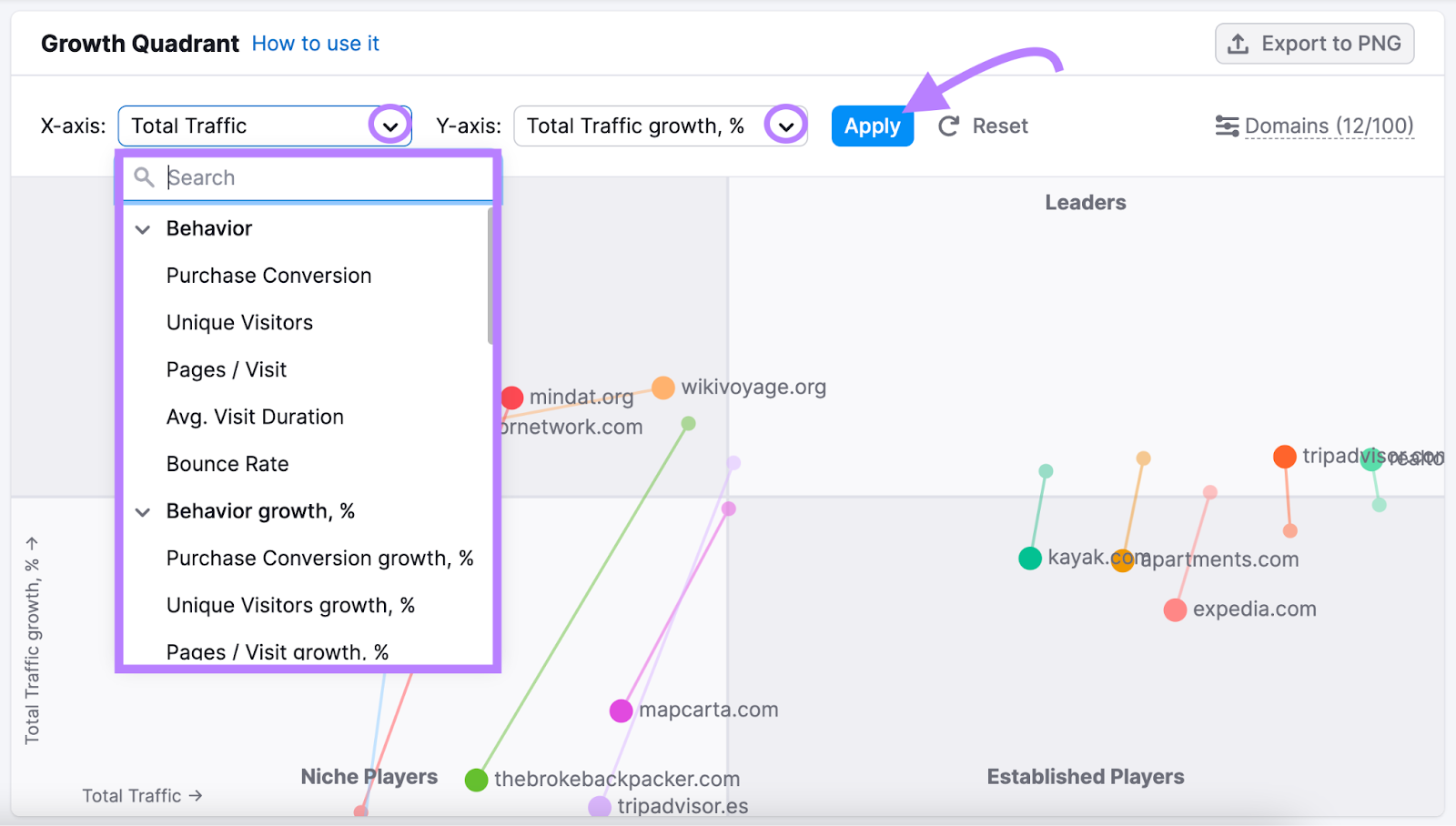

For example, this is the Growth Quadrant from Semrush. It’s a competitor matrix you can generate using the Market Explorer tool.

This quadrant-based matrix helps you visualize your industry’s competitive landscape. And divides competitors into four categories:

- Game Changers

- Leaders

- Niche Players

- Established Players

We’ll explain what these categories mean later. And show you how to build this matrix using your competitors’ data.

First, let’s explore the benefits of using a competitive matrix.

Why Is Using a Competitive Matrix Important?

A competitor analysis matrix provides competitive insights that help you gain an advantage in the market.

The matrix’s main purpose is to show where your company stands compared to your competitors. To be more aware of your (and your competitors’) strengths and weaknesses.

This can then be used to:

- Strategically position your brand: By seeing how your offerings stack up against competitors, you can find better ways to position your products or services. And highlight what makes you different and fill in any gaps in the market.

- Make informed decisions: With a clear view of the competitive landscape, you can make data-driven decisions about product development, marketing, and resource allocation

- Predict competitor moves: Understanding your competitors’ strengths and weaknesses can help you anticipate their next moves. And stay ahead of them.

In short, a well-researched competitive analysis matrix provides you insights to confidently navigate fierce competition. Even in a perfectly competitive market—where most businesses sell identical products.

5 Competitor Matrix Types with Examples and Templates

There are various types of competitive matrices, each for different use cases. You can choose one or more depending on your analysis goals.

Let’s take a look at some of the most popular types.

1. Competitive Comparison Grid

A competitor comparison grid (also called a competitive positioning matrix) is a framework that visualizes how customers perceive your company relative to your competitors.

It considers factors like price, quality, service, and innovation to help you understand your market position.

Typically, it’s drawn using two axes that each represents a crucial success factor.

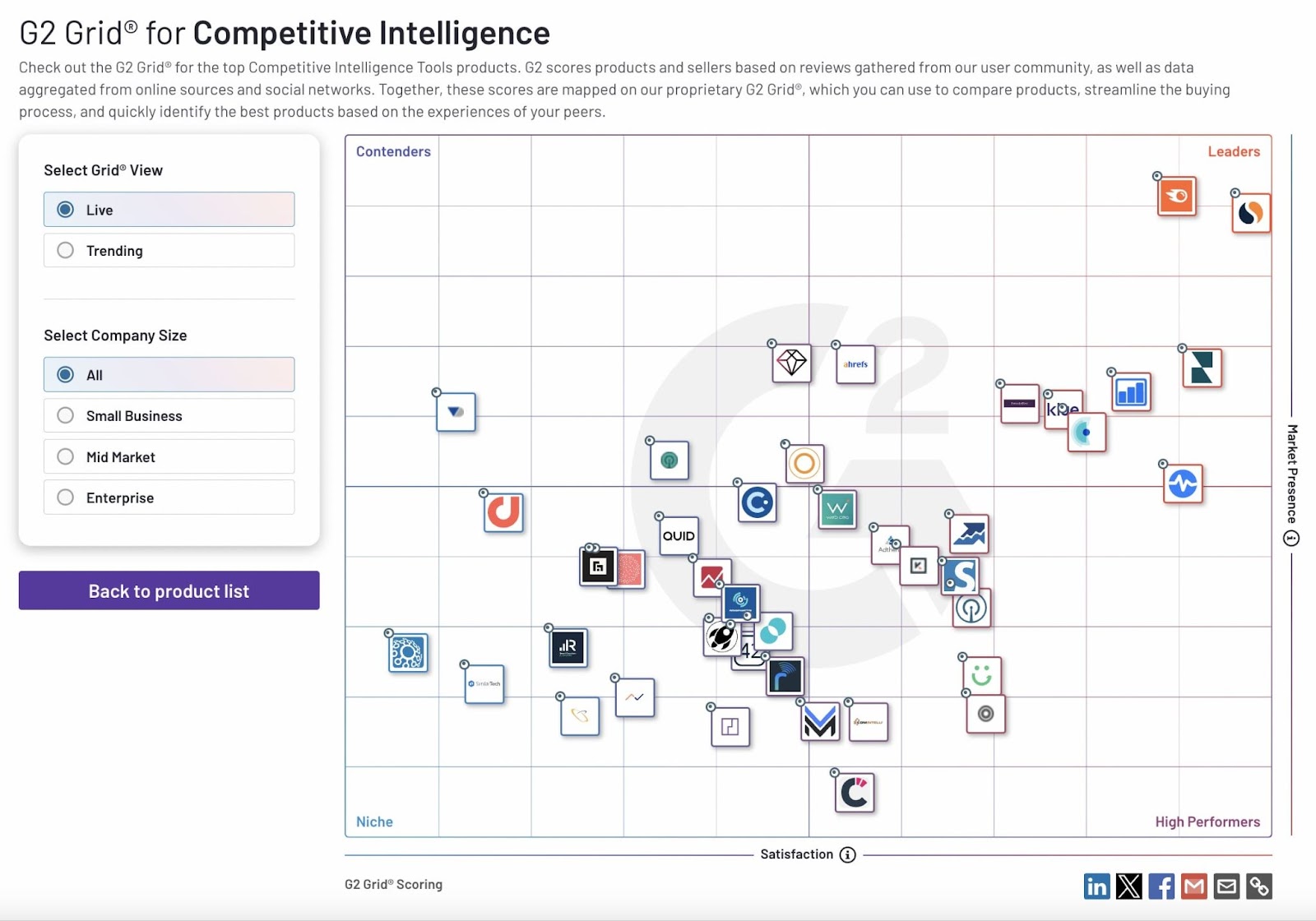

Let’s look at the G2 Grid for competitive intelligence tools as an example.

Image Source: G2

It has “Market Presence” on the y-axis—which is calculated using G2’s scoring methodology that draws from a number of sources. And “Satisfaction” on the x-axis is based on user reviews.

Based on these scores, companies are divided into four quadrants:

- Leaders: High user satisfaction and high market presence

- Contenders: High user satisfaction and low market presence

- High Performers: Low user satisfaction and high market presence

- Niche: Low user satisfaction and low market presence

You can visualize the digital competitive landscape for your industry similarly with Semrush’s Growth Quadrant matrix.

