This is my second post in a series about the March 2024 broad core update. Again, it was a huge update with many moving parts, so I wanted to cover several interesting things that went on versus writing just one post. For this post, I’m going to cover a very interesting case study that underscores the complexity of the March core update. Specifically, how multiple systems were being updated during the update, how those systems could counterbalance each other, and how that can cause a ton of volatility along the way (including reversals).

This story is about a site that was doing well over time, but always had some baggage content-wise. That content was written for Search and ranked extremely well for many queries tangentially related to the site’s core business. I’ve always called this “fringe content” since it’s not directly related to a site’s core competency. Based on how well that content was ranking, and its broader appeal, a majority of the site traffic was going to that editorial content. And I have covered the importance of ‘staying in your lane’ many times before, and this content definitely was a lane or two over for the company.

But that wasn’t the only place questionable content that crept in over time. There were also parts of the core ecommerce site that contained what I would call fluff content. Some had been around a while, while some was added relatively recently (introduced in 2023). I’ll cover more about the content, and the overall situation, below.

“Danger Will Robinson!”, and the “But it ranks” conundrum:

I started helping the site in 2018, and the site owner would have me audit the site every year or so since then. The site has improved a lot over time, the ecommerce section is strong overall, and they had a lot of editorial content (as I mentioned above). During those audits, I definitely brought up the danger of the “fringe” editorial content several times, but the site owner was afraid to touch the content based on how well it was ranking, how it earned some powerful links over time, etc. The site owner is savvy SEO-wise, and definitely understood the situation, but would come back to me and say, “but it ranks, so how bad could it be?”

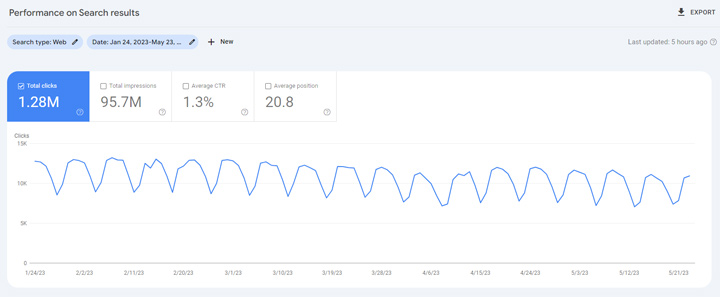

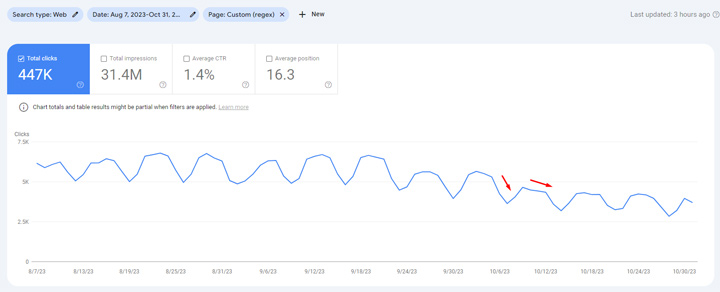

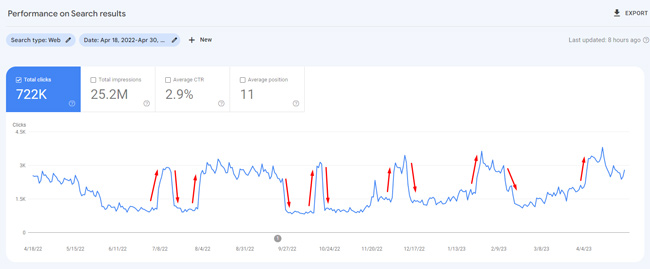

Here is a snapshot of traffic in the spring of 2023 to give you a feel for how things were going. The site was ranking for many queries across both the ecommerce portion of the site and the editorial content. But again, a large percentage of the traffic was driven by the editorial content. I’ll cover more about that soon.

