Posted by

Shay Harel

Accessing country-specific Google search results has been turned a bit on its head recently. When Google announced that you could not use a specific ccTLD to access a country’s search results, international SEO underwent a dramatic change (for the record there is a workaround that gives you access to country-specific results). Though, in typical Google fashion, accessing international search results was not the only thing to change. With the domain change, Google changed the data trends of some of the most important features on the SERP across the globe. Beyond the inherent interest in tracking such changes, these alterations present both new SERP feature trends as well as insight into the very domain-level change Google made in late October.

Google Pushes More Ads After Restricting ccTLD Access

In many ways, Ads are the most important feature on the SERP for obvious reasons. Thus, knowing that the display trends of AdWords ads across the world have changed in a variety of ways is significant. There were in fact numerous changes to the data path of ads on the SERP. These new trends have showed various levels of consistency, with some trends reverting back to previous showings faster than others. Looking at the full picture, some interesting insights start to emerge.

Large Ad Spikes with Strong Initial Gains

On just the second business day after Google changed its ccTLD policy in an effort to keep search more localized, ads began appearing on more Page Ones in multiple countries. The increase was beyond dramatic. Just by way of example, in the US, the percentage of Page One SERPs (desktop) that contained at least one ad increased 342%! I don’t know how else to describe that other than by saying, that’s a lot more Page Ones that have ads on them, and that’s an understatement.

This though is not the new trend. Over the next few days, i.e., November 1st and 2nd, the percentage of ad-filled Page One SERPs declined. However, the two-day decline, in relative terms, was not overly significant. By the end of the drop, the US was still up 280% relative to the pre-spike data trends.

Other countries that showed a similar data path are: Canada, the UK, Australia, South Africa, Singapore, Hong Kong, and India. Thus, in general, this AdWords data path impacted countries whose official language is English, as it is in Singapore, Hong Kong, and India.

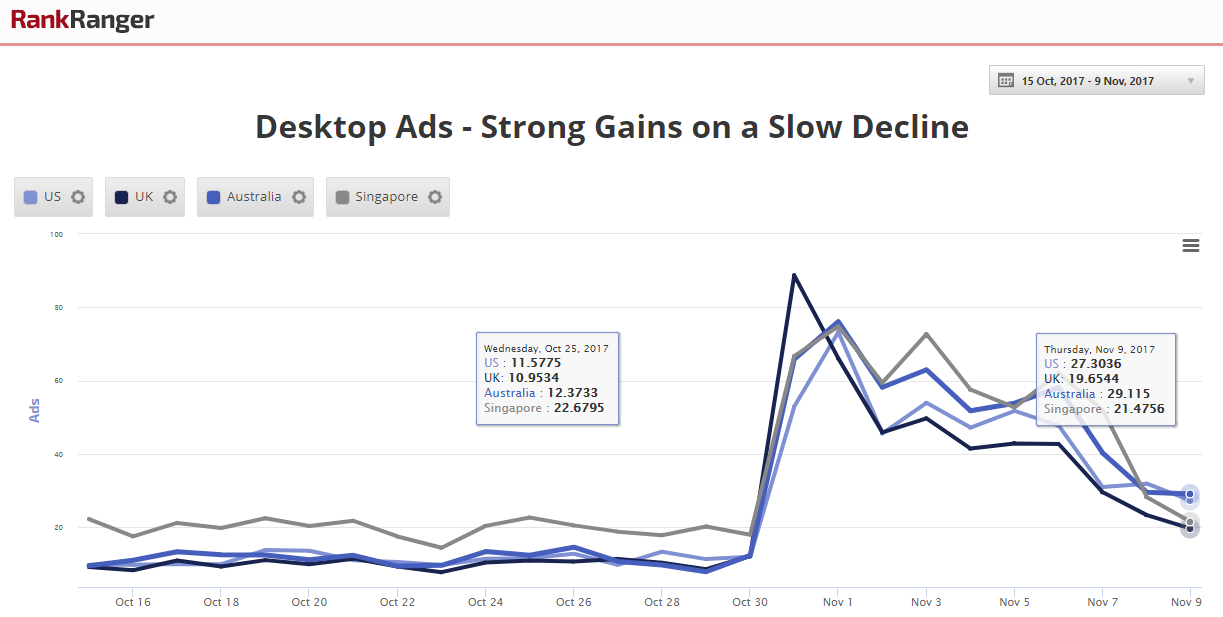

Desktop ads in the US, UK, Australia, and Singapore show a huge spike followed by a gradual decrease.

That data from November 2nd and on fluctuates up and down slightly with a steeper decline between November 6th – 8th.

10 days after the initial spike, the increases in the percentage of Page Ones showing ads for selected countries were as follows:

US: 121%

Canada: 11%

UK: 62%

Australia: 131%

South Africa: 10%

Singapore: 20%

Hong Kong: 66%

Despite the spikes, it would appear, that ads are slowly reverting back towards previous levels (more on this later). Whether or not ads do revert to previous trends, the downright enormous increases shown above are significant given their proximity to Google’s updated policy towards ccTLDs (more on this later as well).

Check out our guide to SERP feature rank tracking.