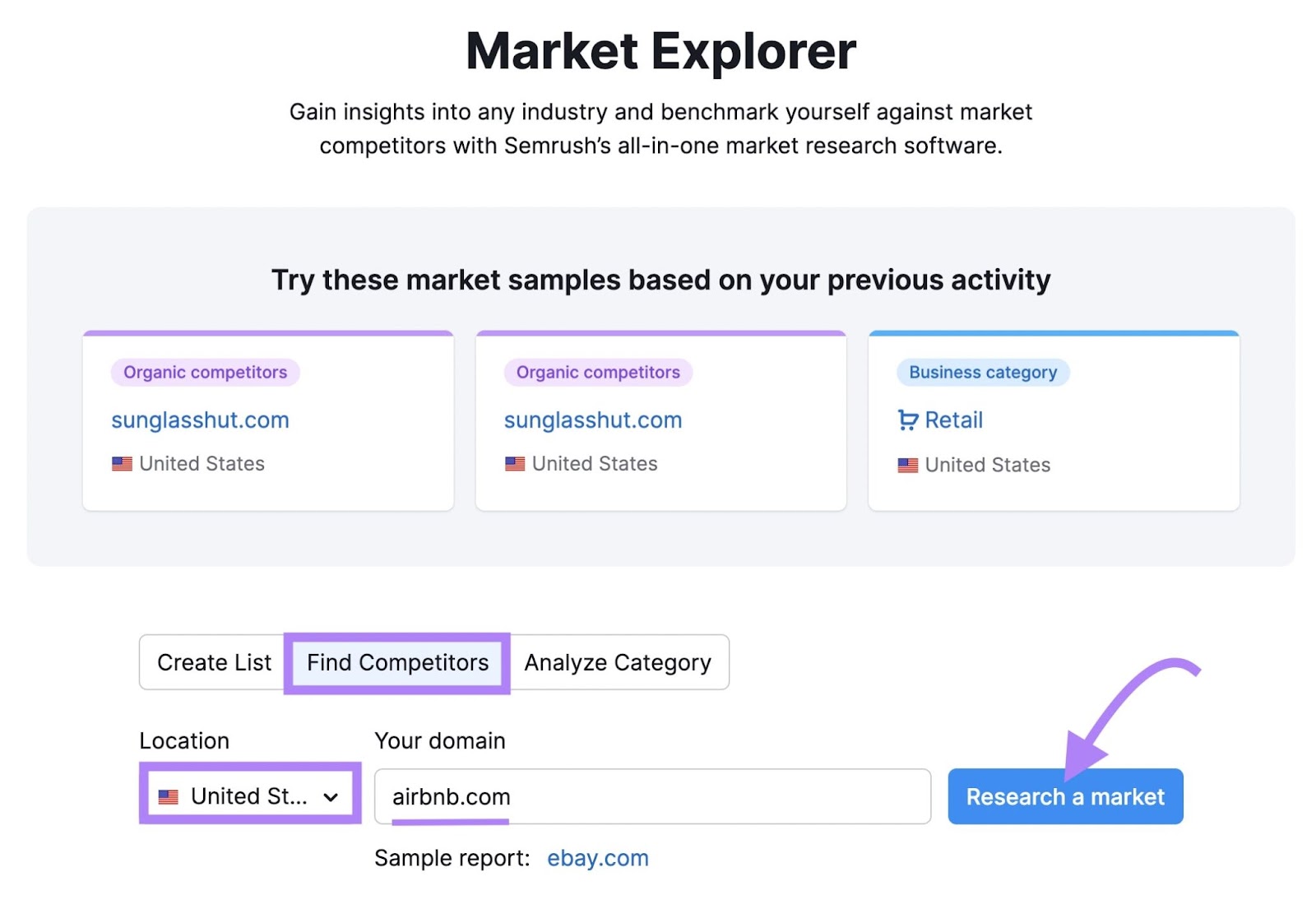

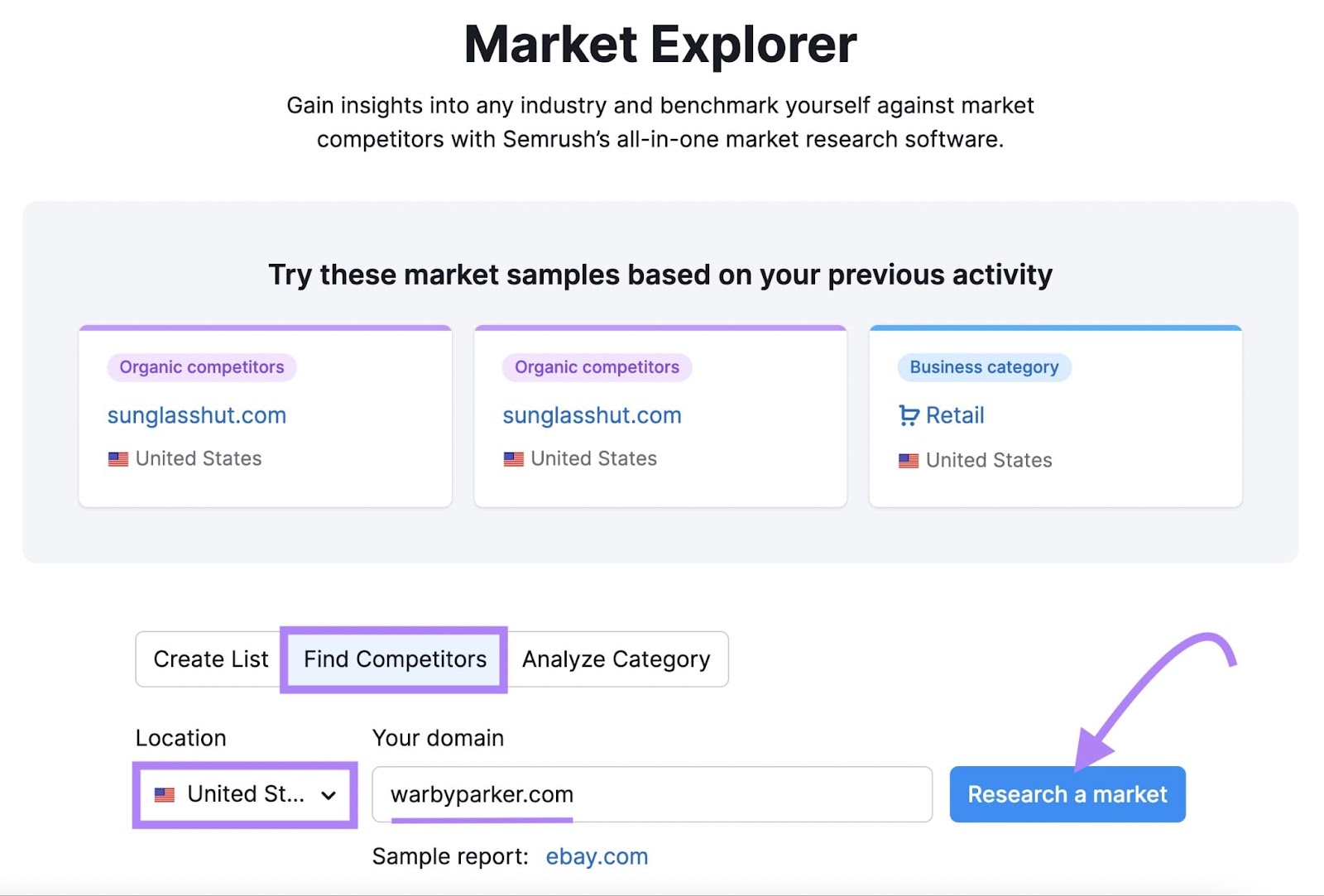

Open the Market Explorer tool and click the “Find Competitors” tab. Then, enter your location and domain name, and click the “Research a market” button.

Scroll to the “Growth Quadrant” widget.

