Posted by

Mordy Oberstein

While the May 2020 Core Update is certainly not the first core update we’ve seen, it might just be one of the most unique. For Google’s second core algorithm update of 2020, we were delivered one of the strongest and most impactful updates we’ve seen in quite some time. Throw in the fact that the update rolled-out in the middle of a global pandemic and we’re left with a lot of data, patterns, and insights to chew on.

In this post we’ll:

- Analyze the way the update rolled-out

- Break down rank volatility increases per niche

- Dive into some of the site-level patterns embedded within the update

- Look at what role COVID-19 may have played

The Peculiar Nature of May’s Core Update Roll-Out

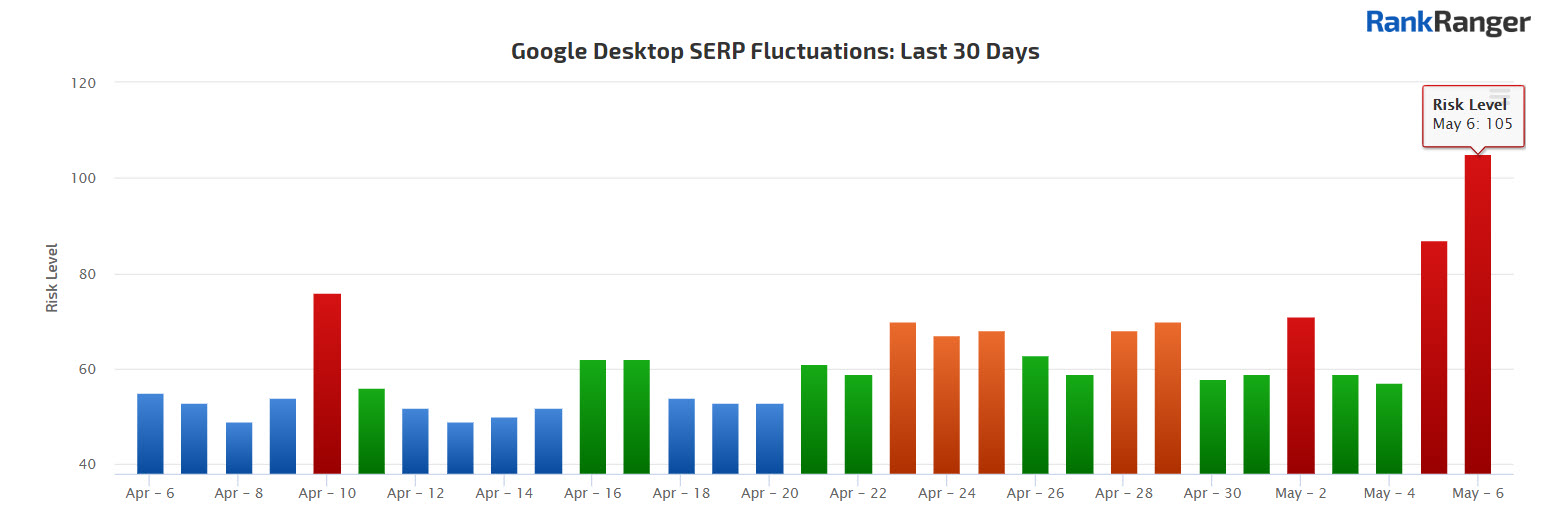

I already mentioned that this update was big. However, that’s not how things seemed at first as Google opened the floodgates of algorithmic change. When the update hit the SERP, the initial levels of rank volatility were underwhelming. May 5th, the first day the update’s rankings were tracked, showed levels of volatility that were certainly impactful but more reminiscent of your typical unconfirmed update.

The Rank Risk Index showing the disparity between the volatility shown during the first and second day of the May 2020 Core Update’s roll-out

To be honest, I thought that either the roll-out was bizarrely slow or that Google was “taking it easy” amidst the COVID-19 pandemic. The latter notion did not hold itself to be true. By the time the second day of the update was upon us it was clear that this update was quite large. As shown in the above image, there is a major discrepancy in the level of rank fluctuations from day 1 to day 2 of its roll-out. Then, after a massive day of rank movement, the update was gone (though there are always aftershocks that play themselves out for a few days after the main roll-out has completed).

How Big Was the May 2020 Core Update & Who Got Hit the Hardest?

With rank fluctuations showing the May 2020 Core Update to be incredibly impactful I took to breaking down the rank volatility increases according to niche. Specifically, I looked at the Travel, Retail, Finance, and Health niches.

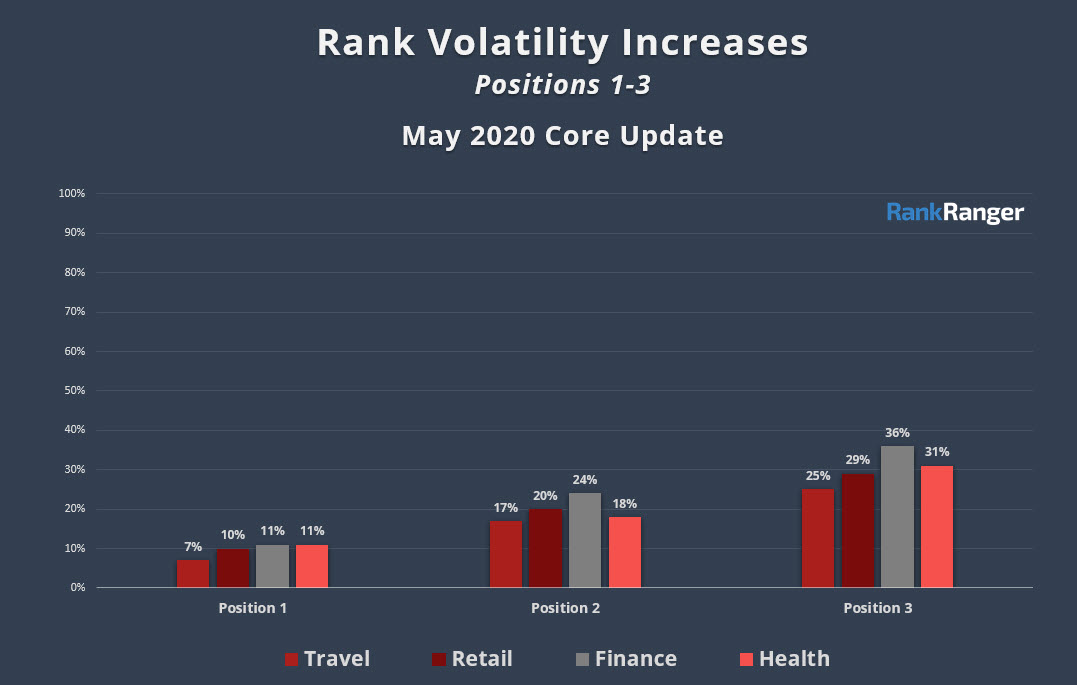

Let’s start at the top of the SERP and work our way down. Here’s how the update impacted the 1st, 2nd, and 3rd positions on the SERP according to niche:

While it’s not odd to see YMYL niches like Health and Finance showing volatility increases in the double digits at the 1st position on the SERP, seeing that level of volatility for non-YMYL niches is entirely unique (e-commerce, while YMYL, is not treated the same as other YMYL categories algorithmically).

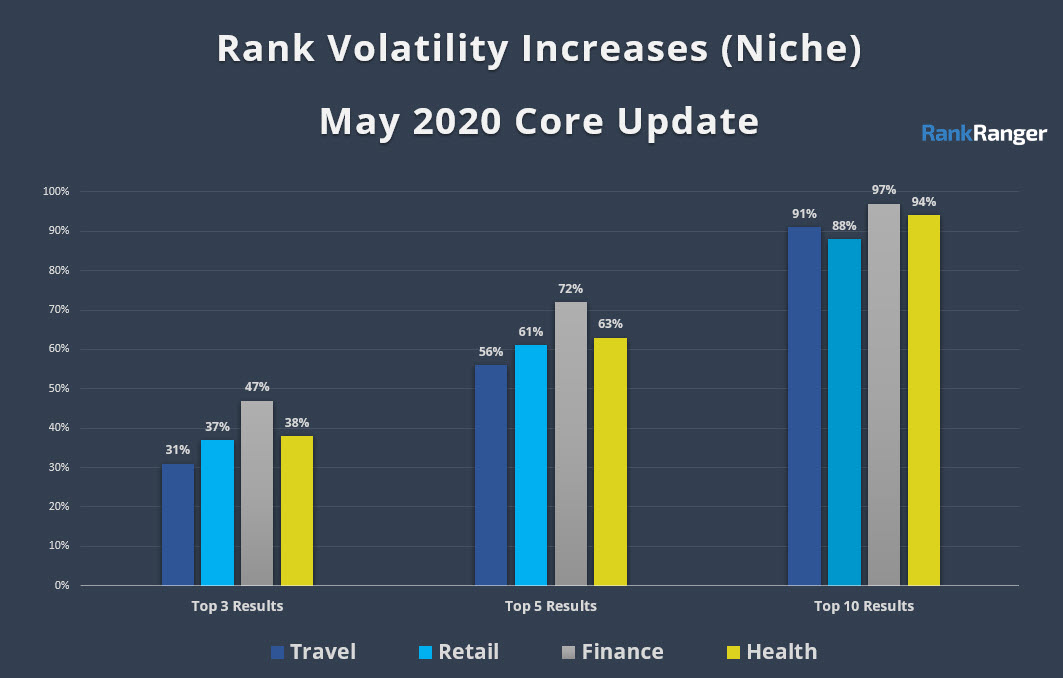

The uniformity among the niches is very much a part of what made the May 2020 Core Update so unique. This equal treatment of both YMYL and non-YMYL niches was not limited to the top three positions on the SERP. Rather, as you can see below, there was an unprecedented amount of rank volatility all the way down the SERP:

As is to be expected as you make your way past the top 3 results on the SERP and then past the top 5 results and eventually to the top 10 results overall the level of rank volatility increases dramatically. That is not surprising.

What is surprising is how consistent the uniformity seen at positions 1-3 was as you moved down the page and look at page one of the SERP overall. As you can see, the Finance niche did stand above the other niches, but not to extraordinary levels. At the same time, the Finance niche is often the most volatile niche. Generally, the niche’s levels of rank volatility stand in far greater contradistinction to other industries. Further, the Finance niche’s counterpart, the Health niche, was not any more volatile than the Travel or Retail niche.