The Divergent Trend in Non-English Speaking Countries

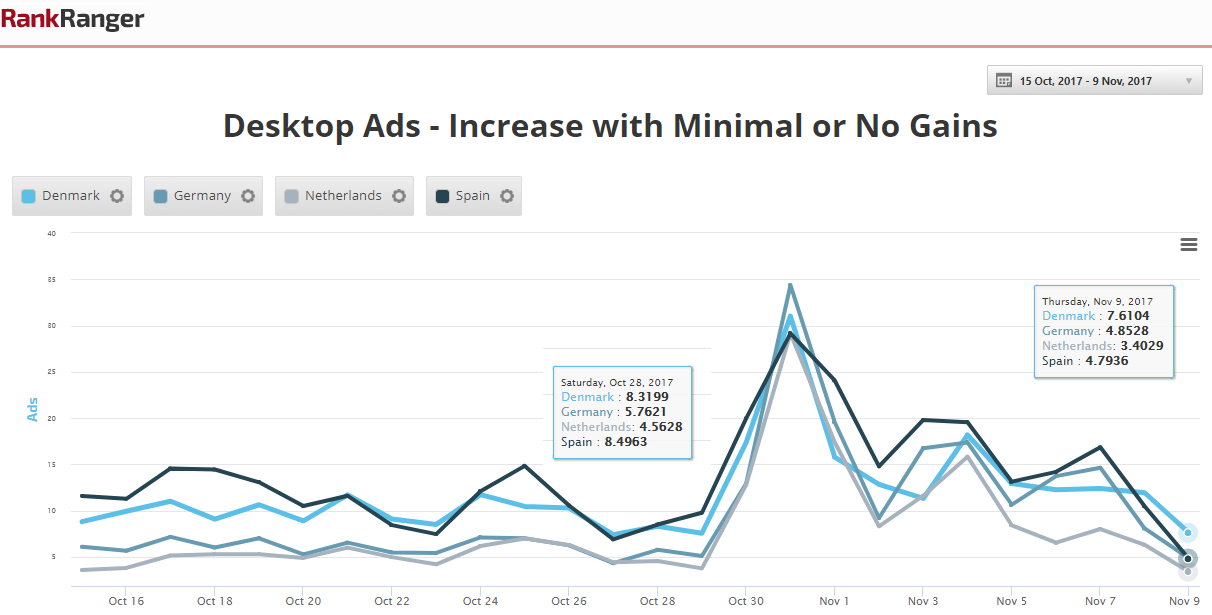

There is another group of countries that also saw huge ad spikes, but ultimately only saw minimal ad gains. Interestingly, these countries are not tied by language, but by region, Europe to be specific. Denmark, Germany, Spain, Netherlands, and France all saw their Page One ad trends alter dramatically.

Again, seeing a huge spike in Page Ones showing at least one ad, in Europe the spike began on the 30th, the first day back to business after Google’s industry altering geolocation shakeup. Again by way of example, Germany saw a shift from 5.1% of all Page One SERPs showing an AdWords ad to 34% of Page Ones containing an ad, a 580% increase on desktop.

Desktop ads in some European countries showing a spike followed by a quick reduction and an eventual return to its original data trend

Unlike the English speaking countries above, after two days of climbing, the ad gains in Europe were significantly diminished by November 2nd and in some cases completely gone by the 9th.

10 days after undergoing the spike, the percentage increases and decreases were as follows:

Denmark: 32%

Germany: 12%

Spain: -48%

Netherlands: 0%

France: -13%

So, unlike what I’m about to show you, the increase in ads wasn’t all but gone right away, it took some time. This is an important point (and again, more on this later). I’ll just say it once more, the proximity to the change in accessing international search results made by Google on October 27th makes this data all the more significant. I can’t highlight that enough.