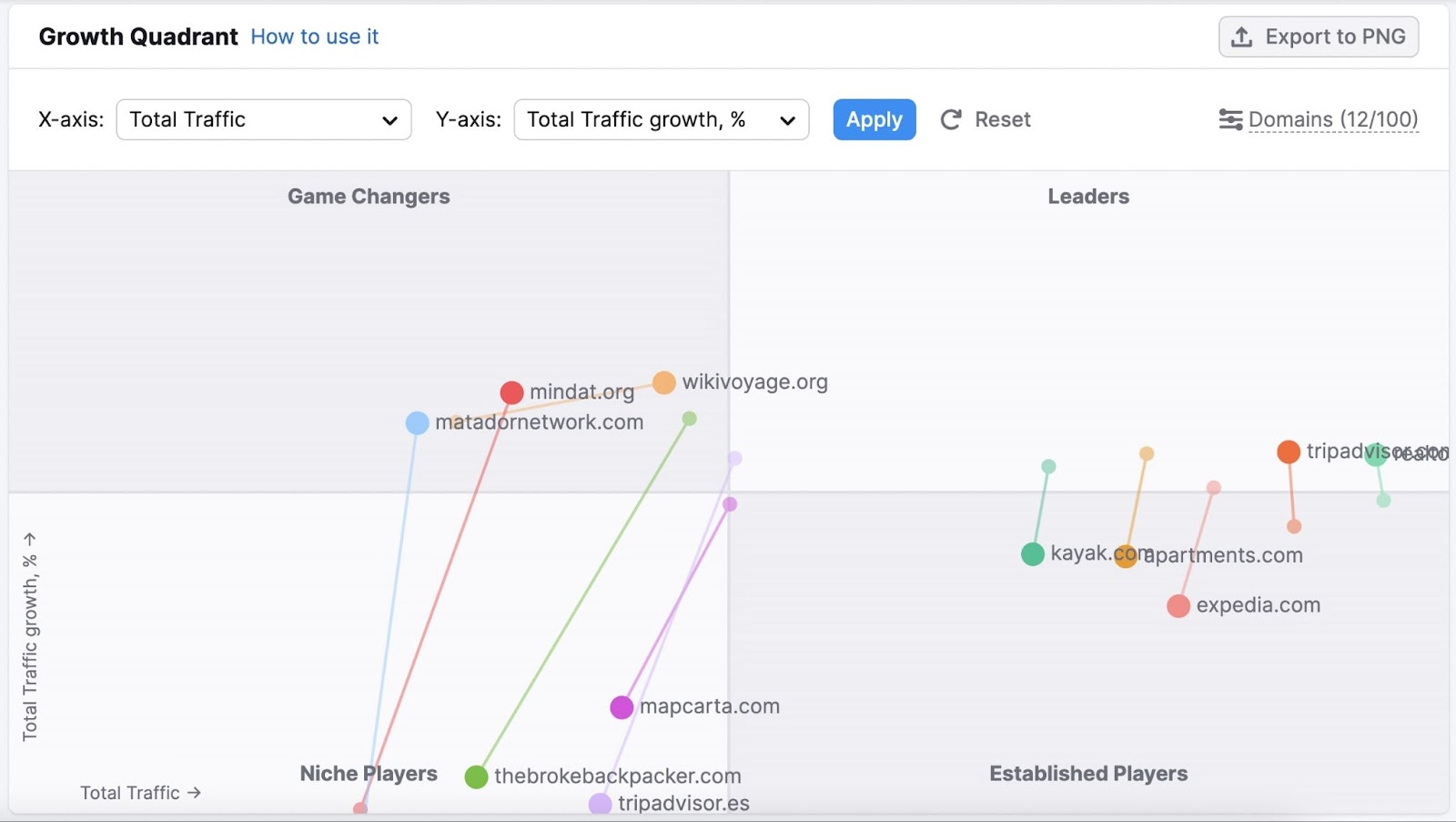

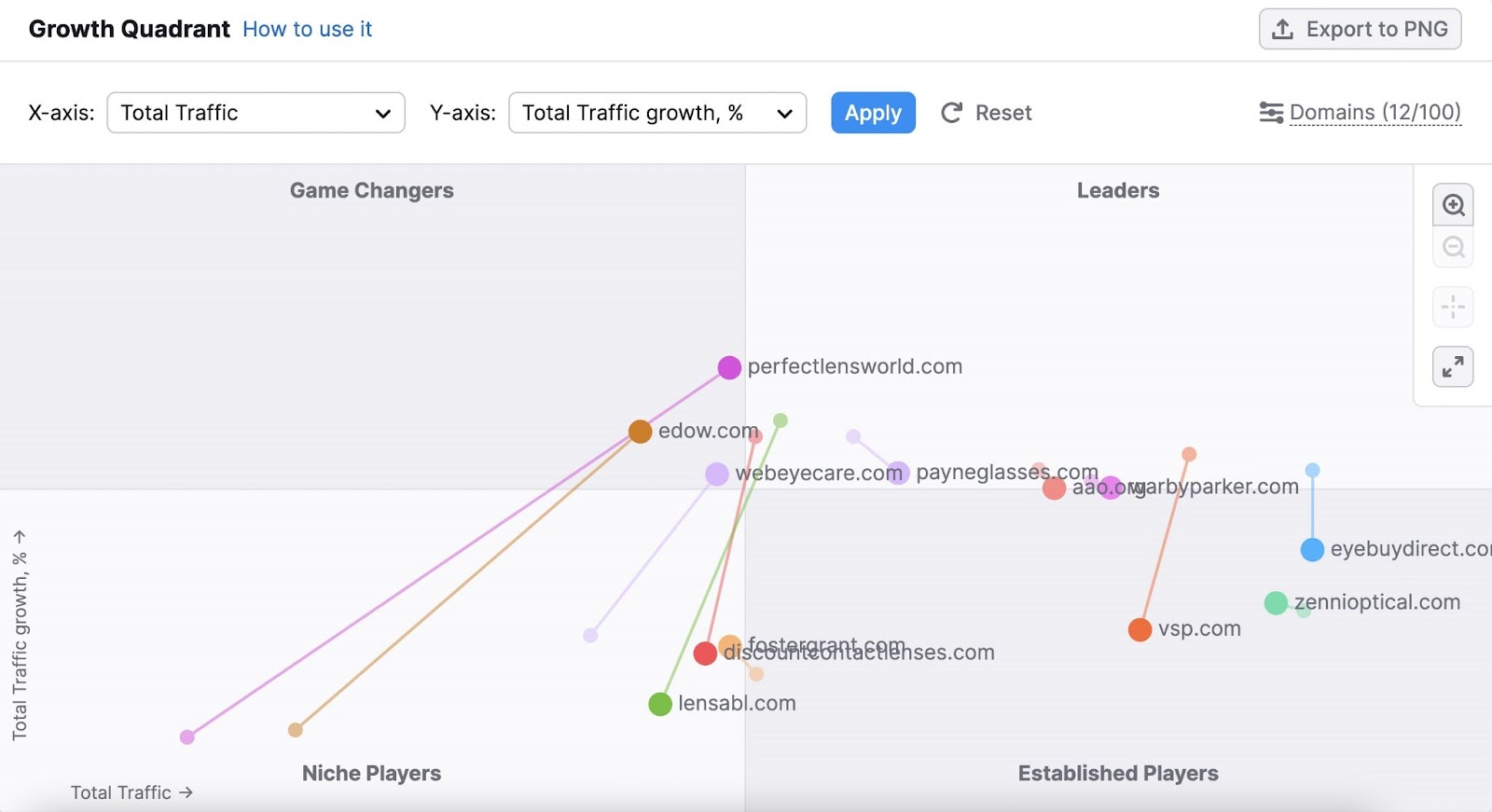

You’ll see your website’s positioning compared to competing sites. Like this:

Using the “Total Traffic” and “Total Traffic Growth, %” metrics, the websites are categorized as:

- Leaders: High-traffic sites with high growth rates

- Established Players: High-traffic sites with low growth rates

- Game Changers: Low-traffic sites with high growth rates

- Niche Players: Low-traffic sites with low growth rates

You can choose different metrics for comparison as well.

Just click the drop-down menu next to “X-axis” and “Y-axis,” make your selections, and hit “Apply.”

Now, see where you (and your main competitors) stand for your selected metrics.

Note the key metrics where your competitors are stronger. And use the insights to plan your growth strategy.

Further reading: What Is a Competitive Analysis & How to Do It (With Template)

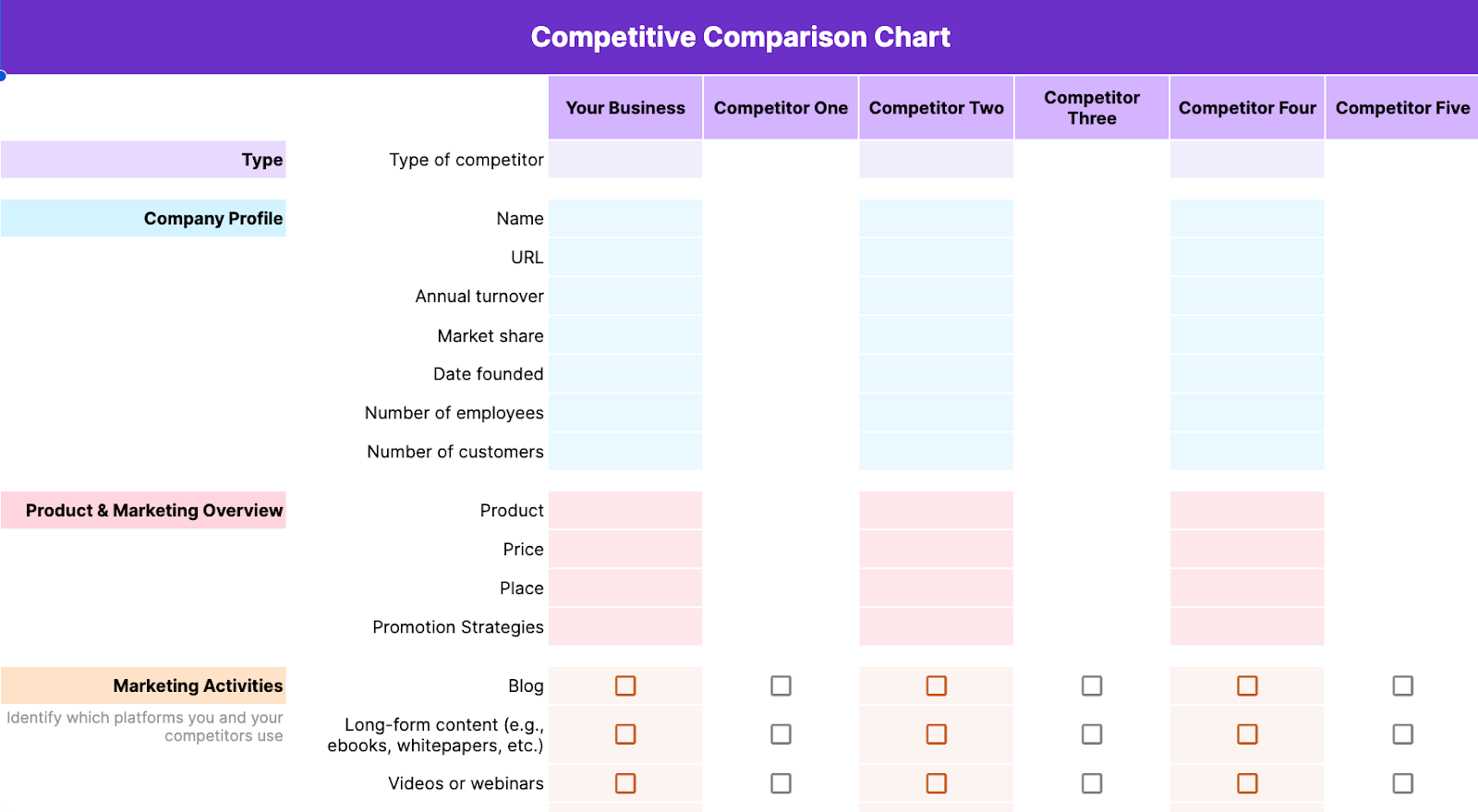

2. Competitor Comparison Chart

A competitor comparison chart (also called a competitive landscape chart) is typically a table used to compare your products, services, or tactics against those of your competitors.