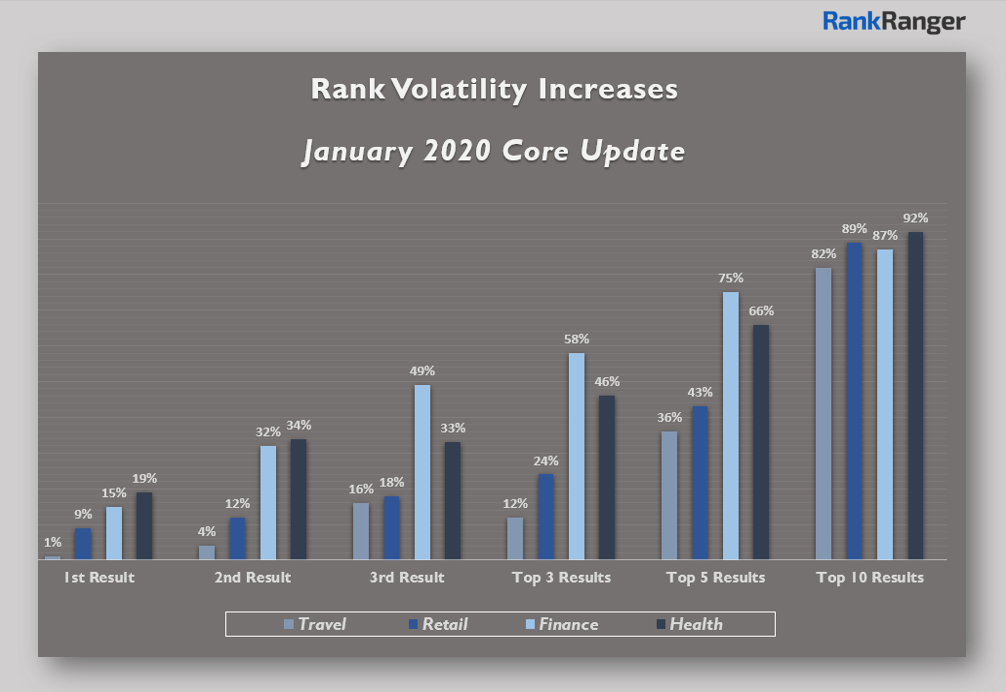

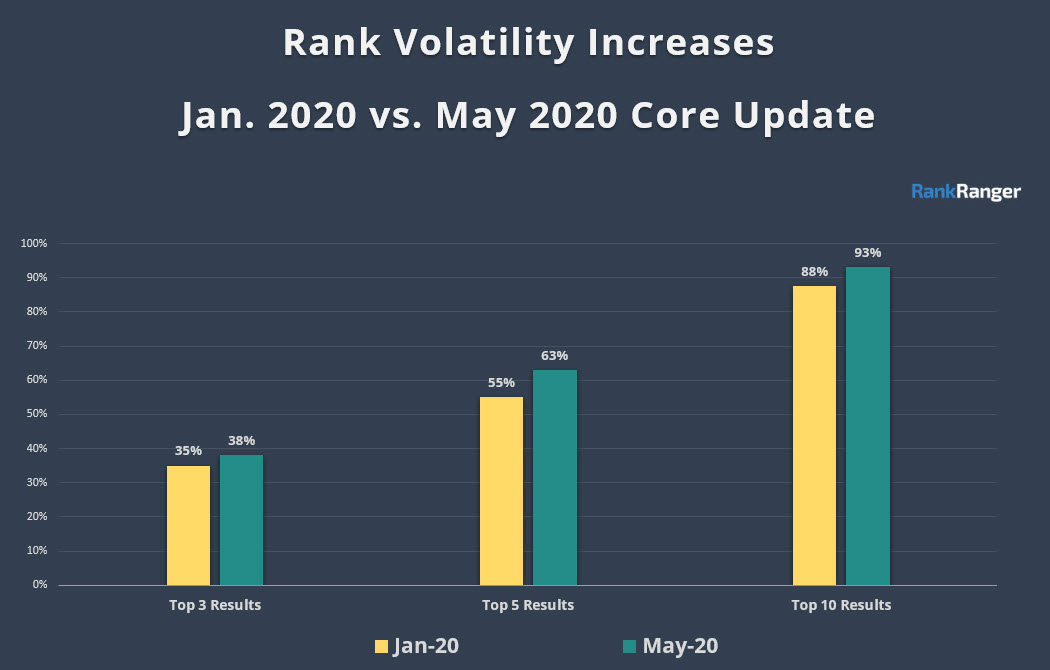

Just to highlight how uniform the rank volatility was during the May update, here’s data from the January 2020 Core Update:

As is very evident, there are extreme gaps in the levels of rank volatility between the Travel and Retail niches relative to the Finance and Health niches until you get to the top 10 results overall. And as mentioned, the Finance niche’s tendency to exhibit more volatility than other industries was far more pronounced back in January.

In short, there was a tremendous amount of rank volatility congruity during the May 2020 Core Update. So much so that it makes this update a unique event.

Qualifying the Size of May’s Core Update

To better help paint a picture as to how significant the May 2020 Core Update was, I went about comparing the levels of volatility seen during the May update to the January 2020 Core Update:

The January update was one of the most impactful core updates on record. Still, the May 2020 Core Update edges it out across the board. While the May update was not vastly more volatile than the January update, the difference in volatility between them is not marginal.

Of course, the white elephant in the room is COVID-19. Is the pandemic behind the rank volatility uniformity? Does it explain why the May update was so vast? It really is hard to say. That said, I do think COVID-19 played a role (as should be fairly obvious) and I’ll get to what I’ve seen on the matter in just a bit.

Ranking Patterns: Insight Into What This Update Was About

With any core update (or unconfirmed update for that matter) finding site-level patterns is very much a hit or miss endeavor. It’s a matter of going down the rabbit hole and seeing if anything sticks. In the past, I’ve been able to pull out some interesting insights, but finding a logic to the new rank trajectories set in motion by an update is not a guarantee.

To that, while there does appear to be some rhyme or reason to some of the ranking changes with this particular update these patterns are not completely definitive. I mean that in two ways:

1) They do not define the entire update. Any given site-level pattern may only apply to a given vertical or a subset of a vertical. Even if it does apply across the board it is just one of a plethora of patterns.

2) The site-level patterns pulled out of an update are often subject to interpretation as an obscene amount of data collection would be needed to confirm them.

In other words, the patterns I am about to present is my best assessment. The information below is my best understanding of what the trends show. The insights may or may not apply across the board and may not be applicable in specific circumstances.

That said, I did look at nearly a hundred different keywords, carefully analyzing which pages won and lost rankings.

Google Goes Straight to the Main Content with the May 2020 Core Algorithm Update

As I mentioned, there is no single pattern that defines or even explains an algorithm update. That said, when I dived into some finance keywords I did notice an interesting peculiarity. Namely, sites that offer boxes of navigation that dominate the above the fold content or have their “informative” content towards the bottom of the page were swapped with pages that did the opposite, with pages that went content-heavy immediately.

In other words, it was as if Google was saying, it wants users to be able to get to the substantive content without delay, without obstruction, and without distraction (or without a site trying to earn revenue first).

Now, seeing this within the YMYL space makes good sense as Google would want to ensure the user has uninhibited access to the most substantive elements of a page’s content without having to do much of anything. (Of course, this makes operating in the affiliate space a bit more difficult, and I do feel for sites that are trying to make that work in the right way).

Here’s a look at what I saw happening on the SERP in specific.

A Tour of a Core Algorithm Update’s Ranking Patterns

The best way to get into this, I think, is to show you how my assessment of the May update progressed. In other words, what did I see and how did one observation lead to the next to the point where I feel strongly that Google used the update to make it easier for folks to get to the crux of the content quicker?

I started with creditkarma.com. Credit Karma lost roughly 40% of its organic visibility at the hand of the May 2020 Core Update. Due to the site’s focus, I started to look at the ranking trends for all sorts of keywords related to credit cards. However, instead of looking at who won and who lost, I was far more interested in what pages replaced what pages!

In other words, forget the biggest winners and losers for a minute. After seeing the ranking trends at the query level for the top 20 results on the SERP, I started to see a pattern… Google was replacing one page with another.