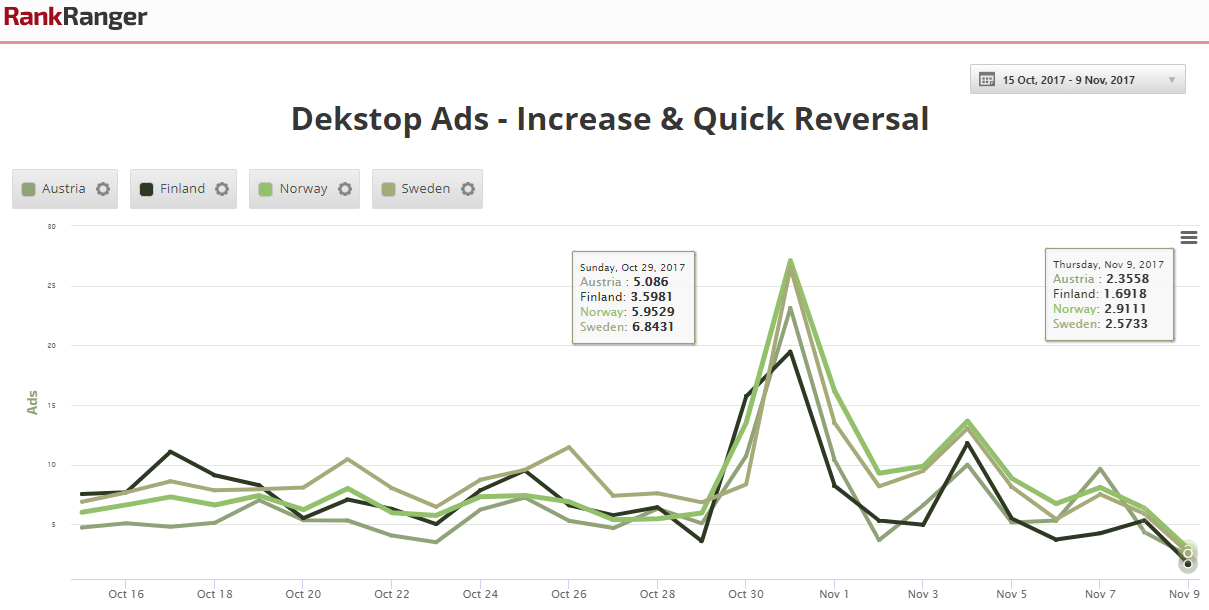

Large Ad Spikes with an Immediate Reversal

In a way, the data below is the most interesting of all. Austria, Finland, Norway, Sweden, and Switzerland all saw ad spikes on October 30th, and all saw those gains totally disappear via a succession of large and small data dips. Why is that so interesting? Well aside from a country like Norway jumping from showing ads on just 6% of Page One SERPs to a respectable 27% (a 350% increase), a very significant trend was broken here. Traditionally, the Northern European countries all followed the same SERP feature data trends and underwent the same changes in those trends (and quite often all of Europe moved uniformly). Here, Denmark (see graph below) and the Netherlands (see graph above) displayed an entirely different trend.

Ads on desktop in Austria, Finland, Norway, and Sweden show huge increases that were immediately reversed.

Why is that so significant? Well other than the fact that it shows Google is going about grouping roll-outs a bit differently, it highlights and perhaps gives insight into recent changes in the behavior on their country code top level domains. How so? Previously, countries close in proximity and language would “share” results. In other words, a country like Belgium, which is close to France and has a large French speaking population, would often show French results. After Google’s October 27 international update, this is not the case (or at least such occurrences are far less frequent). Meaning, when Google went hyper local with its results, it segmented those countries that had what I’ll call a “search overlap.”

The segmentation of the overlap is illustrated here with ads, where Google has separated traditional SERP feature trend partners. As such, you now see geographically and linguistically associated countries (such as Denmark and the Netherlands) drifting apart (at times) vis a vis their SERP feature trends. In other words, you can actually see the location segmentation of October 27th occur by tracking the ad trends on the SERP, how cool is that?!

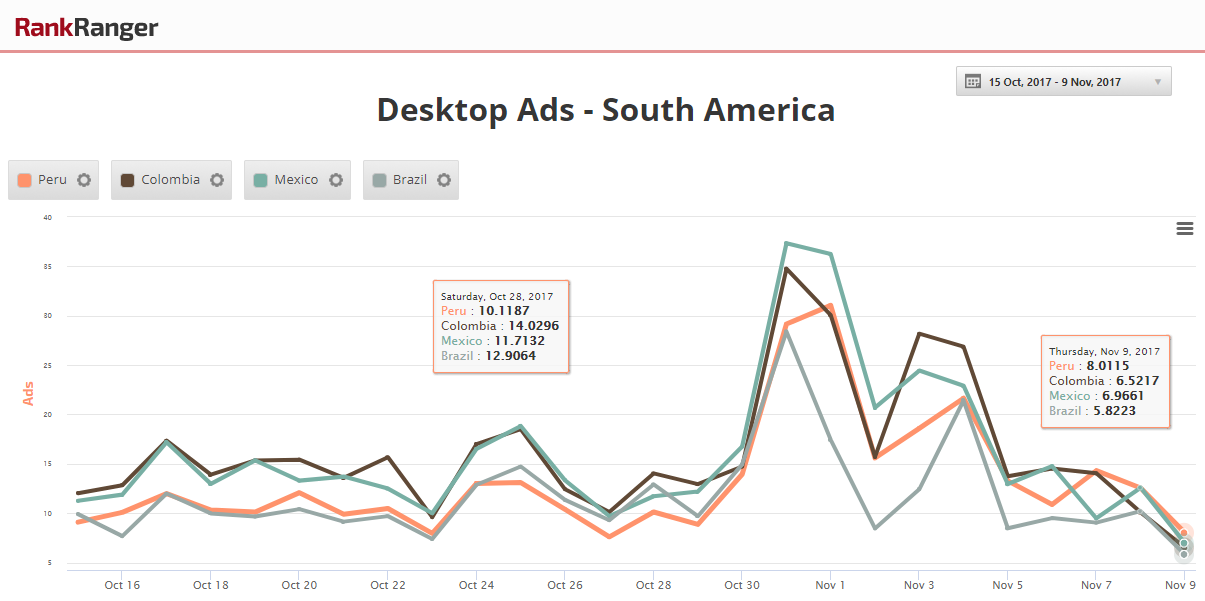

It’s worth noting by the way, Peru, Colombia, Mexico, and Brazil (all South American countries of course), showed the same initial spike as was seen in the countries listed above, as well as the same ultimate loss, but as shown below did so through a series of more radical spikes and decreases.