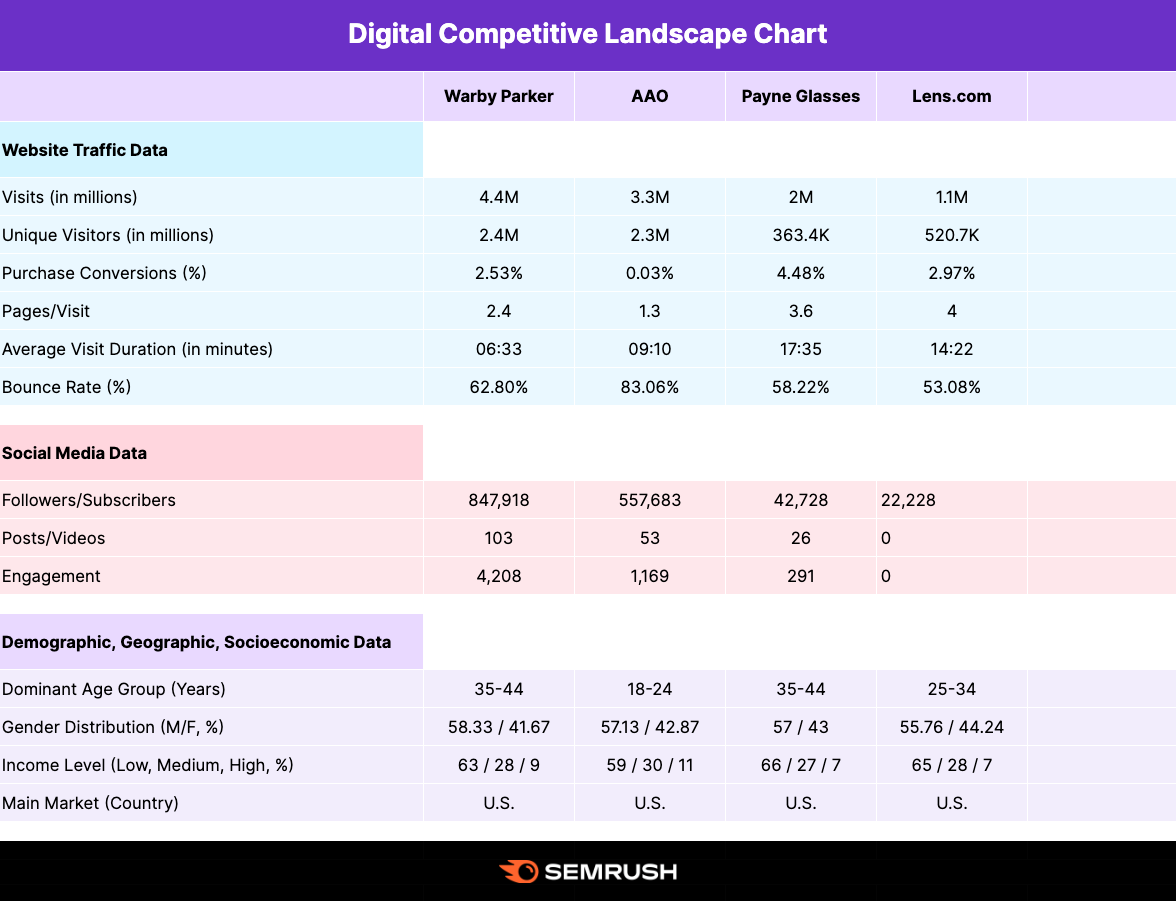

Like this:

This competitor matrix is especially useful for a broad competitive analysis. Because the side-by-side comparison gives you quick insights such as:

- The strengths and weaknesses of your competitors’ go-to-market strategies

- Your competitors’ relative presence in specific marketing channels

- Your competitors’ most successful acquisition channels

Use the competitive comparison chart template (the second tab) to create your own.

You can also use comparison charts for narrower analyses (e.g., product or feature comparisons).

Which can be useful for:

- Product or service development: Identify gaps in the current market, improve your offerings, and establish a strong differentiator

- Marketing and sales: Fine-tune your messaging to highlight your unique value proposition

- Strategic decision-making: Guide decisions about pricing ******, feature development, partnerships, and acquisitions

Or, identify a handful of areas that are most relevant to your business to focus your analysis on.

You can use the competitive landscape chart template (the sixth tab) to do this. And edit the fields to fit your needs.

3. Gartner’s Magic Quadrant

Gartner’s Magic Quadrant compares how brands stack up in a specific technology market. And analyzes them on their ability to understand and influence the future of the market and their performance in key areas like market share, product capabilities, sales channels, and customer experience

Based on the above factors, each company is placed into one of the following quadrants:

- Leaders: These are well-established brands with strong execution capabilities. And a clear vision for the future of the market.

- Challengers: These brands have adequate resources and a strong ability to execute. But they need to work on vision.

- Visionaries: These players have a solid vision and intellectual properties. However, they’re comparatively weak or slow in execution.

- Niche players: These brands serve only a specific market segment. Or have a limited product portfolio.

One example is Gartner’s Magic Quadrant for DevOps Platforms. And the data within it can help you make informed decisions.

Let’s say your brand falls in the “Visionaries” quadrant. You have a disruptive idea but lack the resources to execute it.

That insight tells you where to focus.

And you could consider joining hands with a business in the “Challengers” quadrant. Since they need what you have—vision—you may be able to negotiate a good partnership.

Just remember that the Gartner Magic Quadrant Matrix is a snapshot. Not a definitive ranking.

4. SWOT Analysis

A strengths, weaknesses, opportunities, and threats (SWOT) competitor analysis matrix evaluates a company’s internal strengths and weaknesses. Plus external opportunities and business threats.

It helps you:

- Identify and use your strengths (e.g., strong brand awareness) to outperform competitors

- Know and address your weaknesses (e.g., poor customer service). Before they cause damage.

- Spot and grab emerging opportunities (e.g., new market segments)

- Foresee and avoid potential business threats (e.g., political instability)

Here are some questions to help you get your SWOT analysis data:

|

SWOT Analysis |

|

|---|---|

|

Strengths |

Weaknesses |

|

|

|

Opportunities |

Threats |

|

|

Gather your leadership team and brainstorm SWOT questions and answers. This way, you’ll get diverse perspectives from multiple stakeholders at your organization.

Then, compile your results in this SWOT analysis template (the fourth tab).

Here’s an example SWOT for a newly launched, fictional organic coffee brand called The Conscious Bean.

Further reading: SWOT Analysis: What It Is & How to Do It [Examples + Template]

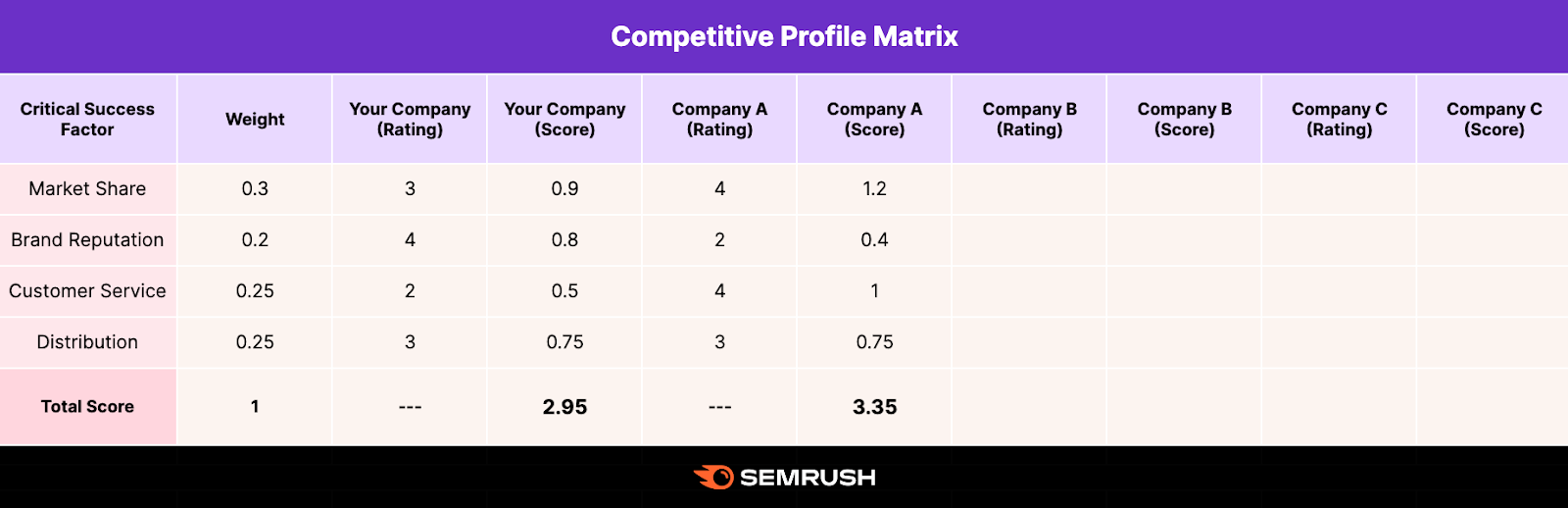

5. Competitive Profile Matrix

A competitive profile matrix helps you benchmark your offering directly against major competitors. To provide a more nuanced view of how you compare overall.

It focuses on rating competitors on critical success factors (CSFs) by using a weighted scoring method.

Here’s how it works:

- List three to four main competitors you want to evaluate

- Determine your CSFs—these are key areas that drive success in your market. Like product or service quality, pricing, customer support, distribution network, or innovation.

- Assign weights between 0.0 (low importance) and 1.0 (high importance) to each CSF. The total weight must add up to 1.0.

- Rate competitors across all CSFs on a scale of 1-4 or 1-5. A higher rating indicates stronger performance for that CSF.

- Multiply the weight by the competitor’s rating for each CSF to get a score. Add individual CSF scores for each competitor. It’ll give you a total weighted score.

Here’s a simplified competitive profile matrix example.

How do you interpret this table?

The company with the highest total score is typically the strongest.

So, make sure to examine how you rank in each CSF compared to others. And revise your strategy accordingly.

Use this competitive profile matrix template (the fifth tab) for your analysis.

How to Create Your Own Competitive Matrix

To complete a matrix, you need to conduct competitor research and gather data—likely using competitive intelligence tools.

We’ll show you how.

Step 1. Identify Your Competitors

Start with a list of all potential competitors—direct, indirect, and emerging players in your market.

Find them using resources like:

Or simply head to Semrush’s Market Explorer tool and click “Find Competitors.”

Select your location, enter your website name, and hit “Research a market.”

