Posted by

Mordy Oberstein

After a relatively considerable period of quiet, Google has rolled out its latest algorithm update. Not since October 2016 have we seen a Google update as long running, lasting five or more days. In this context, the current rendition of Google’s ever-changing algorithm has a degree of esteem that is not common to all updates. Like its counterparts though, discerning the actual impact of the update on rank is intrinsically elusive. That is, determining the character of the update, as well as what sites in what positions were impacted is challenging. Allow me then to offer some context and a bit of understanding of what transpired, specifically what ranking positions were most impacted by this update.

Google’s June Algorithm Update – High Fluctuations, Low Chatter

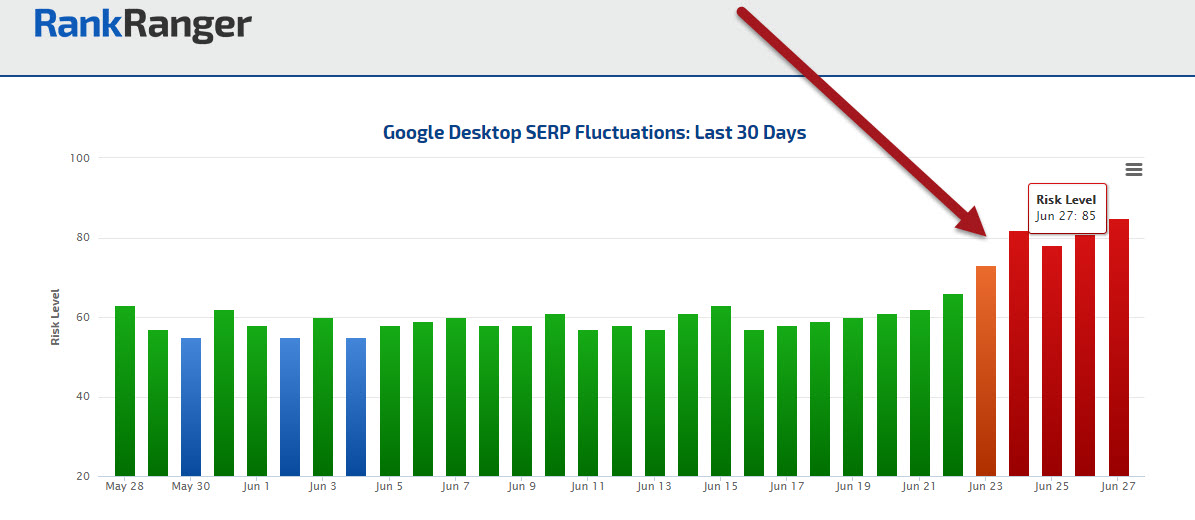

Despite the length of the current update, the initial chatter, per Barry Schwartz of SERoundtable, was quite light. This is obviously peculiar, not only in light of the length of the update, but the fluctuation levels themselves as well. The risk levels on our Rank Risk Index have risen above moderate, and show a continuous series of high fluctuation levels.

The Rank Risk Index shows a substantial increase in rank fluctuations over an extended five day period

With rank fluctuations being what they are, a voluminous degree of chatter would be the norm, or at minimum the expectation. What then is behind the slow development of industry chatter in this instance? This question, oddly as it may be, plays a significant role in understanding (of course partially, as only Google knows the full picture) what transpired with this update.

On Analyzing the Update

Having sifted through an enormous amount of data, I’ve boiled the update down, at least for our purposes, to three metrics:

- Top 3 Results – Exact Match (%)

- Top 5 Results – Exact Match (%)

- Top 10 Results – Exact Match (%)

Before going any further it’s important to understand what these metrics mean and how I utilized them. These metrics take a start point, and of course and end point, and track the percent of sites within the top 3, 5, or 10 ranking positions that were in the same position at both the start and end points.

For the sake of simplicity, let’s take an example. Say our start **** was January 1 and our end **** January 31. This series of metrics tracks the percentage of sites that were in the same position on both January 1 and 31, and further segments the data by showing percentages for top 3, 5, and 10 positions.