Desktop ads in South America generally followed a similar, but slightly divergent data path as was seen in Austria, Finland, Norway, and Sweden

The Impact of Google’s Location Update on Ads

What’s going on here? Spikes that take days upon days to come down, spikes that come down quicker, spikes that come down immediately… what is going on with ads? It’s not as if we’re dealing with a country here and a country there, we’re talking about downright crazy ad patterns across the planet! What’s the deal?

Here’s the deal.

On October 27th, Google SERPs, like Elvis, were all shook up. Google, despite selling the update as a way to make sure you see relevant results, turned the international SEO world on its head by eliminating global access via a ccTLD. The update changed everything. Sites that once appeared for a query were suddenly gone, replaced. How Google goes about showing results for a query, totally changed. Simply, the Google search engine underwent an overhaul. But AdWords didn’t. As Google tries to emphasize, the ad team and the search team don’t conspire together to give big paid search spenders organic preference. As such, the Google organic and paid search teams don’t interact, at least not as you would think.

I think this is a classic case of the right hand not talking to the left. The search team over at Google pushed the geolocation upheaval out, and the ad team was caught off guard in the sense that it inherently could not go about adjusting ad patterns until after the roll-out. Now, all of the sudden, there’s a schism that manifested itself as a spike. In some countries, the fix was more seamless and you saw the ad gains disappear overnight. In other locations, syncing the two search elements was a bit harder, and the reversal took longer. Still, in countries like the US and the UK, getting everything back on the same page appears to be either taking even longer, or is a more delicate process that demands a more gradual fix.

There is one more element here to take into account (and like a good storyteller, I’ve kept it up my sleeve until now). In those markets where ads were quick to come down after the spike that correlated with the ccTLD update, ads are now showing on even less SERPs than before the data spike. Meaning, in these countries, ads did not only revert back to previous levels, they went below them.

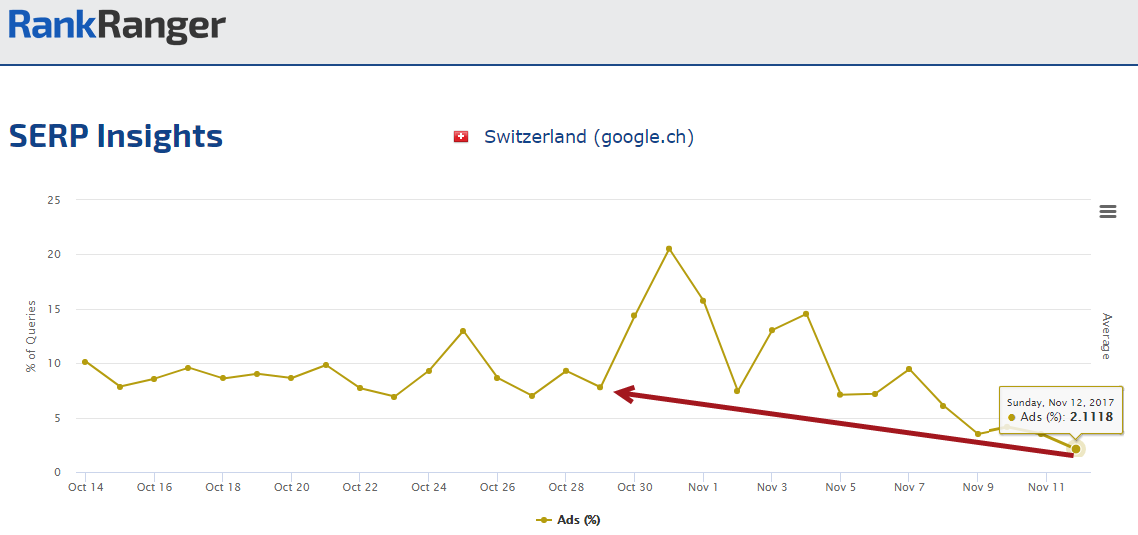

Page One ads in Switzerland show on just 2.1% of all SERPs, a 5 point drop from October 29th and a 73% decrease as shown on the Google SERP Feature Tool

As of November 11th, Austria, Finland, Norway, Sweden, Switzerland, Peru, Colombia, Mexico, and Brazil all show less SERPs with ads than right before the “ccTLD associated spike.” I would strongly speculate that other markets (i.e. the US, UK, Australia, etc.) that are still on the decline down from the initial spike, will eventually manifest the same data trend.

It could be, as I’ve radically suggested previously, Google is moving away from AdWords ad revenue… you can stop shaking your head…. Instead, Google is pursuing a new revenue strategy that includes an increased emphasis on SERP feature revenue. Part of the new revenue picture also includes Local Service Ads, which are set to spread to 30 more cities by the end of the year, which is just in time for Google’s Chrome ad blocker to roll out. Ah, now it makes a bit more sense to say Google is moving away from ads a bit! There’s a method to my madness!

Local Pack Shifts with Google Location Emphasis and Limitation

What would an emphasis in localization look like without changes to the Local Pack? Google’s updating of its country-specific search results accessibility had an international ripple effect on the Local Pack. Here, like ads, there were a few different trends that present some pretty interesting insights.