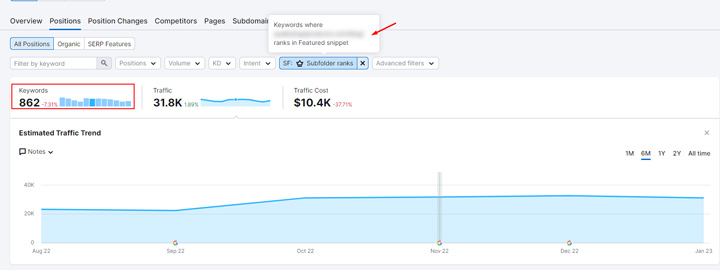

In addition, the editorial content had won featured snippets for 862 queries leading into 2023. And that’s based on Semrush data, so they probably had more:

The “but it ranks” argument is a great point, and it’s incredibly confusing for site owners. I touched on this in my post about Navboost and why “highly visible AND low quality” is a most dangerous combination. Eventually, that won’t end well for a site. For the site I’m covering in this post, that drop happened in the fall of 2023. And it was ugly.

Site background information, setup, and more.

The site I’m covering is an ecommerce site with several areas containing editorial content. The site has been around a long time and had its fair share of SEO issues over the years. I started helping the site owner in 2018 and the site has been on the straight and narrow since then.

The core ecommerce side of the site is strong overall, it provides a solid user experience, and is set up well from an SEO standpoint. But there were things that crept in over time on the core ecommerce section of the site that raised red flags when I audited the site. Some were newer issues that were implemented in between the last time I helped the company and now. I’ll explain more about that soon, but I wanted to start with the most glaring issue – the fringe editorial content that was HCU(X) bait.

In my opinion, the editorial content is where things went off the rails. A chunk of the editorial content definitely fit the mold when it comes to Google’s September helpful content update (HCUX). It was content that didn’t really support the core business or its prospective customers at all. Sure, it was tangentially related to the industry the site focuses on, but it didn’t help prospective customers in any way. The site owner knew people were searching for those queries and published content targeting them. And it was structured, optimized, and written in a way to heavily match those queries, which I have seen across many sites impacted by the September HCU(X). For example, it was like every People Also Ask (PAA) question had its own subheading and content…

But here’s the rub. That fringe editorial content ranked well before the fall of 2023. It ranked really, really well. As I covered earlier, it had even won many featured snippets for queries related to that content. Actually, so many people were searching for those queries compared to their ecommerce queries that the fringe content accounted for a majority of traffic from Google. I’ll cover more about Navboost soon, but Google’s measurement of user interaction signals had to be primarily from the fringe content versus ecommerce content. Although Navboost is just one factor of several, it’s an important one, and that was not a good thing for this site (in my opinion).

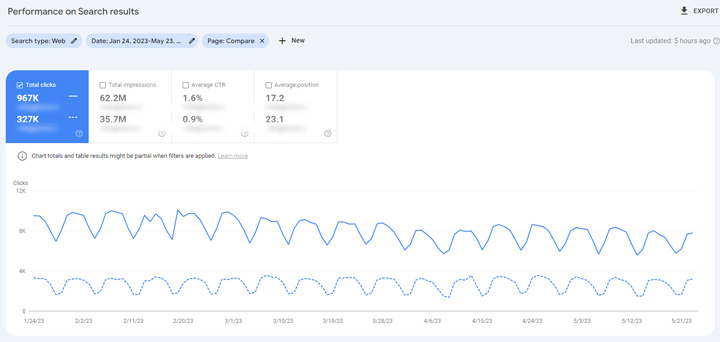

Below, you can see the editorial content dominating from a traffic standpoint from Google. The solid blue line is traffic to the editorial content and the dashed line was traffic to other areas of the site (including ecommerce):

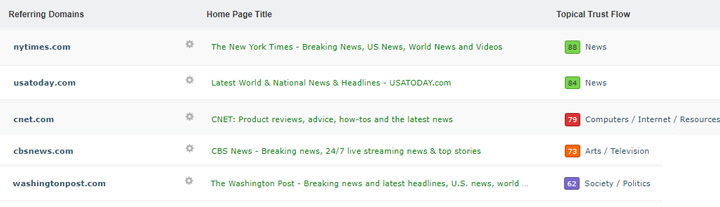

In addition to content primarily written for Search, they also published some content based on studies and surveys they ran. The studies also weren’t really directly tied to the core business. They were often fun and could generate buzz around those topics, but they wouldn’t help any prospective customers. Actually, some of those studies generated so much buzz that the blog posts often earned powerful links. And I mean links from some of the top news publishers in the world. The site owner was often on a “link high” seeing those powerful links roll in, which was giving them a false sense of security that all was well SEO-wise. More on links soon.