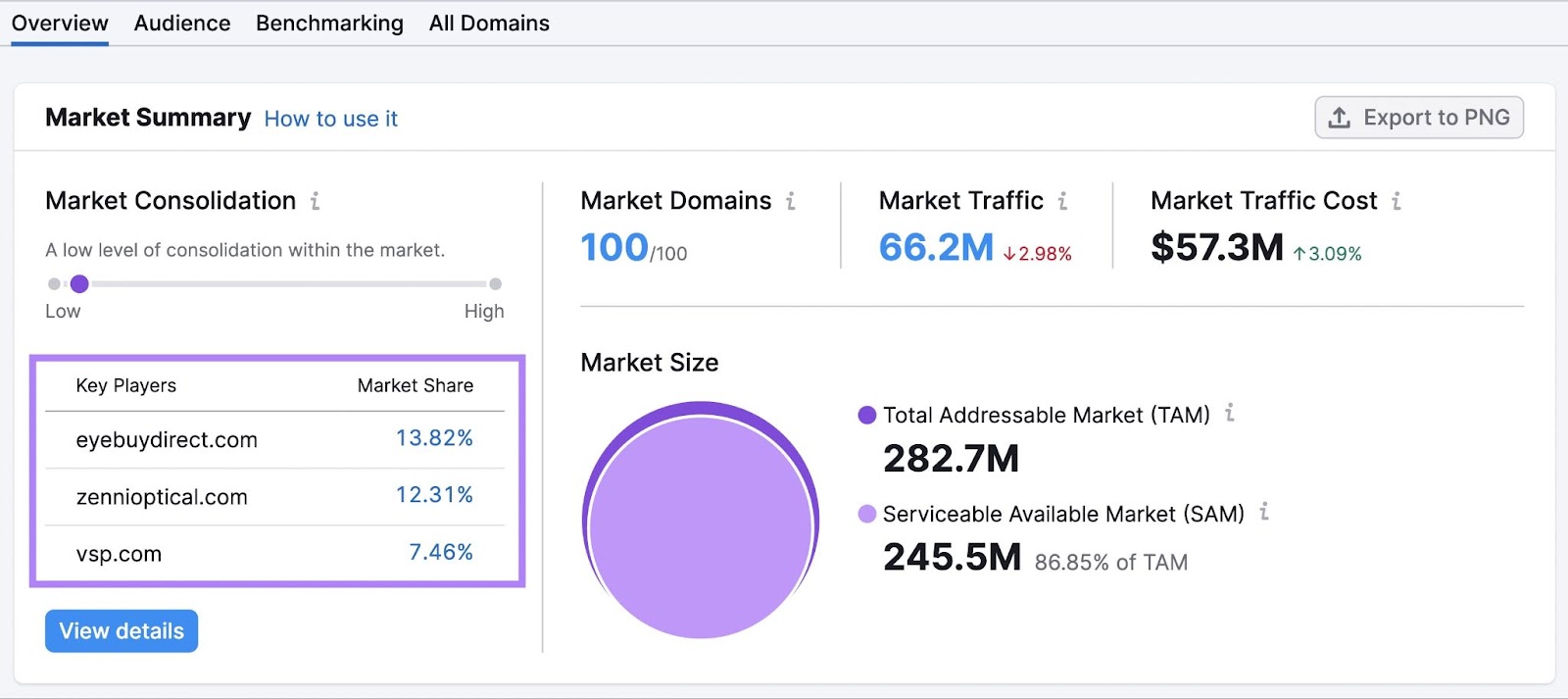

In the default “Overview” tab, you’ll see “Market Summary.” It shows a list of key players. And their market share.

Scroll down to reach the “Growth Quadrant.”

You’ll see the competitive landscape along with competitors’ positions in the market.

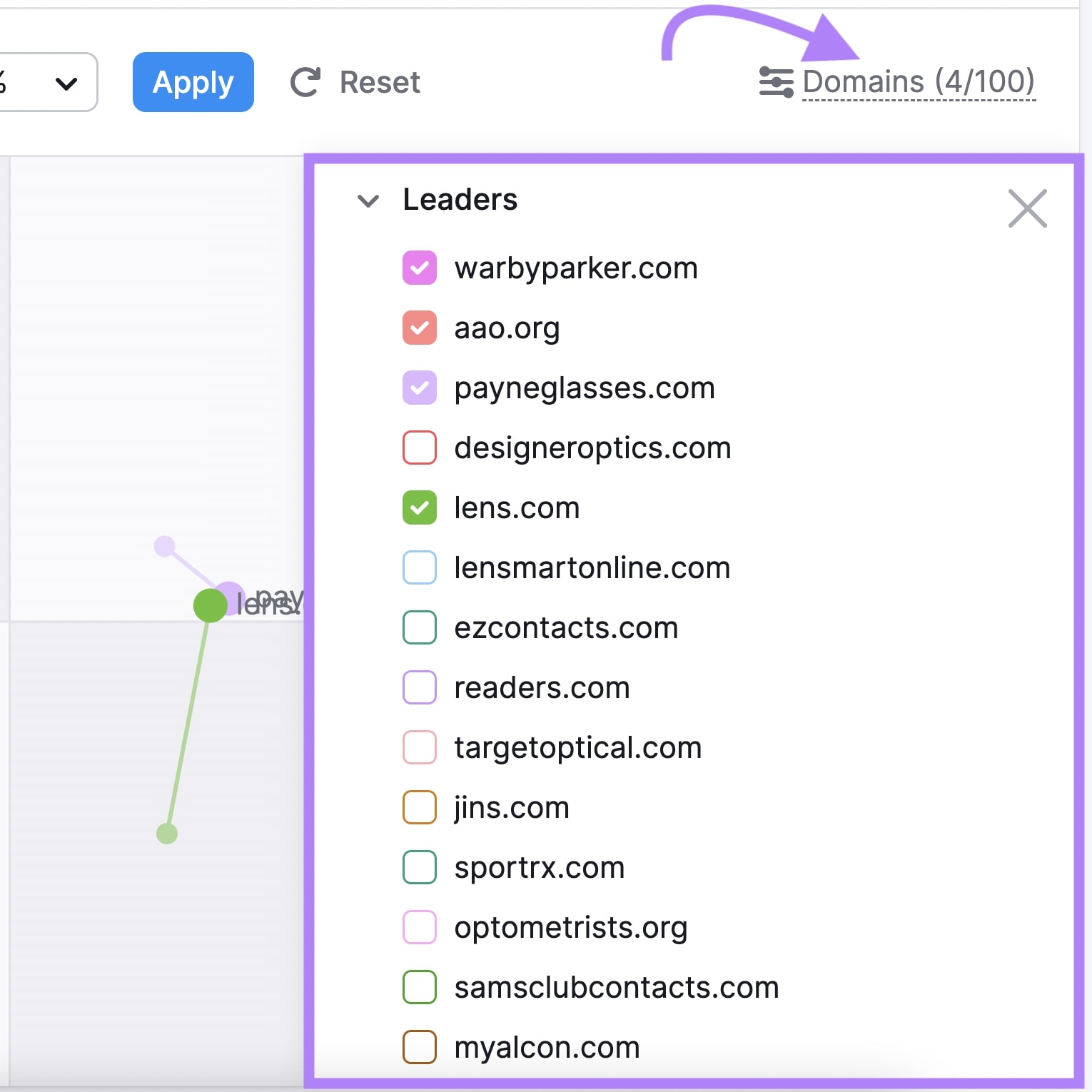

Now, identify your quadrant (“Leaders,” “Established Players,” “Game Changers,” or “Niche Players”). And click “Domains” near the top right corner of “Growth Quadrant.”

You’ll see the full list of the competing domains in your market.

Scroll to the list of domains in your same quadrant and select a few for your analysis.

Step 2. Determine Comparison Factors

Next, select comparison factors based on your competitive analysis goals.

They’ll guide your research. And help you choose the right competitive matrix type for your analysis.

For our example, we’ll look at the following factors:

- Website traffic data: Visits, unique visitors, purchase conversions, pages viewed per visit, visit duration, and bounce rate

- Social media data: Followers/subscribers, posts/videos, and engagement rates

- Demographic, geographic, and socioeconomic data: Dominant age group, gender, income level, and main market

Then, add you/your competitors and your comparison factors to a copy of the matrix template that works best for your situation. In this case, we recommend using the competitive landscape chart (the sixth tab).

Step 3. Gather Data

Now, you’ll need to collect the data that corresponds with your comparison factors to fill in the matrix.

Here’s what that entails based on the ones we identified above:

Website Traffic Data

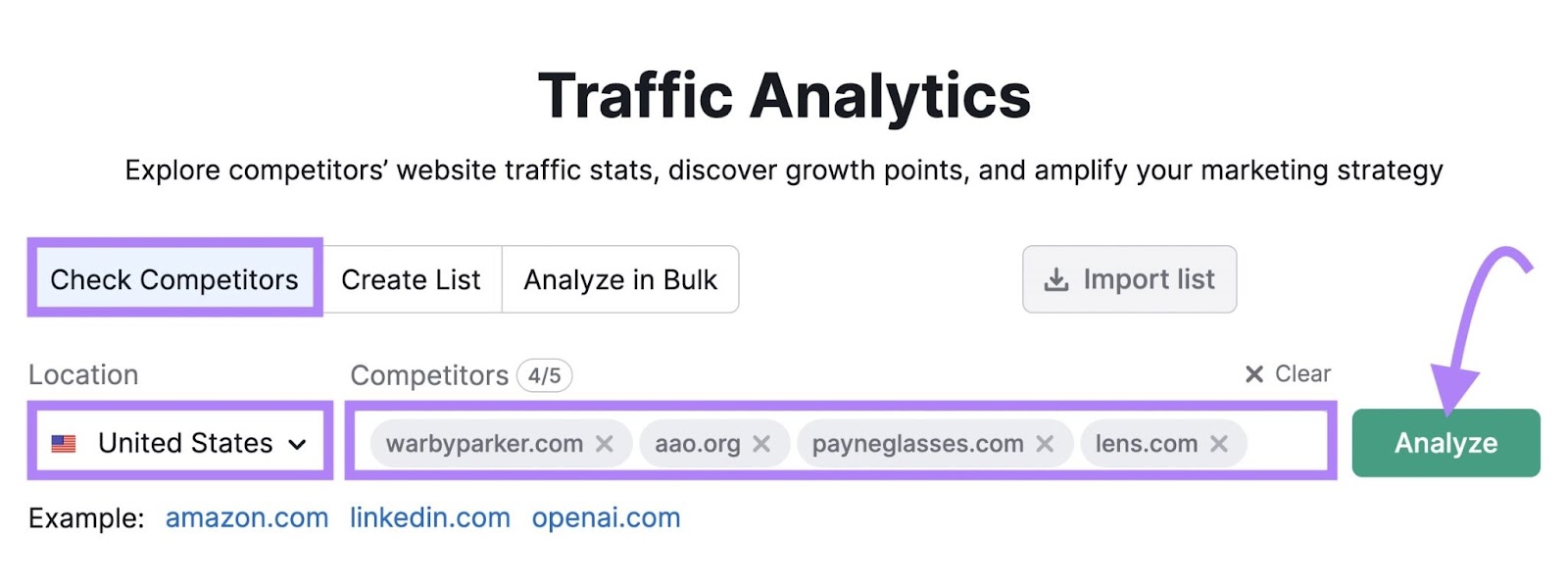

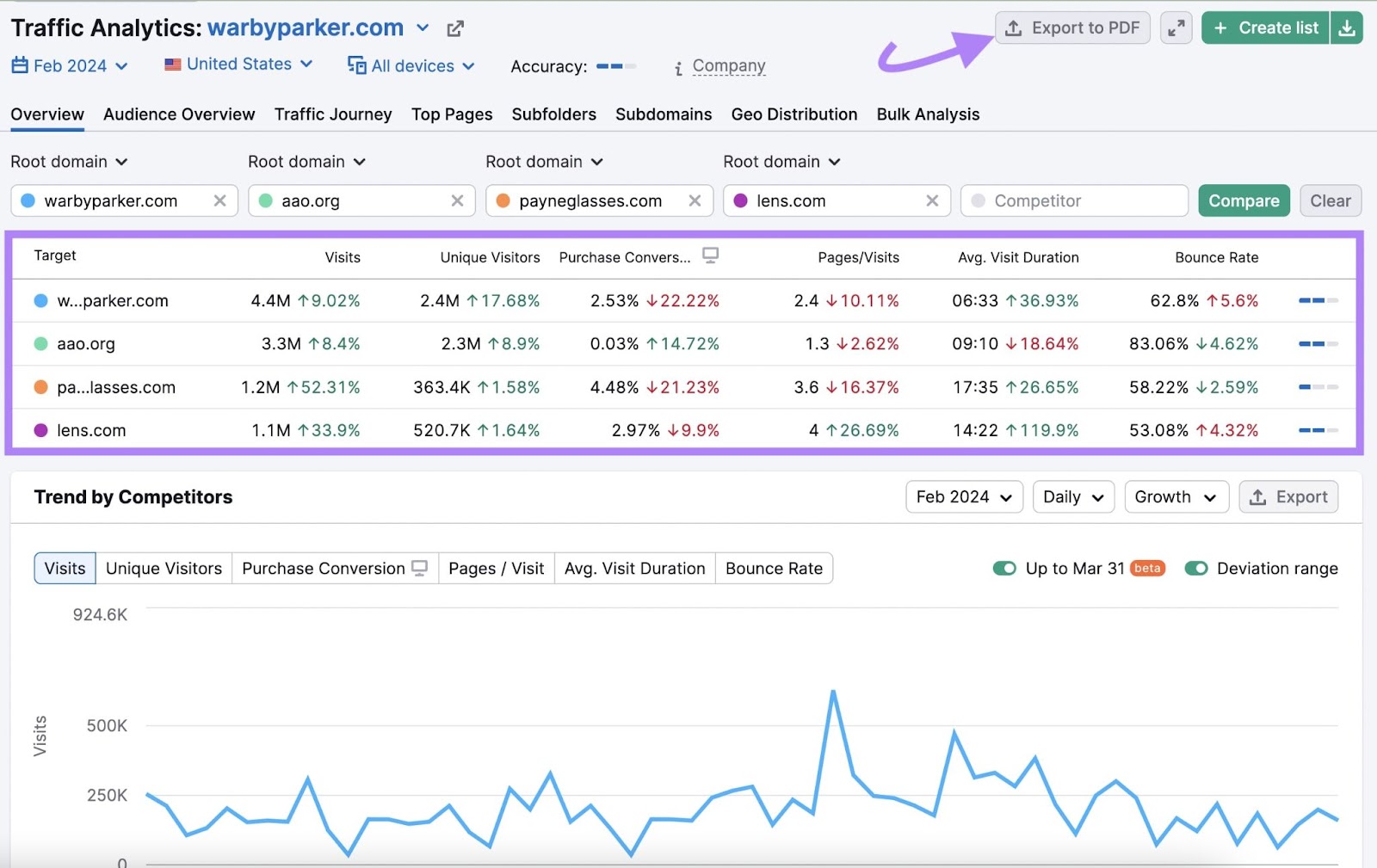

We’ll use Semrush’s Traffic Analytics tool to get the website traffic data.

Open the tool and click “Check Competitors.”

Next, select the location, enter your domain and your competitors’ domains, and click “Analyze.”

You’ll see the important website traffic metrics for the selected sites for the last full month (you can change the **** range if you wish). So you can analyze your site’s performance against the competing domains.

Click “Export to PDF” to get this data in your email.

Or paste it directly into your template copy.

Social Media Data

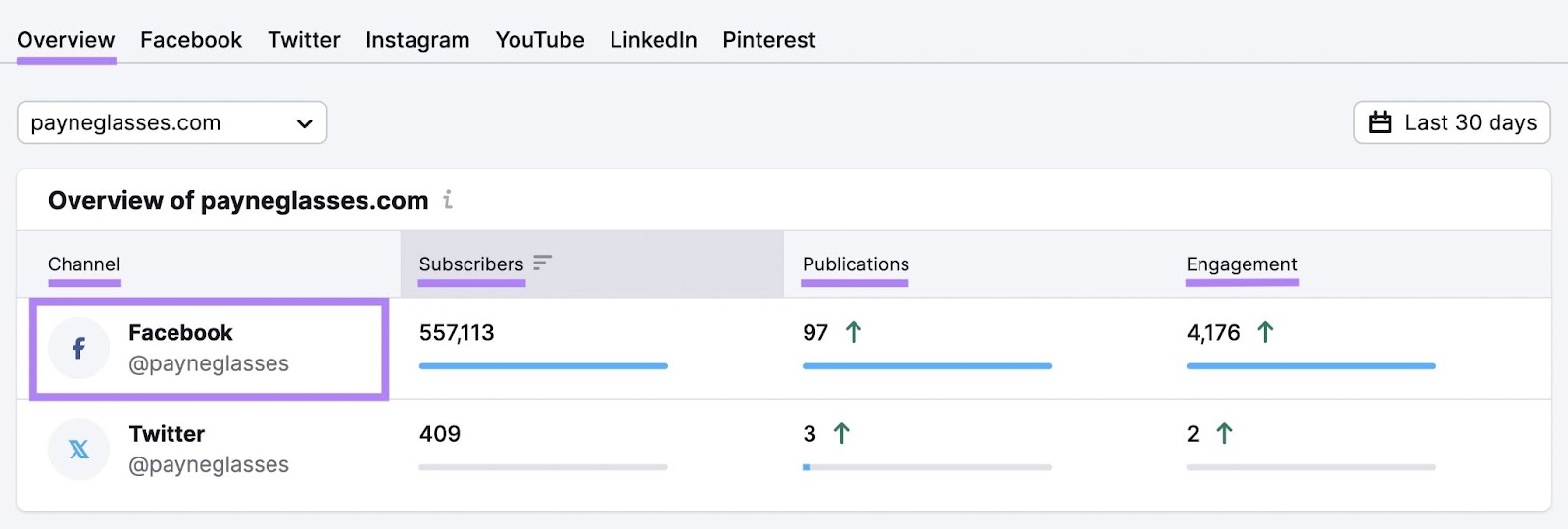

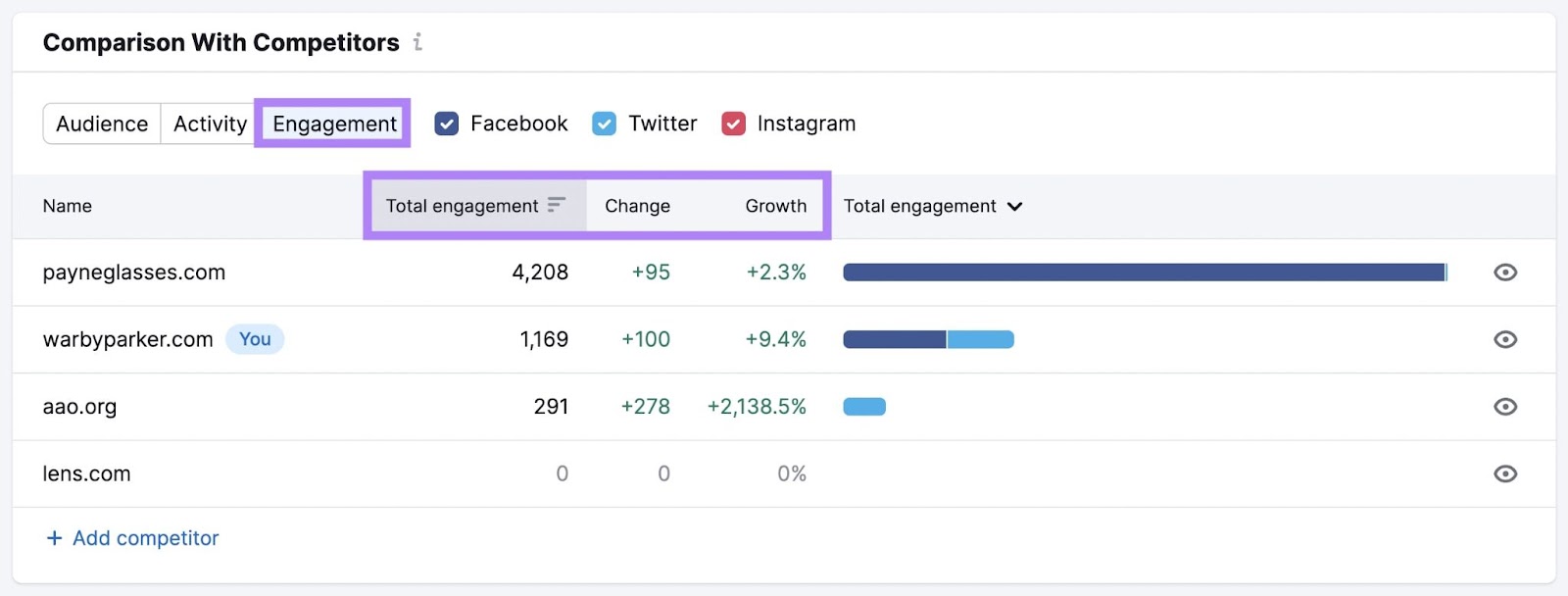

Now, let’s go over how to get competitors’ social media data using the Social Tracker tool (part of Semrush Social). It lets you track the social media activity and performance of up to 20 competitors.

Open the tool. And follow the Social Tracker configuration instructions.

At the top of the “Overview” tab, you’ll see the chosen competitor’s audience size, posting activity, and engagement on different social platforms.