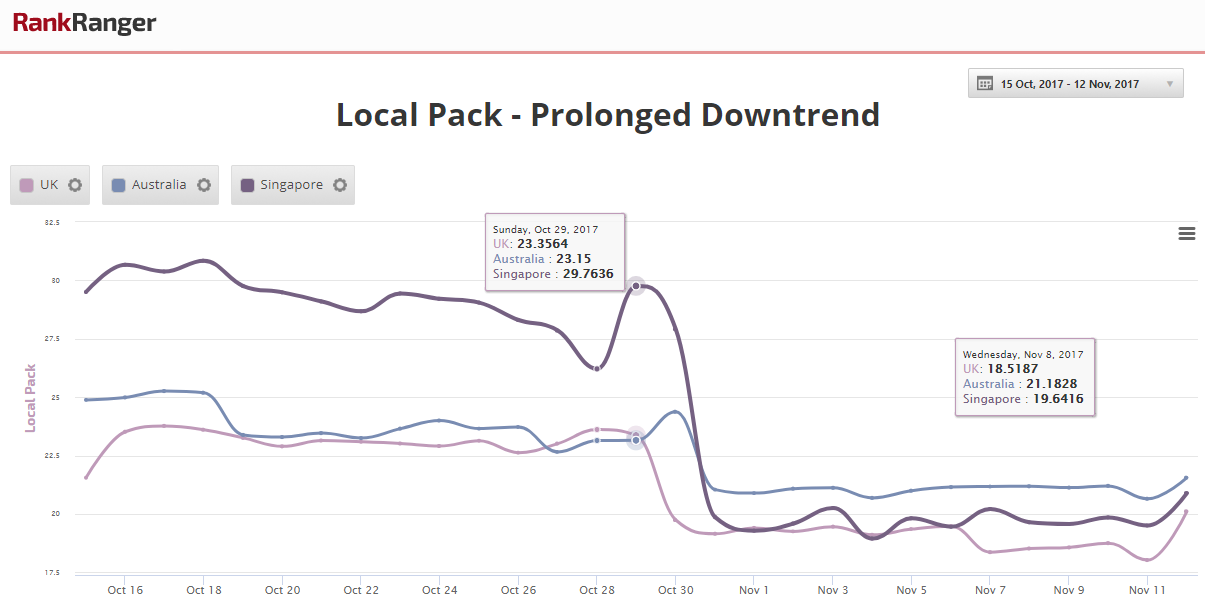

Let’s take a look at the trends, shall we? First up, The UK, Australia, Singapore, and oddly enough, Norway (see my earlier point about Google’s new country segmentation), all saw a reduction of Page One SERPs that contained the Local Pack. The trend towards less Local Packs began on October 30th, which of course was everyone’s first day back to work after Google’s “location shuffle.” By the 31st, Singapore had gone from showing Local Packs on nearly 30% of Page One SERPs to just 20%, a 10 percentage point swing.

Local Packs in the UK, Australia, and Singapore show a decrease that correlates to the October 27th ccTLD update

The following is the decrease in the percentage of Page One SERPs showing a Local Pack for the aforementioned countries 10 days after the reduction initiated:

UK: -19%

Australia: -13%

Singapore: -25%

Norway: -15%

Interestingly, these countries have started to show a Local Pack resurgence on November 9th (see above graph) that could signify that Google is working to bring the feature back to previous levels. Norway however, at the time of the writing of this article, has yet to rebound at all.

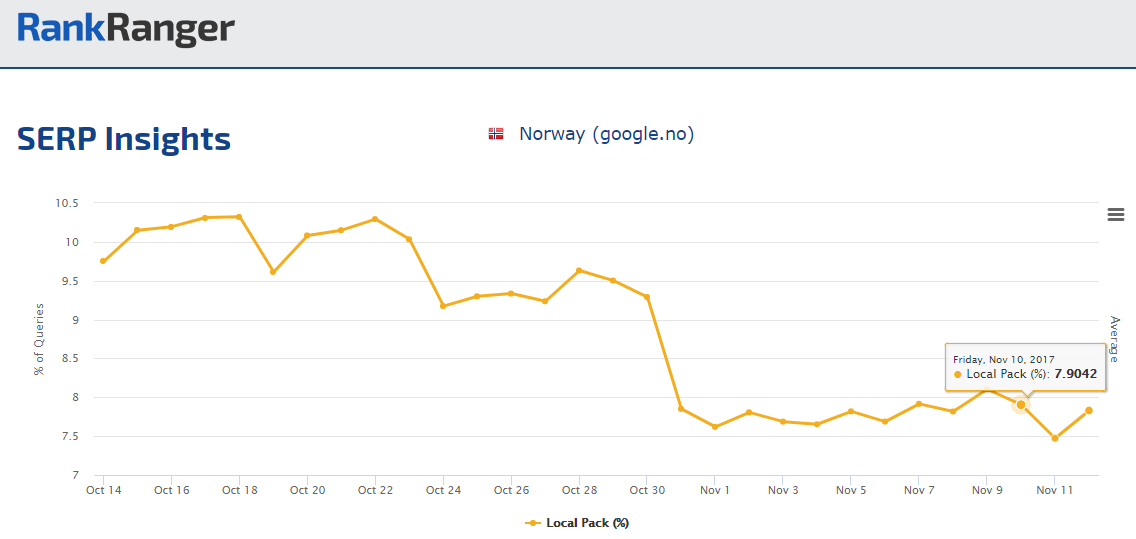

The Local Pack in Norway still shows at low levels as of November 11th.