The obvious thing to do was to analyze the two pages and see if there was a particular pattern that explained these instances. For example, for a lot of the credit card keywords I analyzed there were pages from Forbes, CNBC, and US News that were clearly replacing pages from other news-oriented websites. That’s noteworthy as it very much points to Google looking at the SERP, identifying content from news publishers, and looking to make an adjustment to what pages it shows from within the news realm. In other words, it’s as if Google said, “we want content from a news publisher, but we want to adjust what’s being shown.”

Parenthetically, this speaks to part of the reason why not every page that had the problems I saw was swapped out. In other words, no pattern is across the board. There are a variety of reasons why a page with a given issue may or may not lose rankings.

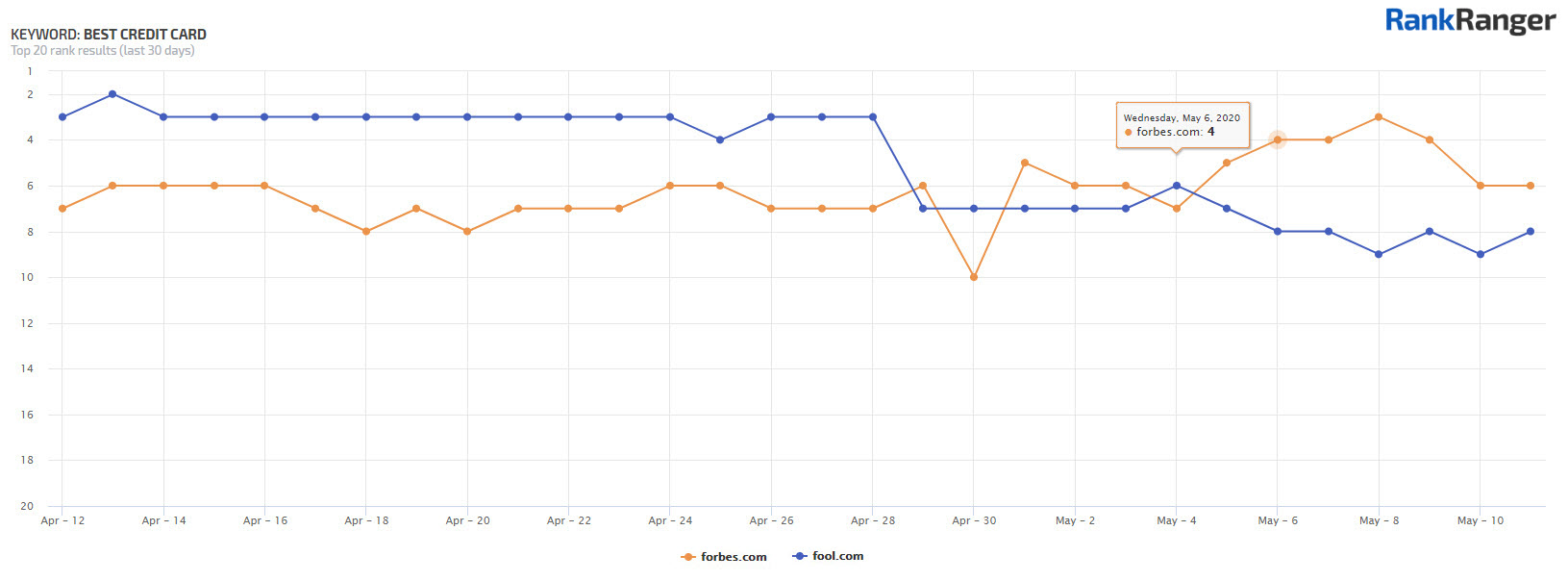

That said, let’s take the keyword best credit card. There is clearly an inverse relationship between Forbes and The Motley Fool (more specifically its subsidiary the Ascent). This relationship spans across both the May update and an unconfirmed update that hit the SERP at the end of April:

This sort of pattern was pervasive and there was a common theme to it.

Have a look at the page from Forbes that ranked in this instance:

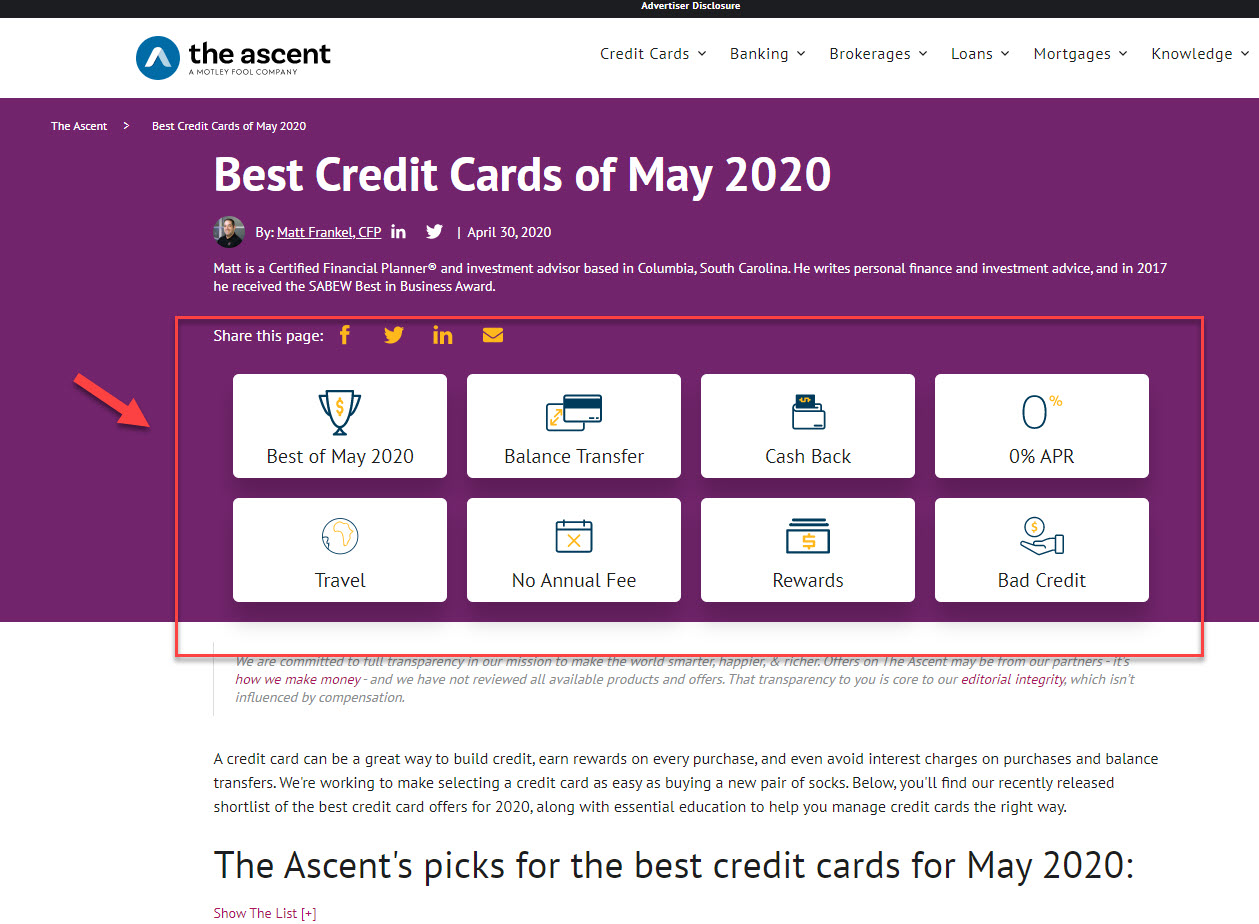

Now have a look at the page from The Fool:

Forbes gives the user direct access to the main content. It’s right there. You don’t have to scroll to get at it. There are no boxes that attempt to offer the user the opportunity to navigate over to other content. With the Forbes page, you simply have the content you came for.

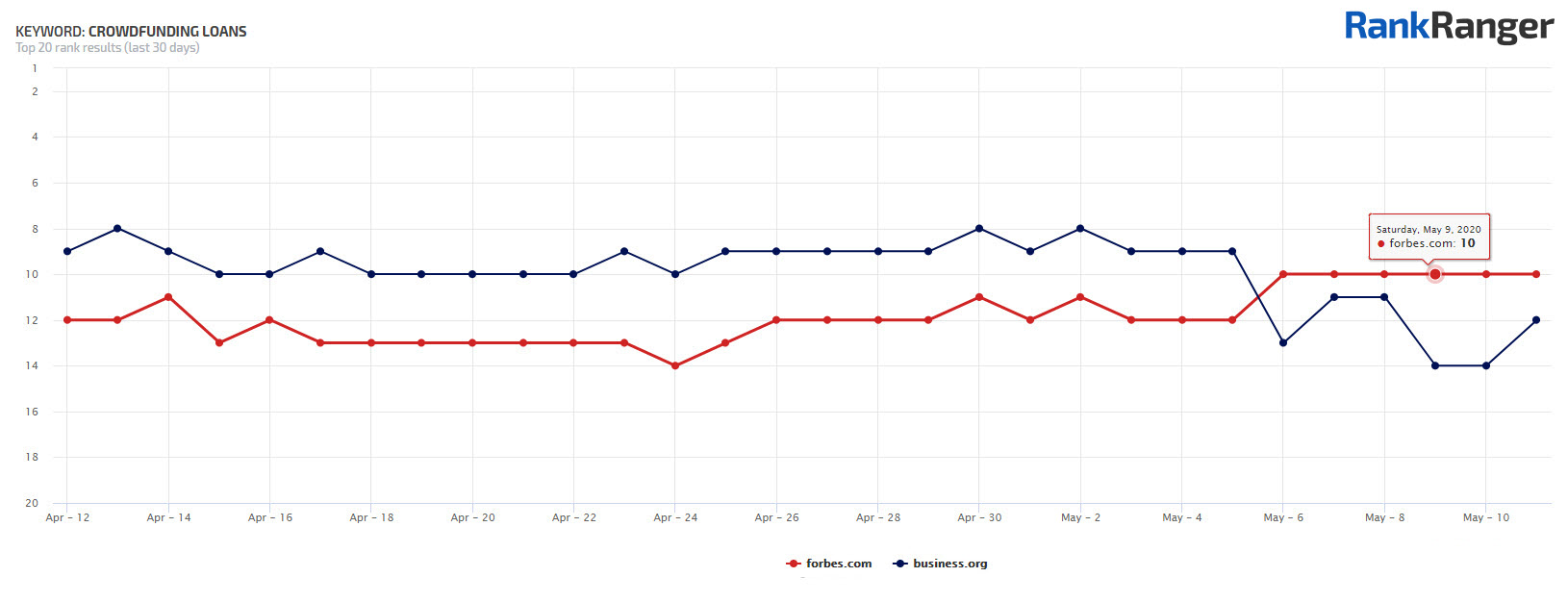

Here’s another example of this dynamic playing itself out with the keyword crowdfunding loans:

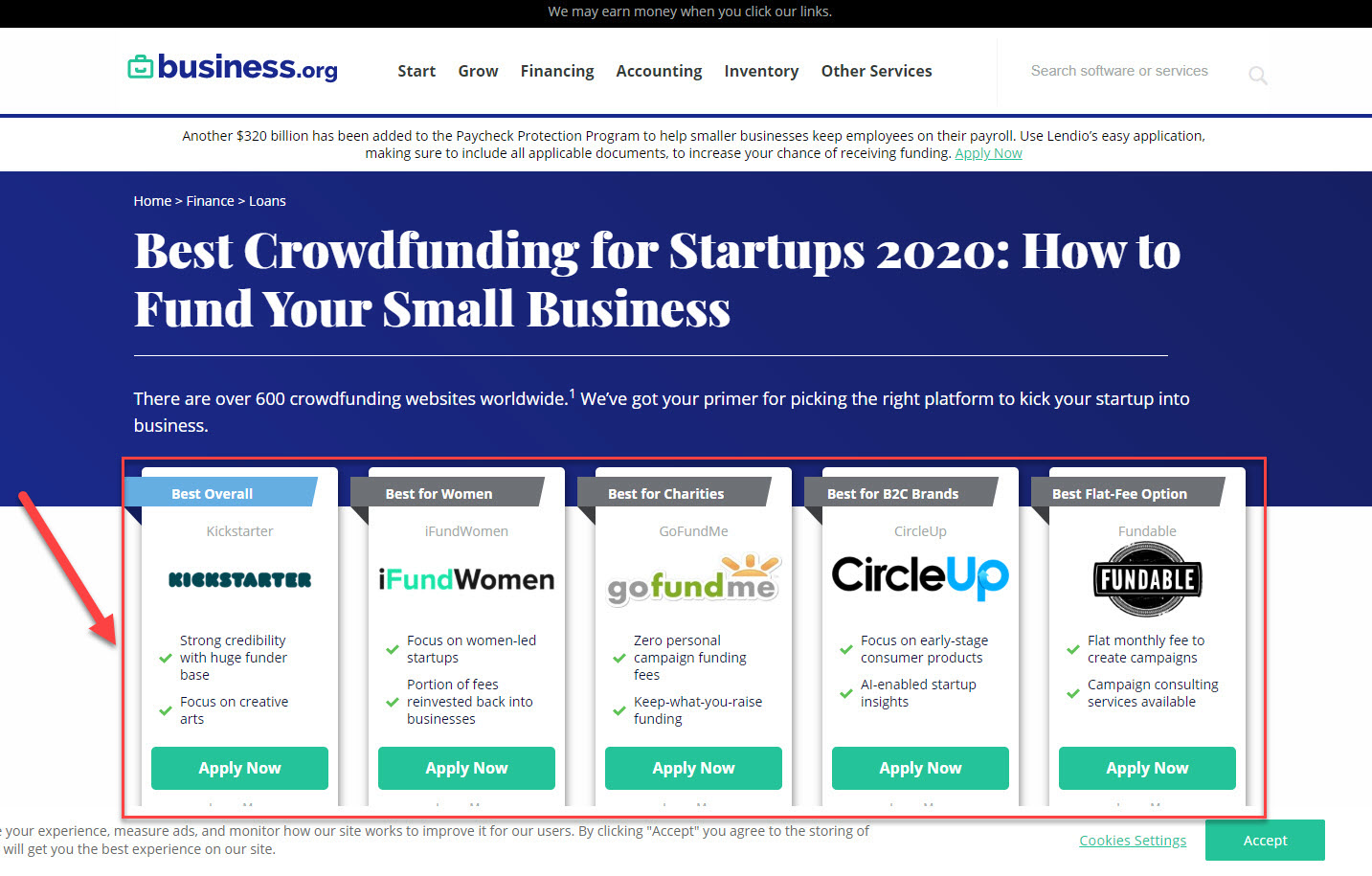

Forbes all but replaces business.org. We know what Forbes’ page format looks like, now here’s what we get for business.org:

Notice anything familiar?

The Problem with the Notion of Google Preferring Direct Access to the Main Content

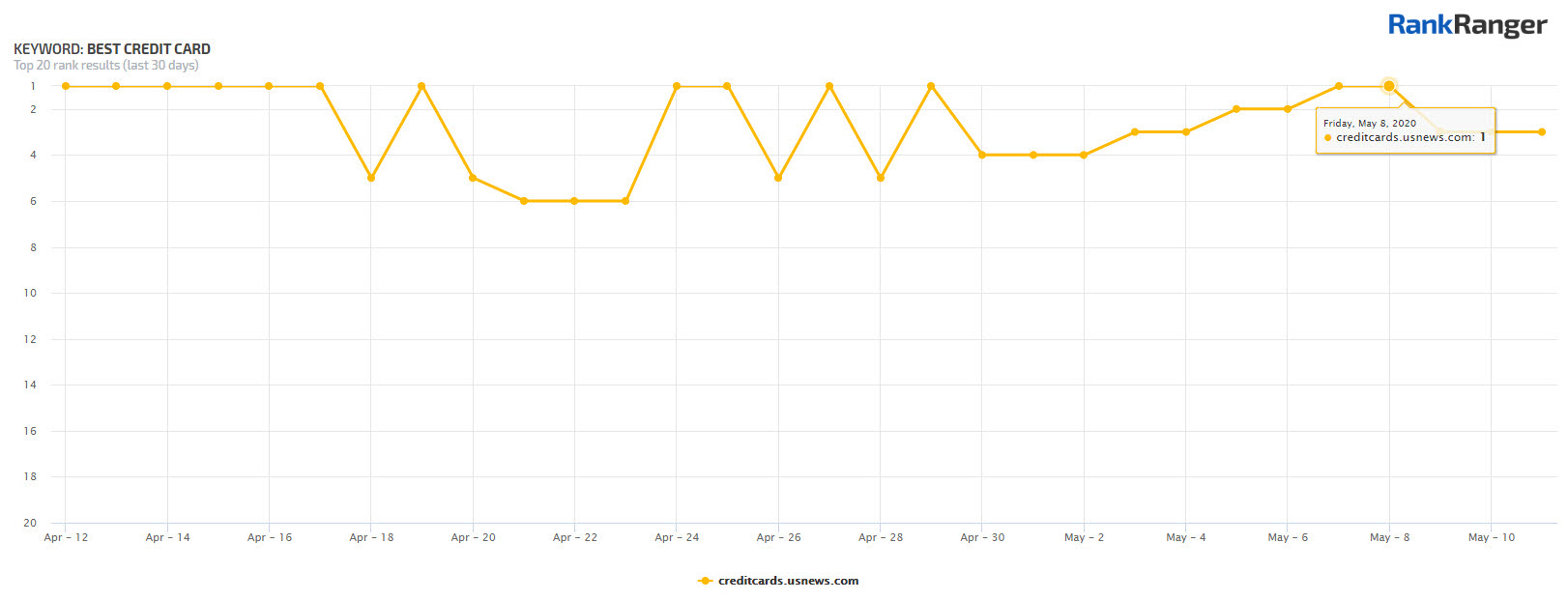

There were two problems I faced with this theory. The first came from US News. For many of the keywords I analyzed within the ‘credit card’ sub-vertical, creditcards.usnews.com saw moderate rank gains… as it did for the keyword in question, best credit cards :