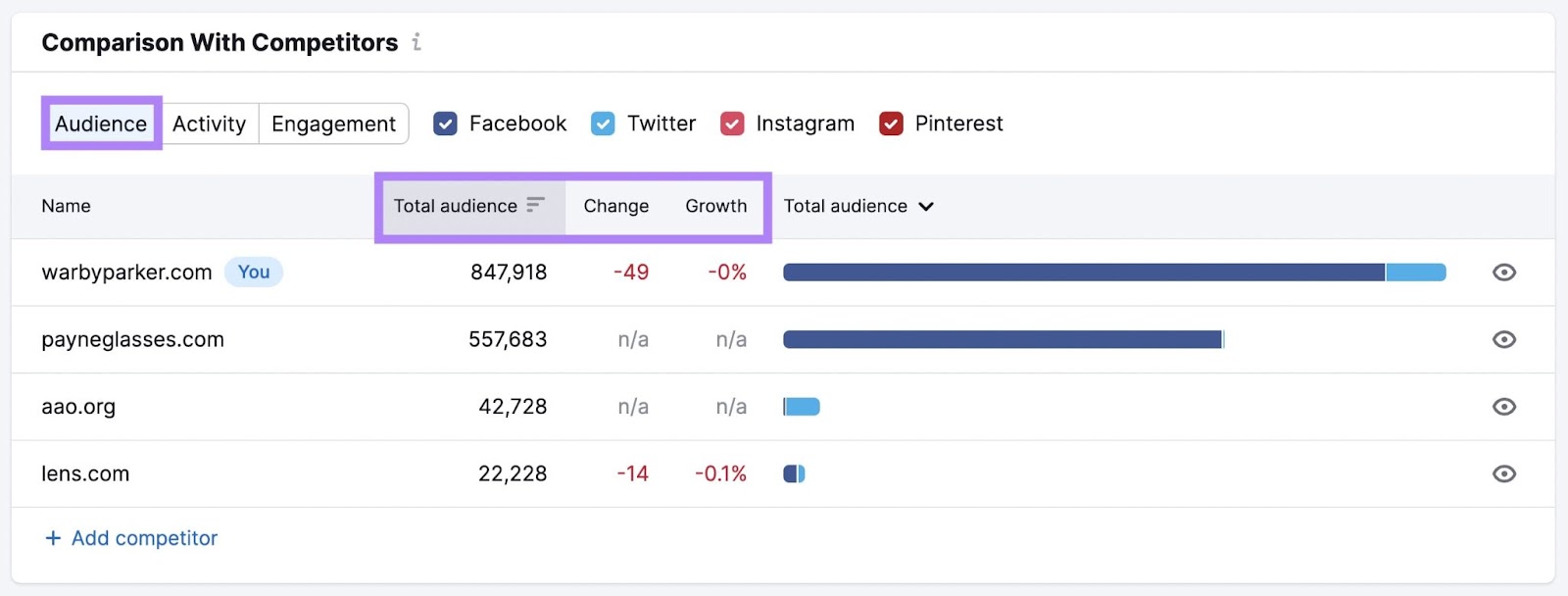

Scroll to the “Comparison With Competitors” widget to see how you stack up against your competitors.

The “Audience” tab shows the total number of followers or subscribers across the social platforms. Including the changes in the audience size.

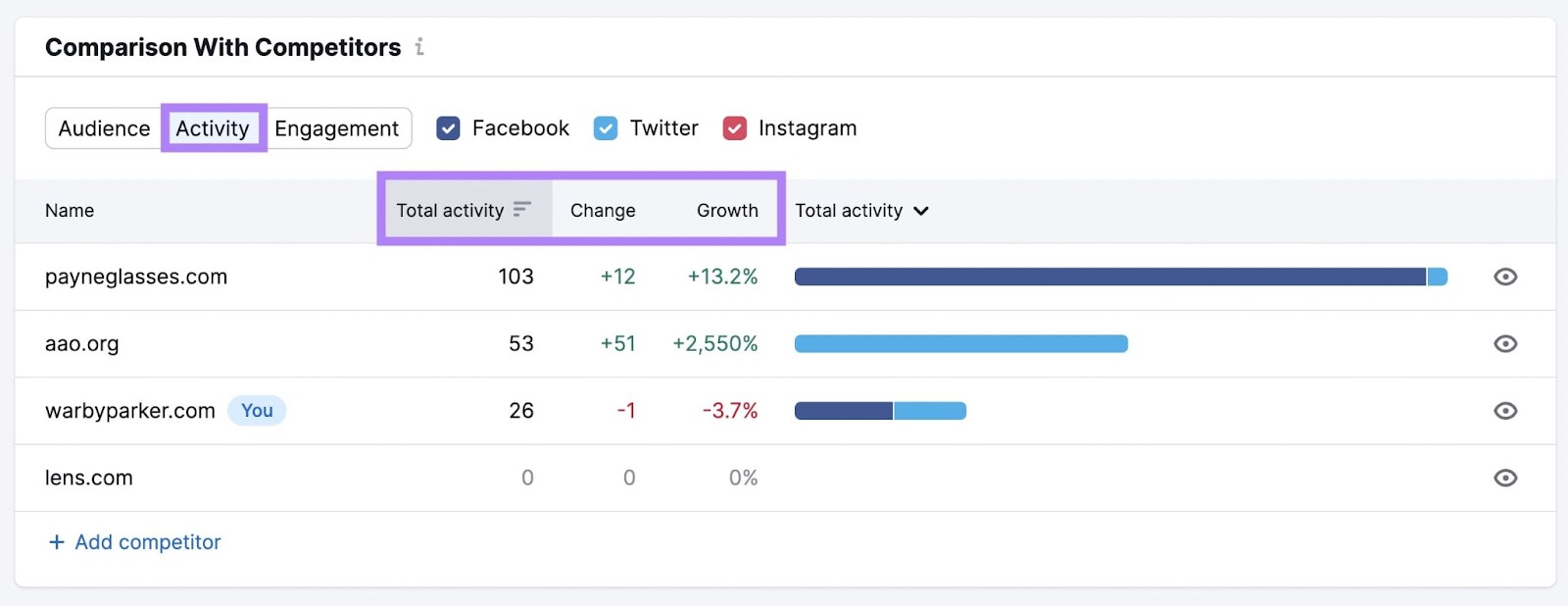

Click the “Activity” tab to see the total number of social posts of each competitor. For the selected period.

Similarly, analyze the total engagement.

You can now add this data to your competitive landscape chart.

Further reading: How to Uncover Your Competitor’s Social Media Strategy

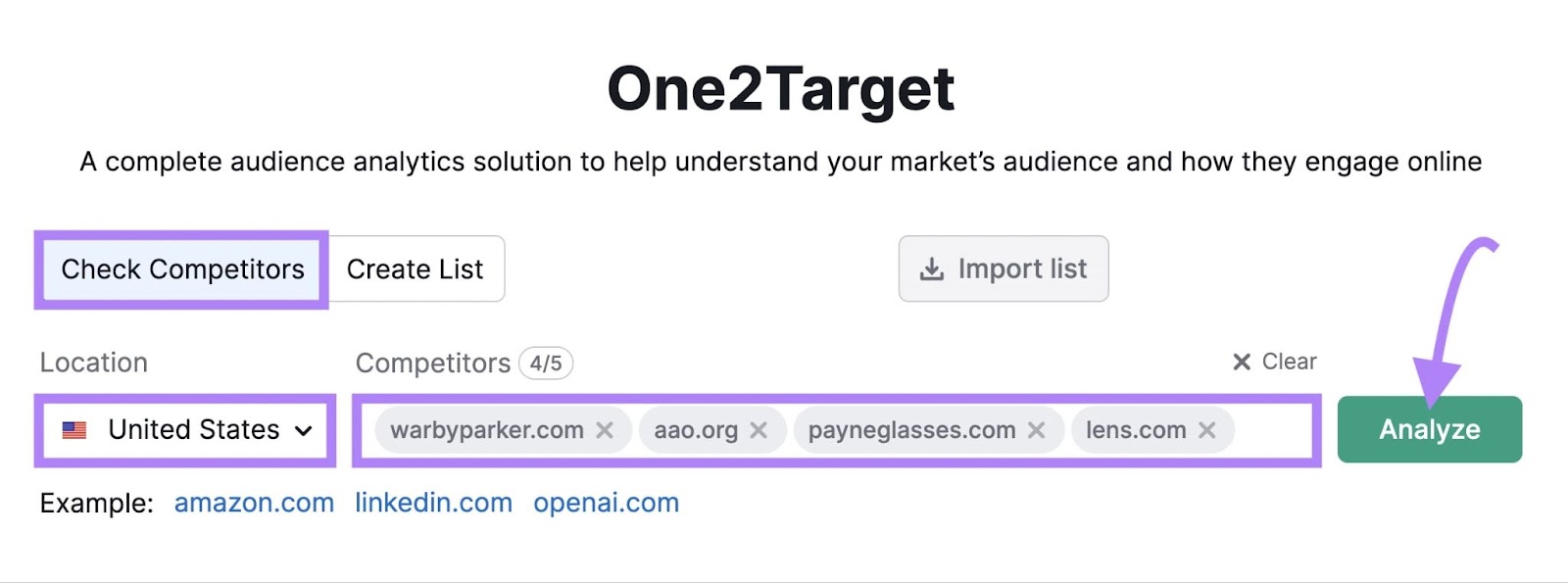

Demographic, Geographic, and Socioeconomic Data

Comparing demographic, geographic, and socioeconomic data can reveal valuable insights about your target audience.

Use Semrush’s One2Target tool to find this information.