This is essentially what was done here, except I have compared two periods to each other, namely our baseline period to the current update period. For our purposes the data can be used to determine where on the SERP the algorithm update was most impactful. Specifically, which ranking positions, if any in particular, is Google targeting with its update? Here in June, Google’s main focus was on sites that were ranking in positions 6-10. Here’s how I know.

The Data Behind Google’s June Update – Niche by Niche

In trying to give this algorithm update some context, I went through the fluctuations on a per niche basis. My intent was to establish a fluctuation pattern, which with the help of a Rank Ranger tool currently under development, I did. While fluctuations were present in both the top 3 and top 5 results, those sites ranking in positions 6-10 were clearly subject to the most SERP volatility. Here then is the data on five of the niches we track (though for the record, this pattern was consistent across all niches, but for the sake of being brief, I am only showing data for five industries).

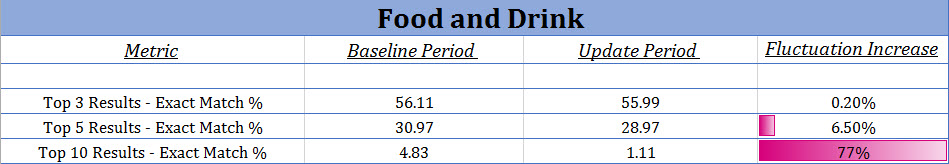

Fluctuations within the Food & Drink Industry

I start with this industry since the discrepancy between the top 5 results and those below them is the greatest.

As you can see above, ranking fluctuations are the norm, tracking an update only means that this norm has spiked. In this instance, the percentage of results within the top 3 that did or did not fluctuate between the start and end of the update were within the norm, for all intents and purposes. There was only a .2% increase in the rank fluctuations within the top 3 results when compared to the baseline data.

Even the top 5 only showed a 6.5% increase in fluctuations. However, when analyzing the top 10 results there was a sudden and serious increase in rank fluctuations (specifically a 77% increase), thereby indicating that sites in positions 6-10 underwent the most rank volatility.

Moving from 6.5% (top 5) to 77% (top 10) is an outstanding 1,085% increase in fluctuations between the top 5 and top 10 exact match metrics.

******** Niche Fluctuations

When trying to determine if Google has rolled out a quality update, this niche is where I start. However, in this case, the ******** niche was not exceptional when compared to other industries. However, like the other niches, here too Google has honed in on sites ranking between 6-10 on the SERP.

As indicated below there was a sort of proportional increase in rank fluctuations during the update as compared to the baseline fluctuation rates. The percentage of the top 3 results that matched exactly at both the start and end points of the baseline period was 51.19%, whereas that number decreased to 43.35% during the update, constituting a 15.3% increase in rank fluctuations.

Fluctuations for the top 5 results increased by 30.8%, double the increase in fluctuations seen within the top 3 results. Doubling the increase seen within the top 5 results, sites within the top 10 positions underwent a 60.3% increase in fluctuations during the update as compared to the baseline period.

As with the Food and Drink niche, the proportional increase in fluctuations between the top 5 and top 10 results is indicative of the level of volatility found within those sites ranking between the 6 and 10 spots on the SERP. Here, the increase in fluctuations between the top 5 and top 10 results was still high, showing a 96% increase.

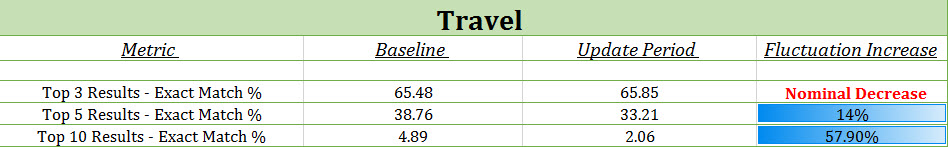

Bottom of Page One Rank Volatility within the Travel Industry

Following the pattern outlined in the two niches above, the Travel industry also saw a significant jump in the level of fluctuations found within the bottom half of the SERP (as compared to the top 5 results).