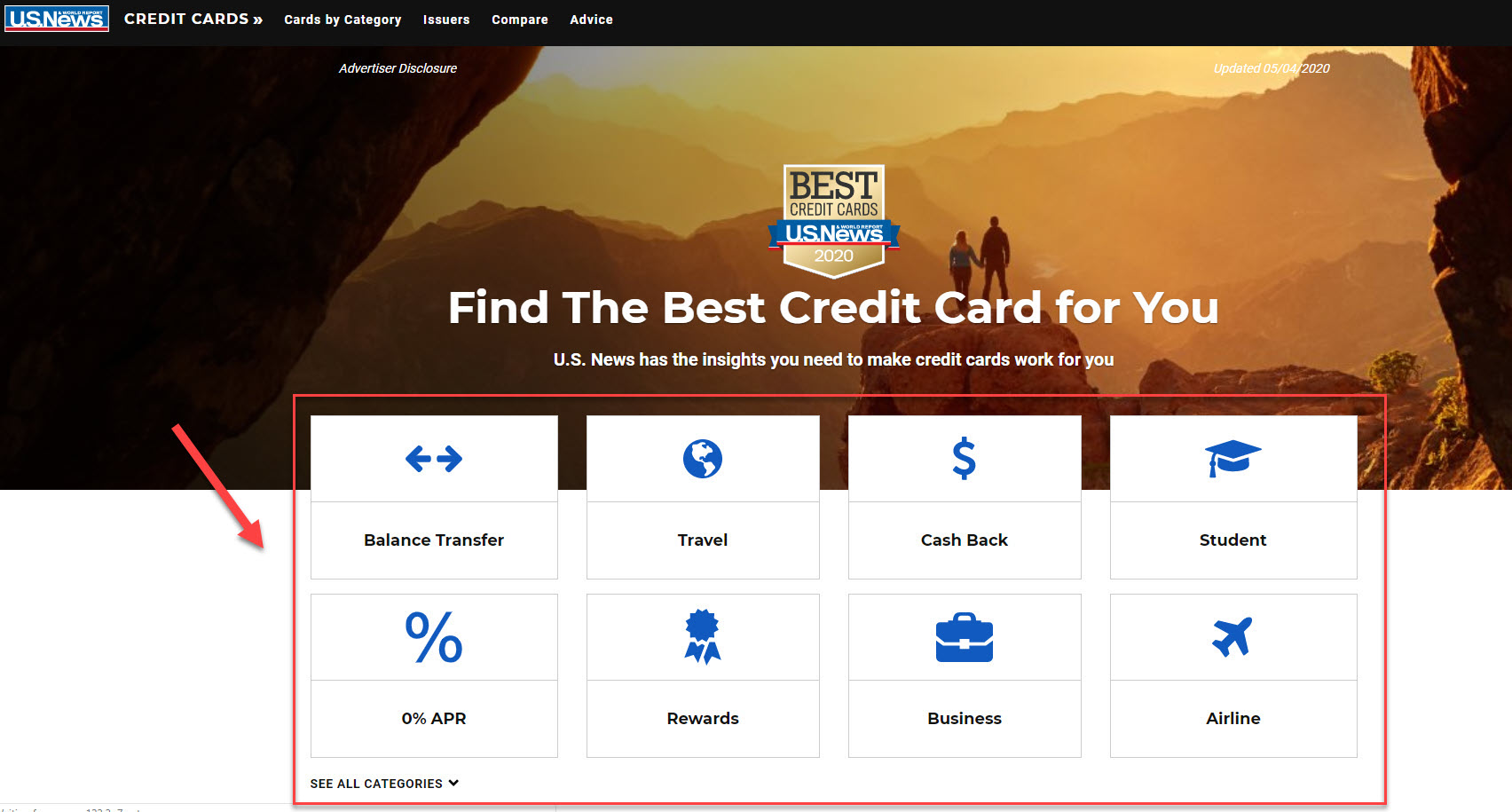

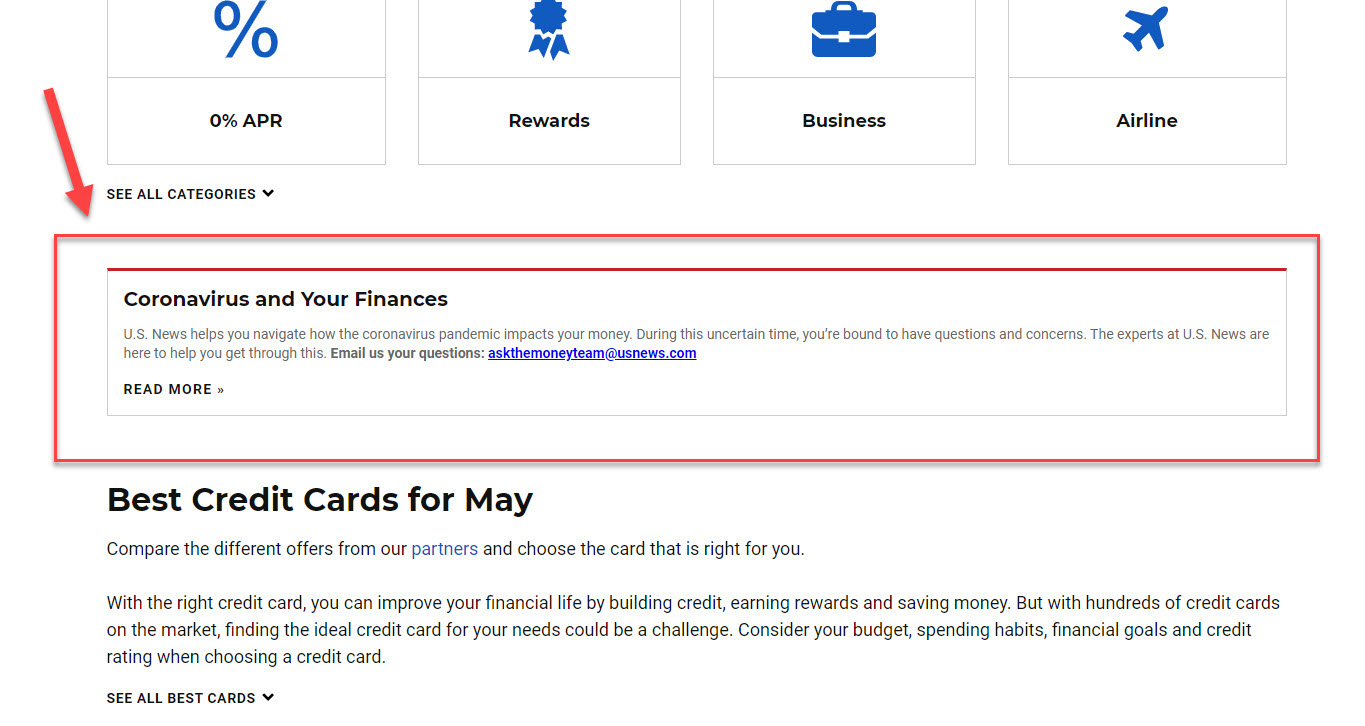

What’s the problem with that? Why is this site seeing relatively small rank gains as a result of the May 2020 Core Update a problem for my theory? Well, here’s how the site’s ranking page for the keyword best credit card looks:

Clearly, this page suffers from the same problem as some of the sites I mentioned earlier in that access to the main content is blocked with navigation to other topics. Here the user would have to scroll as none of the main content appears above the fold.