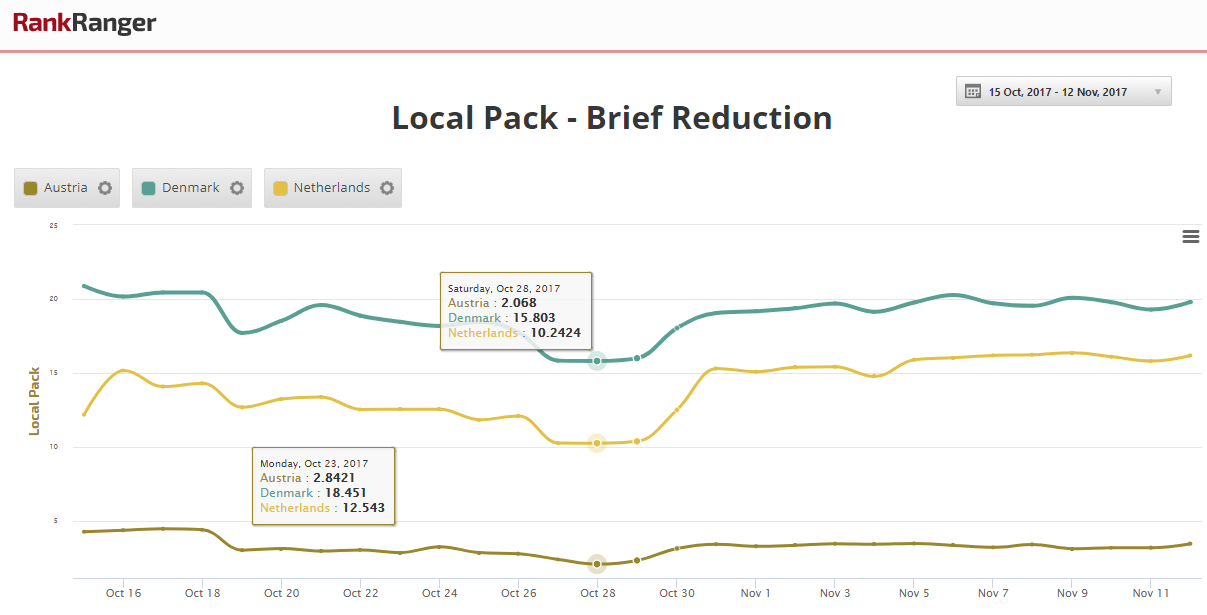

While the above trends show a connection to the geolocation update Google executed on October 27th, the data trends for Local Packs in Denmark, the Netherlands, and to a lesser extent Austria, highlight this correlation all the more so.

As the new location based results scheme was set to roll-out, Local Packs in the above countries already began to show some downward movement. As the change goes into effect, the feature stabilizes a bit, and by the time we hit October 31st, Local Packs have been restored to previous levels. However, the dips were substantial, at least in Denmark and the Netherlands where Local Packs saw a roughly a 2 and 3 percentage point dip respectively. The timing here is all but perfect in that it indicates the Local Pack movement was surely related to the changes Google made to international SERP access.

Austria, Denmark, and the Netherlands all see a short-lived dip in Page One Local Packs that correlates to Google’s ccTLD update

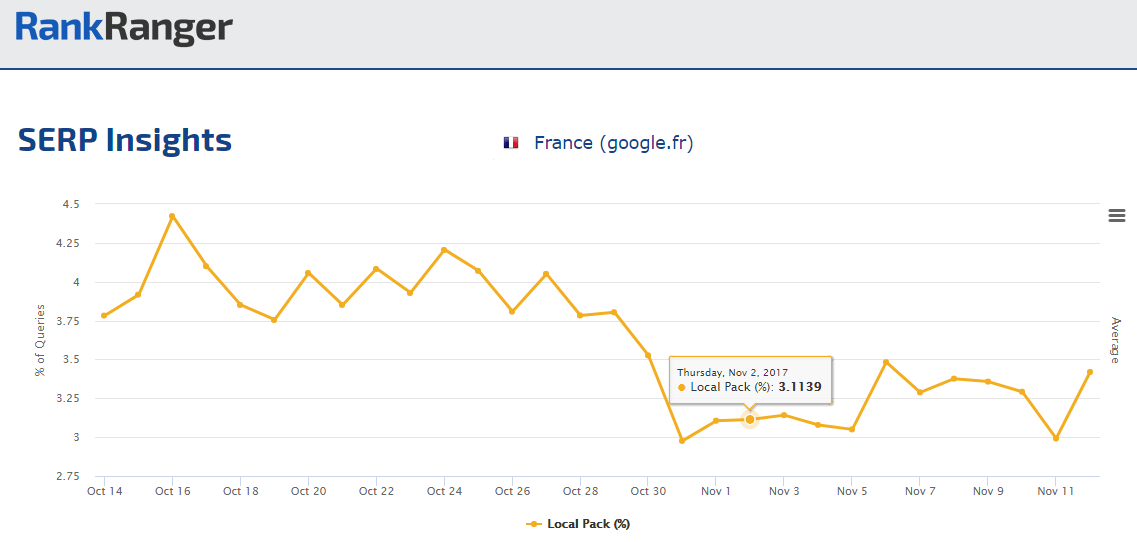

France saw a strikingly similar Local Pack data trend as well. The main difference in this instance is that the dip in Page One Local Packs began about a day after Google’s location update, not before. However, here too, after a dip and period of leveling out, French Local Packs moved upwards towards previous levels.