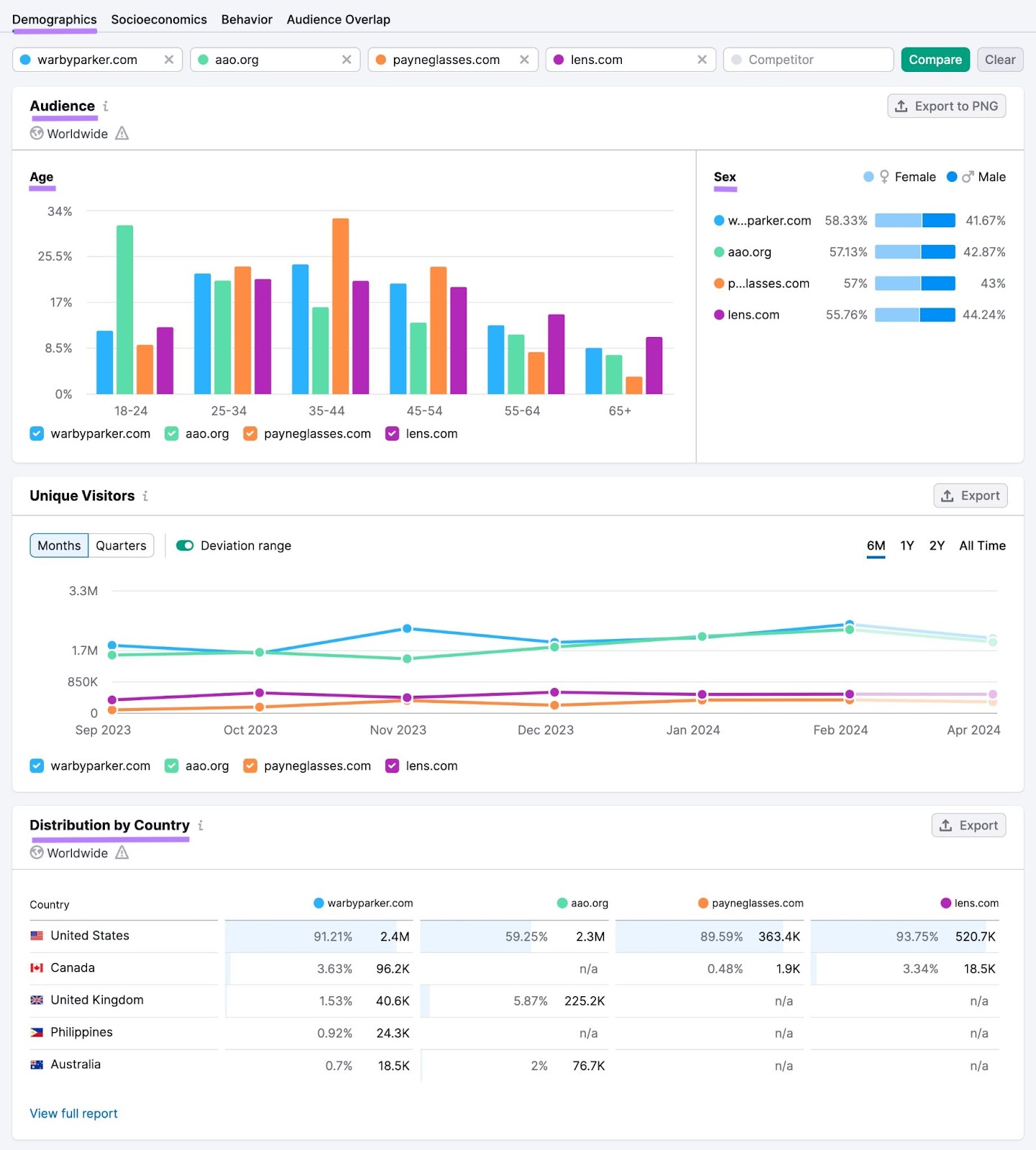

Enter the same domain names and select the location. Then, click “Analyze.”

In the “Demographics” tab, you can pull data about age, gender, and country.

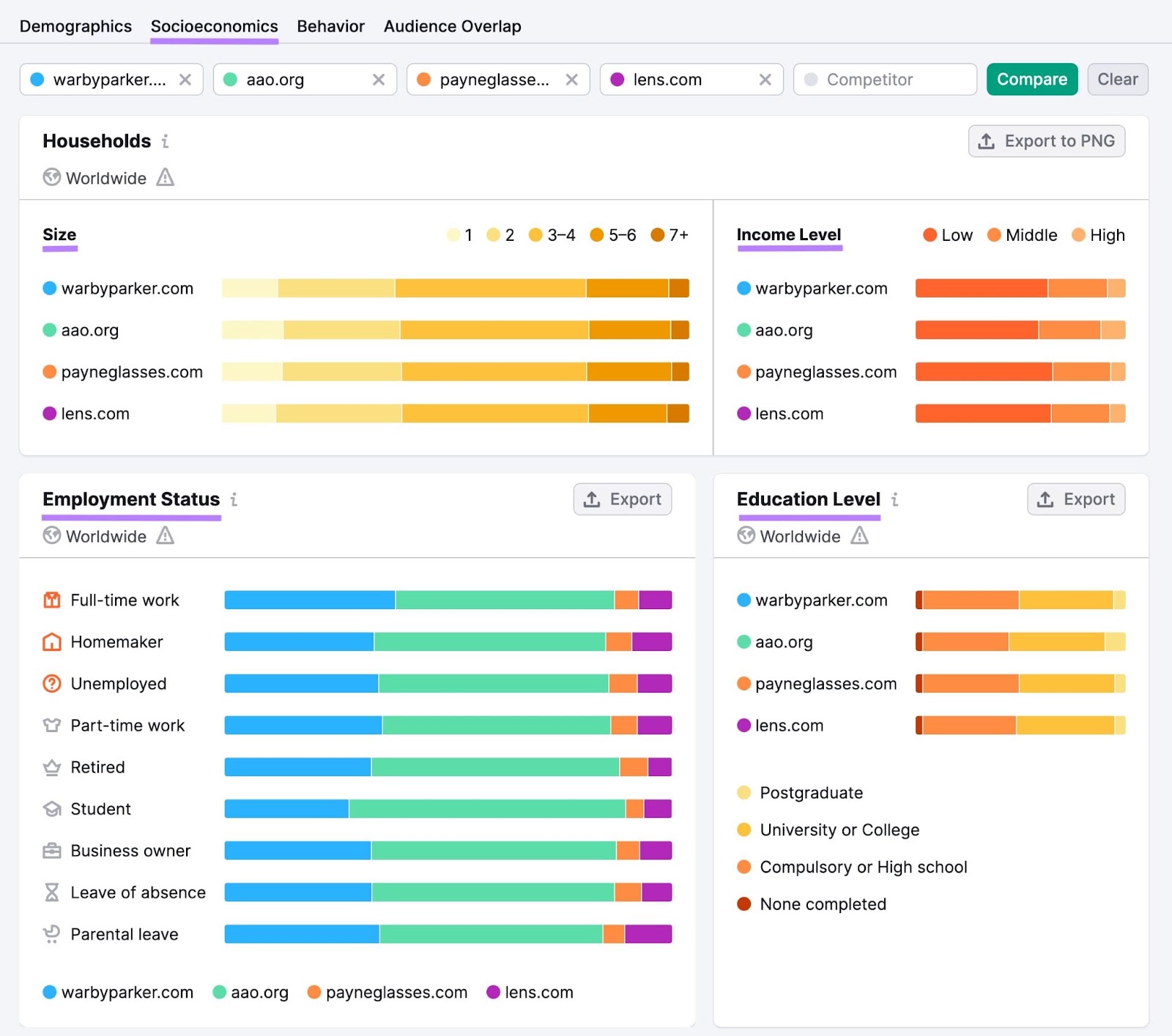

In the “Socioeconomics” tab, you’ll see household size and employment status. Plus education and income level.

These insights can guide your product, pricing, and marketing strategy.

For example, if a large part of your audience is in a low-income bracket, then you’re most likely operating in a price-driven market. That means buying decisions are likely to be influenced most by the price of the product.

In such markets, you may want to focus your messaging around value for money. And drive sales volume with discounts, offers, and promotions.

Step 4. Fill In the Matrix

Now that you’ve collected your data, simply add it to your comparison matrix. In this case, the competitive landscape chart.

It might look something like this:

Use Your Findings to Gain a Competitive Advantage

The main goal of creating a competitive matrix is turning data into insights you can act on to drive growth.

But maintaining a long-term competitive advantage also requires an awareness of your competitors’ actions.

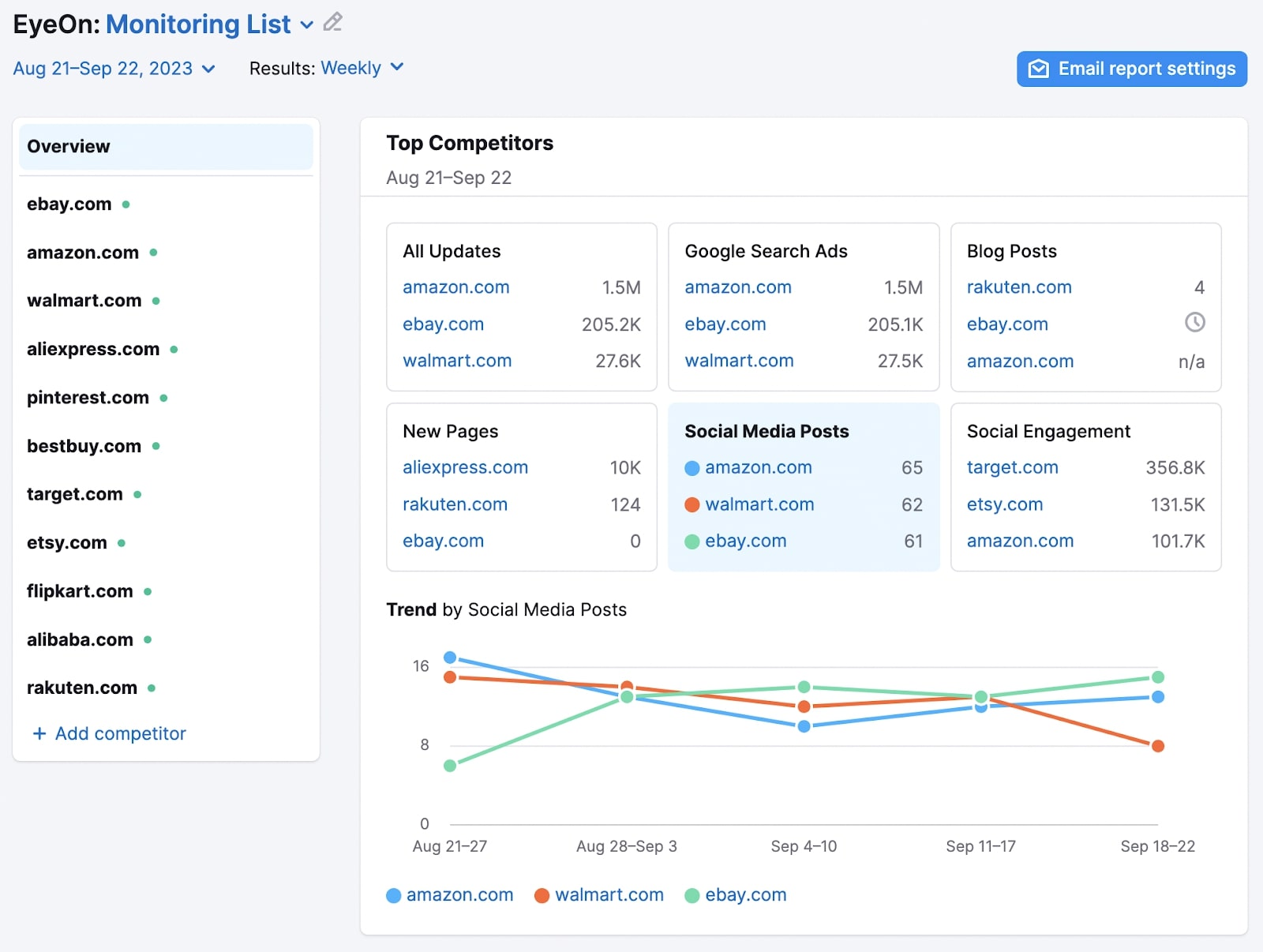

Use Semrush’s EyeOn to automate tracking your competitors’ online marketing activities.

It keeps you updated on your competitors’ newly published pages, blog posts, Google ads, social media updates, and more.

Source link : Semrush.com