Here are some examples of the domains linking to the studies:

And I mentioned that the core ecommerce part of the site also had some issues content-wise. Overall, it was a strong ecommerce setup from an SEO standpoint, but some things had crept in since the last time I helped them. And then there was the fluff category content, which I always mentioned was unnecessary. You can read my case study about removing fluff ecommerce descriptions to see how another client of mine ended up performing better AFTER removing all of that content.

Back to this site, though. That fluff content on category pages was definitely not helpful for users, it was there for Search, and there was quite a bit of it… In addition, the category pages provided over-optimized blurbs of text for each product. It wasn’t terrible, but definitely became over-the-top in my opinion just based on the amount of products listed per page. Those issues were just for the category pages, though. The product pages were fine and didn’t have any content issues.

The misleading flow in traffic before an algorithm hit.

Can you see why the site owner had a tough time figuring out how to deal with the content? Sure, there were mixed signals about the quality and relevance of the content, but it ranked like crazy and earned some ultra-powerful links. On that note, I think the drop that happened in the fall of 2023 underscores the decreasing power of links over time. When a site with links from some of the top publishers in the world tanks like this site did, then it’s pretty darn clear that those links don’t carry as much power anymore.

It also reinforces the point that there are other systems counterbalancing the systems evaluating link signals. You can read my post about the HCU transition to core to understand more about the counterbalancing of systems in Google’s core ranking system.

The image below is a good way to think about the various systems that make up Google’s core ranking system. As an example, maybe System 065 counterbalances the power of Systems 214 and 129.

Google HCU(X) + October 2023 broad core update: A deadly one-two punch.

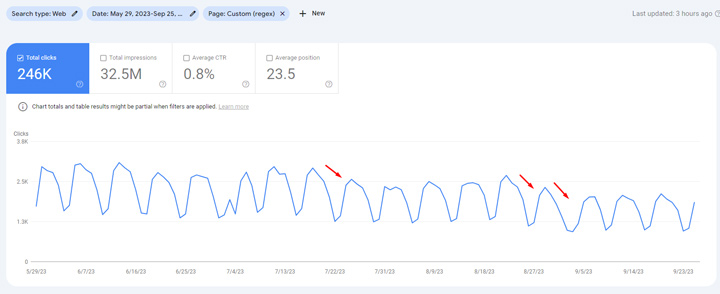

In the fall of 2023, the site got pummeled. And it wasn’t just one update that impacted the site, it was several. And beyond that, it was several types of algorithm updates that impacted the site. The site first saw a drop with the August broad core update, but mostly in the ecommerce area of the site. The fringe editorial content didn’t drop at all. It’s also worth noting that the site saw a lot of volatility in July of 2023 when we saw a number of unconfirmed updates (which very well could have been testing the fall updates).

Between the July drop and August drop, clicks dropped by 20%. You can see the first drop below in July and then more with the August core update.

Then the second, larger drop was from the September helpful content update (HCUX) with that fringe editorial content I mentioned earlier seeing a clear drop. But since the HCU(X) classifier is site-level, rankings across the entire site dropped as well, including the core ecommerce site. And that was extremely scary for the site owner.

Then not long after the HCU(X) rolled out, the site saw a bigger drop with the October 2023 broad core update. The drop in rankings impacted all queries across the site. What I was seeing drop-wise is pretty normal with the HCU(X) and with broad core updates. There was the HCU classifier being applied with site-level suppression and then there are site-level quality algorithms with broad core updates that can have a big impact on rankings. This combination was deadly for the site. Between multiple confirmed updates, and the July unconfirmed update, the site dropped by 41% in the fall of 2023.