Local Packs in France show a similar, yet delayed, data trend to that seen in Austria, Denmark, and the Netherlands

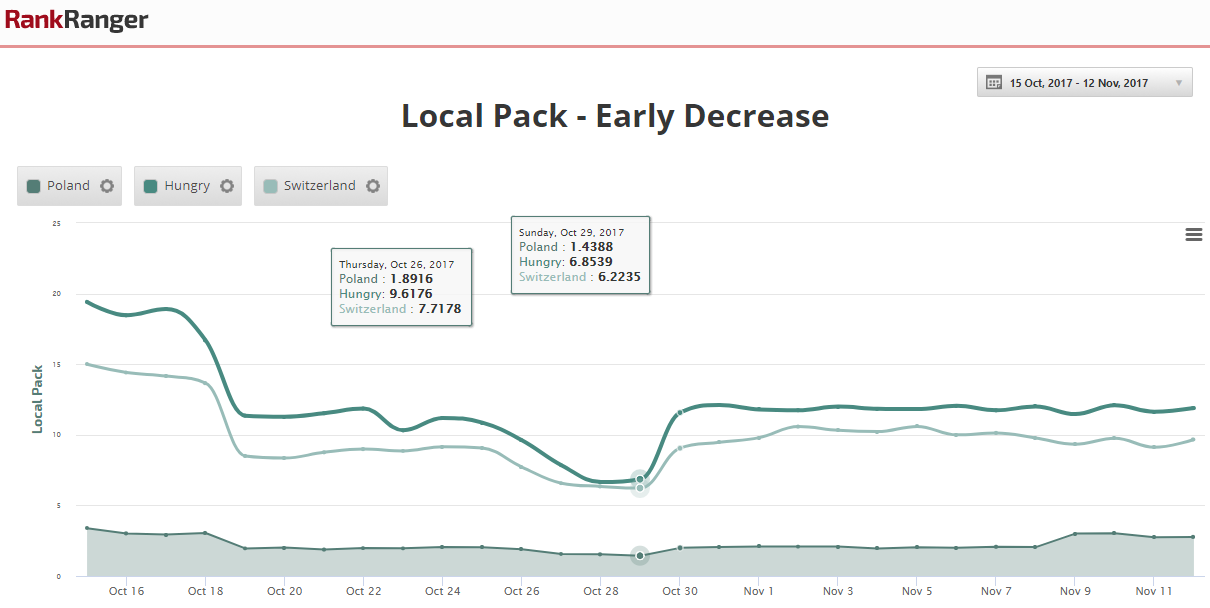

Similarly, Local Packs in Poland, Hungary, and Switzerland saw a similar data trend as well. Here however, the decline in the SERP feature’s presence began as early as October 19th, with an extended period of stability that lasted through the 26th. With the change to Google’s ccTLD policy, Locals Packs in these markets underwent a second, but smaller, decrease. After Google’s location alterations, the feature spiked back up on the 30th (yes, the first business day after the update). In this instance, Local Packs did revert back to previous highs.

Though showing an earlier downtrend in Local Packs, the reduction that correlates with Google’s ccTLD update is still clearly visible in Poland, Hungary, and Switzerland

Local Pack Fluctuations – What Does the Data Indicate?

One of the most important things to notice here is that the already fragmented country groupings seen in regards to ads were even more splintered here, with the Local Pack. There seems to almost no regional logic to the trend shifts. As someone who has a constant eye on SERP feature trends, I can tell you, that is very peculiar.

That being said, I’ve tried to rack my brain around the trends here from multiple perspectives. When I have a decent theory, I’m happy to of course offer it. Here, in all honesty, it’s tough. What I can say is, the fact that countries around the word saw a decrease in Local Packs just as Google changed its ccTLD policy, cannot be a coincidence.

What we do know is that Google overhauled its SERPs on October 27th to be more locally centered. That its one local SERP feature shifted along with such an update can’t be accidental, and reflects the type of change Google made on 27th. Why did the feature restore so quickly in some countries and not in others, why did some markets see a preliminary decrease, etc., all all good questions. I personally think all of the preceding and subsequent Local Pack data changes are related to the ccTLD change, I just can’t put my finger on exactly what transpired (we’re all human, right?).