Here however, the niche showed even a slight increase in rank stability within the top 3 results, as percentage of matching results during the update were nominally more stable than during the baseline period. However, from a data perspective the increase is trivial. The top five results though displayed a more than modest increase in fluctuations as compared to the baseline period. With stable top 3 results, the 14% increase shown within the top 5 metric can as such be attributed to positions 4 and 5.

Similarly, the 57.9% increase within the top 10 results exact match metric can be traced to those sites ranking between positions 6-10. In fact, the increase in fluctuations between positions 1-5 and positions 6-10 is a substantial 314%.

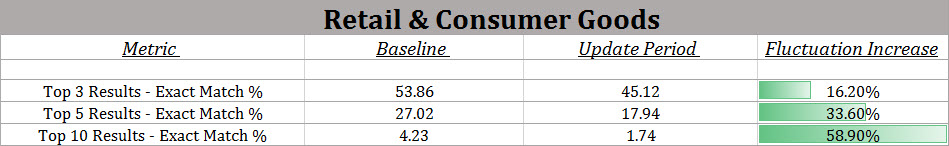

The Google Algorithm Update’s Impact on Retail and Consumer Goods

Of all of the niches, the Retail and Consumer Goods industry showed the most overall volatility, as here, and again as compared to the baseline period, the top 3 results did show a moderate increase in fluctuations. In contradistinction to the previous industries presented, the top 3 results that remained the same between the update’s start and end points decreased relative to the baseline by 16.2%. Meaning, there was a 16.2% increase in rank fluctuations within the top 3 results during the update.

Again, moving down the SERP the fluctuations only increase. The top 5 results saw a 33.6% increase relative to the baseline, while the top 10 results saw a 58.9% increase. As with the previous niches, the increase in fluctuations between the top 5 and top 10 results was significant, though at 75% the increase here is the smallest differential between the niches.

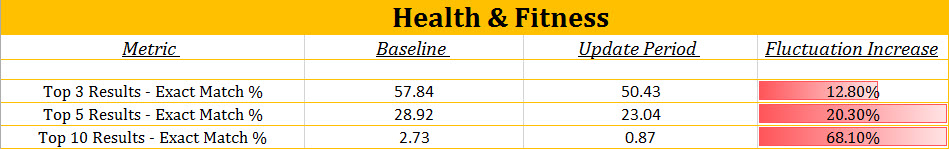

Rank Fluctuations within the Health and Fitness Industry

Rounding off the niches presented within this post, the Health and Fitness industry, like Retail and Consumer goods, also saw a substantial increase in fluctuations within the top 3 results. During the update, the top 3 results saw a rank fluctuation increase of 12.8% compared to the baseline period, while the top 5 results saw a 20.30% increase. Completing the pattern, the fluctuation increase spiked at 68.10% when looking at the top 10 results, again indicating a significant fluctuation uptick within positions 6-10.

Here, unlike the Retail and Consumer Goods industry, there was a considerable increase in fluctuations when moving from the top 5 to the top 10 results. With a 235% increase between the sets of SERP positions, there is conclusive evidence that Google has honed in on sites ranking between the 6th and 10th position on the SERP.

June 2017 Google Algorithm Update Conclusions

Coming full circle and returning to my original point, the lack of initial industry chatter is actually quite logical. For the majority of industries, the top 3 results saw minimal fluctuation changes. For the Travel industry, as well as within the Food and Drink industry, there was no increase in fluctuations within the top 3 results from a statistical point of view. In other words, it’s not as if your top ranking site is now on page 5.

Even the top 5 results, though showing moderate increases across the industries, were not off the charts with volatility. It’s only when looking at ranking positions that normally fluctuate extensively, do you start to see the increased volatility. If you look at the baseline data above, once you move towards the bottom of the SERP, it’s quite rare that the results are consistent from the start through the end of a particular period, and that’s on a good day, not during an update. Looking at this update, the fluctuations are there, you just have to look a bit more carefully. Specifically at positions 6-10. With the dramatic increase in fluctuations when looking at the top 10 versus the top 5 results, we can identify that the bottom portion of the SERP saw the brunt of the rank volatility… this time around.