First, here is the drop for the ecommerce content from the October core update:

And here is the drop for the editorial section of the site:

And when you add it all up, here is the overall drop for the site when all types of content were taken into account. Again, the site had dropped by 41% since July 2023:

It’s also worth noting that my client was running into some very strange problems with Google Ads that was inhibiting them from providing air cover while organic traffic was down. So they had a huge drop in rankings based on major algorithm updates, but they also experienced advertising problems that seemed to be more on Google’s end than theirs. Needless to say, it was incredibly frustrating for them.

Heavy Analysis, Tough Decisions

Based on the impact, the history of the site, the fringe content, etc., it was pretty clear what the core issues were with the site. It was that fringe content that crossed into HCU(X) Land, and maybe that HCU(X) classifier contributed to the continued decline during the October broad core update.

And that’s a shame since the content didn’t really support the business at all. It just drove a ton of traffic over time and earned some powerful links, but it didn’t help or support prospective customers in any way. It also had no impact from a conversion standpoint at all. Nobody searching for that information would actually be a prospective customer. Sure, the content earned links, but now it was killing the site.

The site owner was clearly in a tough position. Could they boost that content and improve it? Should they just put a stake in the ground, nuke it, and go down the right path content-wise? Or should they just wait it out and hope for some miraculous recovery? These were hard questions that the site owner had to work through, along with my guidance from an SEO standpoint.

“Goin’ legit!”: Disconnecting completely from the fringe editorial content and nuking the over-optimized ecommerce content.

I received an email from my client basically explaining that they had enough with fringe content like that, they explained they wanted to have the best site possible, and one that they could proudly point any Google search engineer to and say, “SEE, THIS SHOULD RANK!”

So they were “goin’ legit”, they wanted to get rid of that fringe editorial content, handle that over-optimized ecommerce content, and power forward with the best ecommerce site possible.

“Farewell and adieu… to you fair powerful links” – Big Changes, Big Swings, And Swift Action

Over the following days I received a number of emails from my client as their team was working through all of the fringe content. They were deciding what to keep, what to boost, and what to nuke. Several times I received questions about how to keep some of the links, but still nuke the content. Hey, they had to try and keep those links… but couldn’t in several situations. I explained their options and they determined when they could redirect urls to extremely relevant content, when they should noindex versus 404, and then when removing the content altogether was the best option. To make a long story short, a number of those links had to be nuked.

Remediation-wise, big changes are often needed to radically improve a serious problem. And my client took some huge swings while improving the site. After heavily analyzing all their editorial content on the site (some of it from years ago), they ended up removing 38% of their editorial content in one fell swoop. Yes, they nuked almost 40% of their editorial content.

My client determined that content was written for Search, didn’t really support the business at all, and accounted for no conversions at all. Sure, it had earned links, but other Google systems and algorithms were clearly counterbalancing the power of those links, and causing a big drop in rankings when those calculations were completed.

It’s also important to understand that since they are an ecommerce site, a majority of the content indexed was in the ecommerce section of the site. So even removing 40% of the editorial content was a relatively small number of urls overall. But even the small percentage of content accounted for a majority of traffic from Google. So from a user interaction signals standpoint, it was a large percentage of that data being evaluated by Google. So my client wanted to flip the script there.

This removal of content resulted in another large drop in traffic as the remaining clicks to that fringe content disappeared. Again, it’s important to understand that this traffic had no impact on the business at all. So the third drop wasn’t as scary compared to what happened in the fall of 2023, which impacted core ecommerce queries as well. And those core ecommerce queries yielded a lot of revenue… That said, brace yourself for the following GSC graph.

The March 2024 Core Update Arrives. Take out the popcorn.

My client implemented big changes in late 2023, about two months after the October core update completed. I explained to my client to view the changes as a long-term move, and they could definitely see some weird volatility in the short term. And then as Google reassessed the site overall, they could hopefully start to see improvements rankings-wise (for their core ecommerce queries, the remaining editorial content, etc.)