Knowledge Panel Undergoes a Significant Global Increase

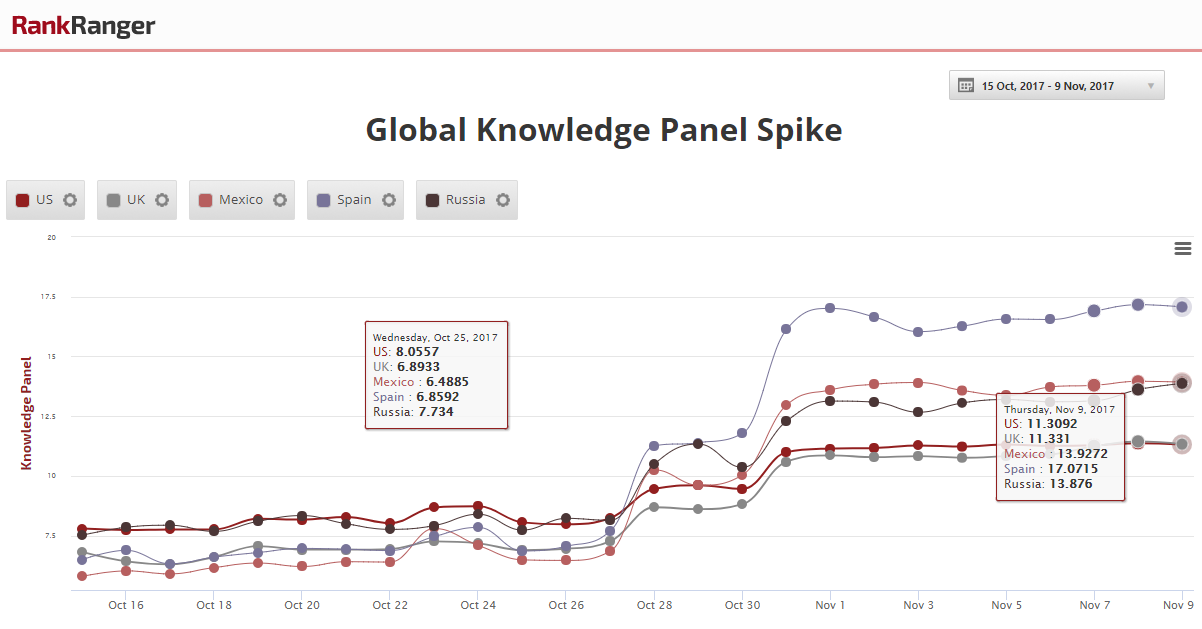

With all of the various trends and inconsistencies, there was one SERP feature that took on a definitive new international trend. In fact, the very day after Google updated its location scheme, Knowledge Panel saw a noticeable spike.

Using the US as a benchmark, on October 27th, the day Google’s update went into effect, Knowledge Panels appeared on just over 8% of Page One SERPs in US. One day later and the feature spiked to showing on approximately 9.5% of Page One SERPs, a big spike for a feature where a half a percentage point shift is volatile. After a few days of little movement, Knowledge Panels underwent a second spike. By October 31st, the US had a Knowledge Panel on 11% of its desktop SERPs, up three percentage points from just five days prior. Since then, as of the writing of this article, the feature has leveled-off and has taken on a new data trend.

The Knowledge Panel underwent two spikes, with the first strongly correlating to Google’s international search result update

As I mentioned, the increase in Knowledge Panels was a global event, with few exceptions (such as the Netherlands, where the feature spiked and then dipped a few days later). As such, countries like Canada, Australia, Brazil, Colombia, Ireland, Denmark, South Africa, Switzerland, Israel, Poland, India, Turkey, Germany, Spain, Russia, Sweden, etc., etc., etc., have all seen a spike in Knowledge Panels that aligns to that mentioned above in the US.

Below are some of the larger increases in the percentage of SERPs showing the Knowledge Panel 14 days out:

US: 38%

Mexico: 101%

UK: 56%

Ireland: 112%

India: 160%

Spain: 113%

Poland: 83%

Does Location Really Matter as Much as Google Says It Does?

This is a funny question to ask. I know, you’re thinking, “Of course location matters Mordy.” I don’t argue, who could or would? But, there is a bit of sleight of hand here (I don’t mean that in a malicious way). Google touts location specific results constantly. The recent geolocation reshuffling was all about increasing the relevancy of results by making them more local. One might walk away from all of this talk (and action) thinking that Google is a seriously diverse search engine that runs a plethora of algorithms, each suited to better deal with showing results for a specific location. I think we’d all like to think this.

Let me ask you one question: If Google was this diverse local machine, then why are all of the SERP feature trends universal? Why do ads spike around the world all at once? Why is there a universal shift in the Local Pack? Why doesn’t the Knowledge Panel spike in just a few countries, or a group of related countries?

It’s because fundamentally, at its base, Google is one thing for every location. Imagine it like this: Google has a center, a core, and this core is how it fundamentally functions. Built on top of that core, layered on top of that foundation, are local parameters that give Google some location-based versatility. But does that make it a diverse, location specific, search engine? No. The local layers are in a way ancillary to the core of how Google goes about not just determining rank, but presenting its SERP, ads, etc. That’s a very different way to look at Google. Google’s SERP presentation does not hinge on local considerations, as you may think it does. It is the result of a unified way of displaying the SERP. Within that construct, yes, there may be variation in how the SERP and its features are presented, but that’s just top layer.

Well, look at that, from a few SERP feature trend changes, to watching as Google struggles with a local update roll-out, to seeing the search engine in a whole new light. Not bad for a few paragraphs of work (OK more than few) if I don’t say so myself.