As we entered 2024 in Google Land, everyone was waiting for a big algorithm update. And a BIG UPDATE we finally received. On March 5, 2024, Google rolled out the March 2024 core update. And it was a huge update aiming to reduce the amount of spammy and unhelpful content in the search results by 40%. It started with a spam update and included thousands of manual actions for “scaled content abuse” and “expired domain abuse”. And then the March core update went into full swing as it finally “landed” a few days later. Google wasn’t messing around.

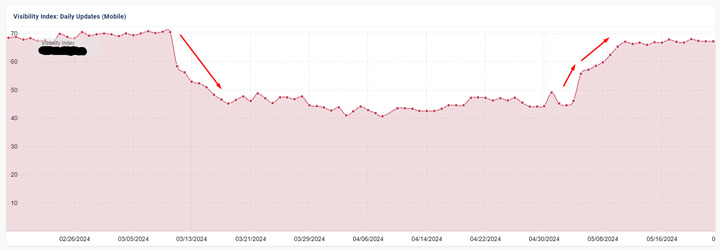

To add to the complexity of the March core update, Google explained it baked its helpful content system into its core ranking system. That was a big move considering how devastating the September HCU(X) was for niche publishers. The March core update was one of the longest and most complex core updates that Google has ever rolled out. It took 45 days to complete (or 53…) but who is counting?

Google explained that site owners could see a lot of volatility during the update (more than usual) as multiple core systems would be updated and reinforce each other. I heavily covered what I was seeing throughout the update via my “Good Morning Google Land!” tweets each day. Needless to say, it was a massive update with some sites surging or dropping heavily.

OMG, it’s working, and quickly:

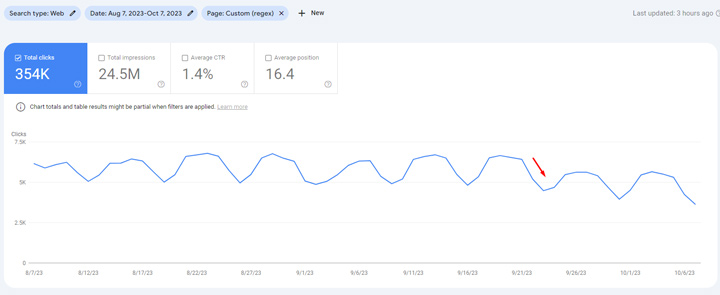

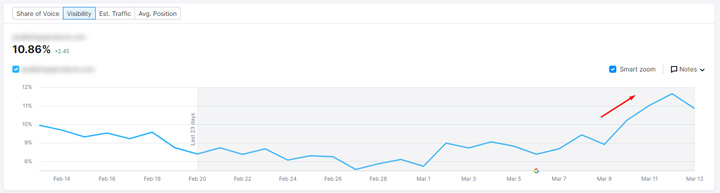

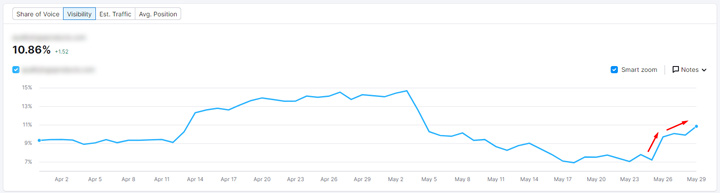

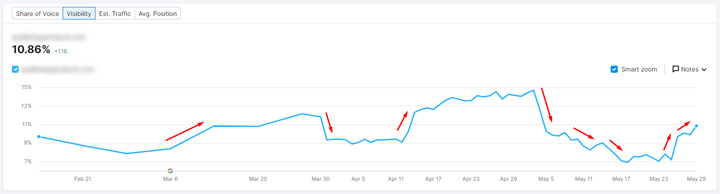

As soon as the March core updated started to show itself, my client started surging. It was awesome to see. Core ecommerce keywords started bouncing back big-time. I have rank tracking set up for the client to monitor a few hundred of their most important queries just as a barometer to understand how the site is performing over time. And it was clear that things were looking good early into the update… Then GSC data started populating and you could see the increase in traffic, rankings, etc.

Here is GSC data for the ecommerce portion of the site surging with the March core update:

It’s worth noting that I thought this would be a quick recovery in my opinion. My client implemented big changes at the end of 2023, so it was really just a few months of data for Google to analyze after years of having that editorial content in place. Also, a number of powerful links were dropped as the fringe content was nuked, so I assumed that would impact the site somewhat as well.

Hold your applause. The first big tremor arrives…

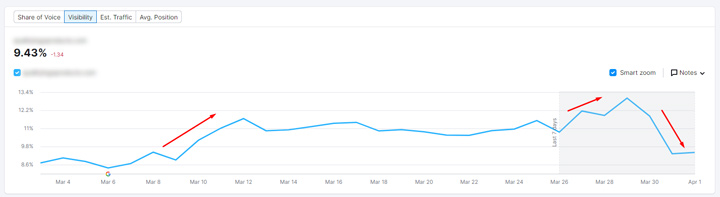

Like I thought might happen based on what Google explained about the update, and what I have seen with tremors with previous updates, the first March core update tremor arrived. And it was a big one that yielded some serious reversals across sites. For example, some sites that started surging, reversed course and dropped. And then some sites dropping heavily, reversed course and surged back. For site owners, this was either totally frustrating, or amazing, depending on which side of the equation you were on.

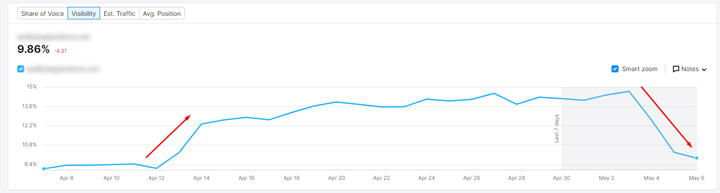

And as you can guess, my client reversed course and started dropping back down. Again, rank tracking was the first sign of something happening. See below.

Then GSC data populated and you could see the drop:

OK, we knew that was possible based on what Google explained… It wasn’t easy to take, but the update was not done yet. My client was really bummed out, but I told them to hang in there as more systems would need to be updated during the March core update.

Then we saw the next big tremor about 15 days later on April 14. And again, it was a big one yielding more reversals… And for my client, this was a welcome change. They started surging back again! My client was excited. Here is the second tremor via rank tracking.

And again, GSC data populated and you could see the surge in clicks again:

And my client put it perfectly from a site owner perspective:“I feel like it’s Vegas! This is all very exciting…”

And as time went on after that tremor, my client kept increasing. Again, it was amazing to see.

Vegas is a perfect analogy.

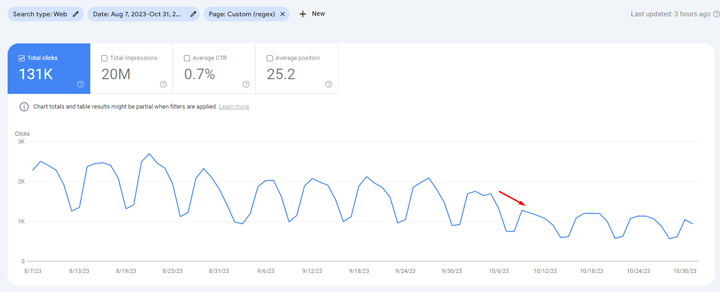

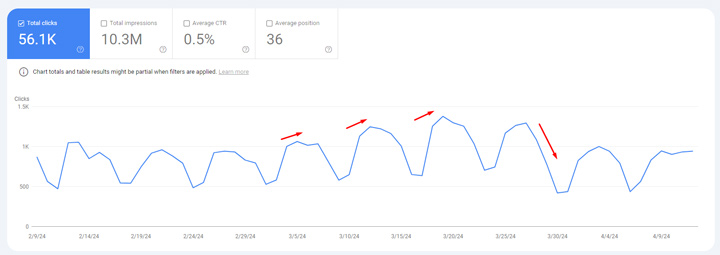

Similar to after the first tremor and reversal, I told my client to not celebrate. The update was not done yet and more systems could be updated that might yield more volatility. Now is a good time to mention that we all thought the update was still going on into early May, but in reality, the March core update had completed on April 19 (but Google just didn’t announce it then).

So May 3rd rolled up, and it was a big day from an update standpoint. There was a big change that impacted many sites that had previously been impacted by the March core update. And yep, that meant more reversals. I shared about 5/3 heavily on X where I showed examples of sites reversing course.

And can you guess what happened with my client? Yep, they reversed AGAIN. This time dropping back down to where they were before the update began. Talk about a roller coaster… Like I’ve said many times in posts and presentations about major algorithm updates, “Welcome To Google Land!” 🙂 Here is rank tracking again showing the third reversal.

And here is GSC data showing the drop:

So how could this happen outside of a broad core update? Well, I have covered for years how Google could decouple algorithms from broad core updates and run them separately. Google’s Paul Haahr explained that to me during the Google Webmaster Conference in 2019 in Mountain View. I believe we have seen that several times over the past few years, and the 5/3 movement could very well have been that. Again, a number of sites heavily impacted by the March core update saw movement then, including some full reversals. Some surged back after dropping, or vice versa.

Here is one great (confirmed) example of this happening:

But the roller coaster ride is not over yet! How about another surge? OMG.

This case study was supposed to end with that drop on May 3rd, and how things have gotten worse since then, but Google was not ready to end the story there… Yep, with the most recent volatility on 5/26, the site is surging back again. The first signs were with rank tracking. See the surge on 5/26.

Here is the full rank tracking story since before the March core update began.

And if you’ve been reading my blog posts for a while, that yo-yo trending might look familiar. In previous posts about Google’s reviews updates, I covered some sites that were clearly in the gray area and surged and dropped like crazy over time (both during reviews updates and outside of them). For example, the screenshot below shows one of those cases. As you can imagine, the site owner was losing their mind as the site surged and dropped like mad.

I just wanted to bring up those wild examples of review sites (there were several), since it’s eerily similar to what’s going on here with this site. I’ll quickly cover the counterbalancing of systems again before ending this post. In my opinion, it’s an important topic for site owners to fully understand.

The counterbalancing of systems with broad core updates and hopeful for the next broad core update:

Needless to say, we were very excited to see the latest surge. That said, the site is clearly in the gray area of Google’s algorithms right now, so we really have no idea if this will stick. Remember, my client had just implemented big changes a few months before the March core update rolled out. That’s after the fringe content was in place for years…

But although I believe the site is in the gray area of Google’s algorithms right now, they did surge (several times) since the March core update rolled out. I think that’s a good sign and it seems multiple systems are relatively happy with the site. And then of course, some other systems are counterbalancing those scores and dragging the site back down. But for now, it’s up again.

We also know that Google is actively reviewing a ton of feedback based on the March core update, and they did explain that sites impacted by the September HCU(X) might see more movement with the next broad core update, so I’m hopeful for my client. They really are doing a good job at improving the site overall (including both the ecommerce side and editorial side).

Moving ahead: Continue driving forward on the quality front.

Like I explained earlier, I’m hopeful for the next broad core update for my client. Overall, the site provides a solid ecommerce experience with much stronger editorial content overall. The fringe content has been completely removed and they are starting to publish more editorial content that supports the business and its prospective customers.

Time will tell how they perform over the long term, but one thing is for sure, I highly doubt they will ever go down the path of writing content based on query volume again… As I explained earlier, my client wants to have a site that they could point any search engineer to and say, “SEE, THIS SHOULD RANK!”. And I think they are very, very close to having that site right now.

I’ll provide an update on how the site is doing over time, especially after the next broad core update. On that front, I’m hoping for a big summer broad core update. Based on the feedback Google received after the March core update, I think we could see some big changes with the next core update (and hopefully for sites impacted heavily by the September helpful content update). Stay tuned.

GG