There is one very important difference with this specific page.

If we scroll down the page just a bit more we get this:

While I did not look at every site on these SERPs, I did look at a lot of them… and US News was the only one to offer a COVID-19 message.

I very much think that this was the difference-maker. That all things being equal, this page would have lost rankings just like pages similar to it. This page was saved and rewarded for its COVID-19 sensitivity. In fact, according to the Wayback Machine, this message was not added back in early March, but far more recently, in mid-April, making the chances of it impacting rank now more likely.

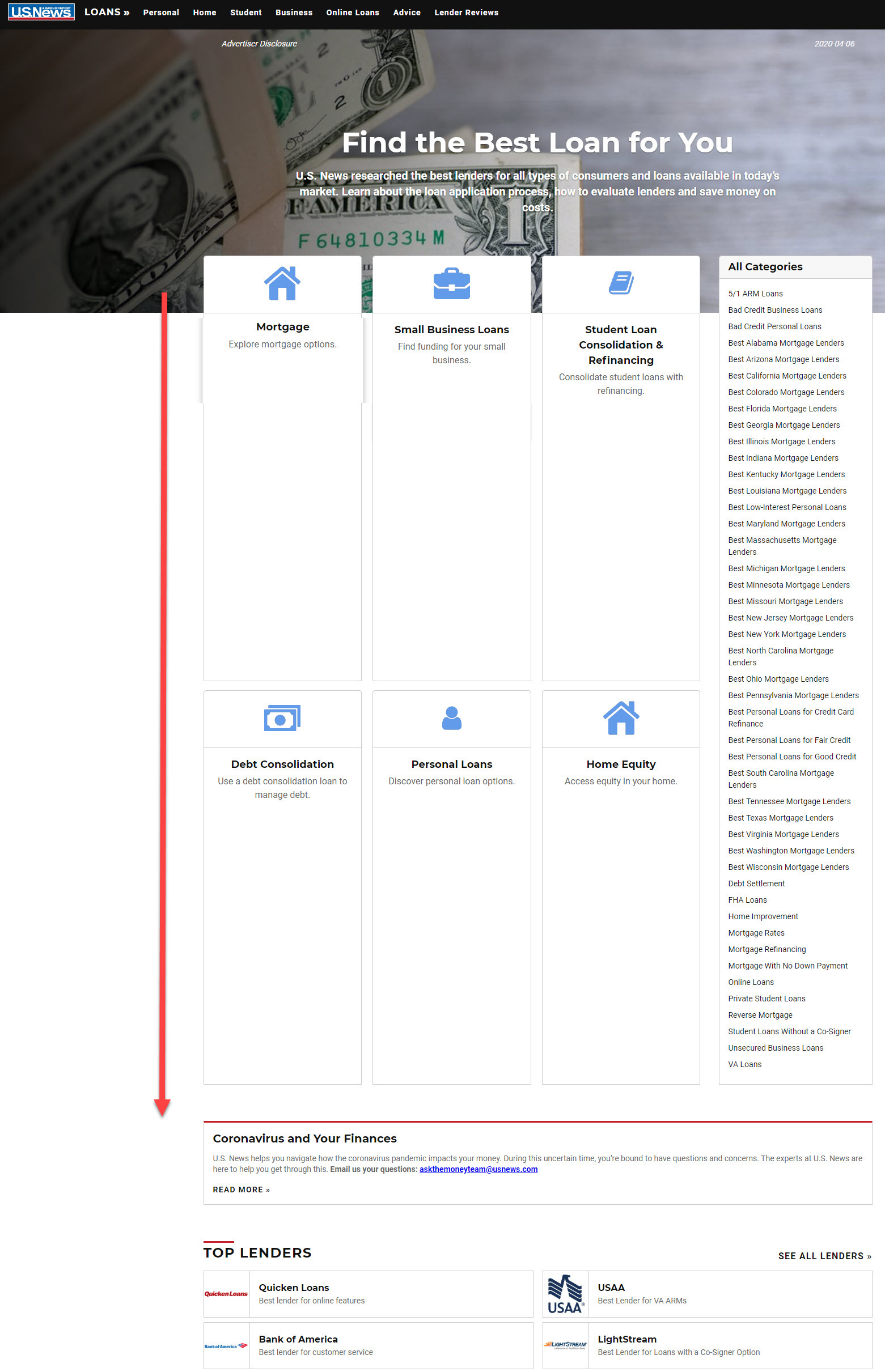

While that sounds plausible, the argument is not concrete, at all. However, here is what is concrete. The page loans.usnews.com saw the inverse pattern. Wherever it ranked for loan queries it, unlike its credit card counterpart, was heavily hit by the update (as a rule).

Why?

Because the page looks like this:

As is very much evident, as new categories were added in the field at the right of the page, the boxes to its left expanded to equal its length pushing the main content very far down the page! In other words, even a COVID-19 message could not save this page. If there is anything that points to Google rewarding sites that offer the main content of the page at the onset, this would be it. This page emphasizes the issue of having truly informative content so far out of the initial view.

The timing here is also perfect. According to the Wayback Machine, this page error was made about two weeks before the May update rolled-out.

Seeing this all but cements the notion (in my mind at least) that Google did not want content unrelated to the main purpose of the page to appear above the fold to the exclusion of the page’s main content!

Now for the second wrinkle in my theory…. A lot of the pages being swapped out for new ones did not use the above-indicated format where a series of “navigation boxes” dominated the page above the fold.

That is, pages from the same sites that used the navigation boxes to fill the page above the fold also lost rankings where that format was not used.

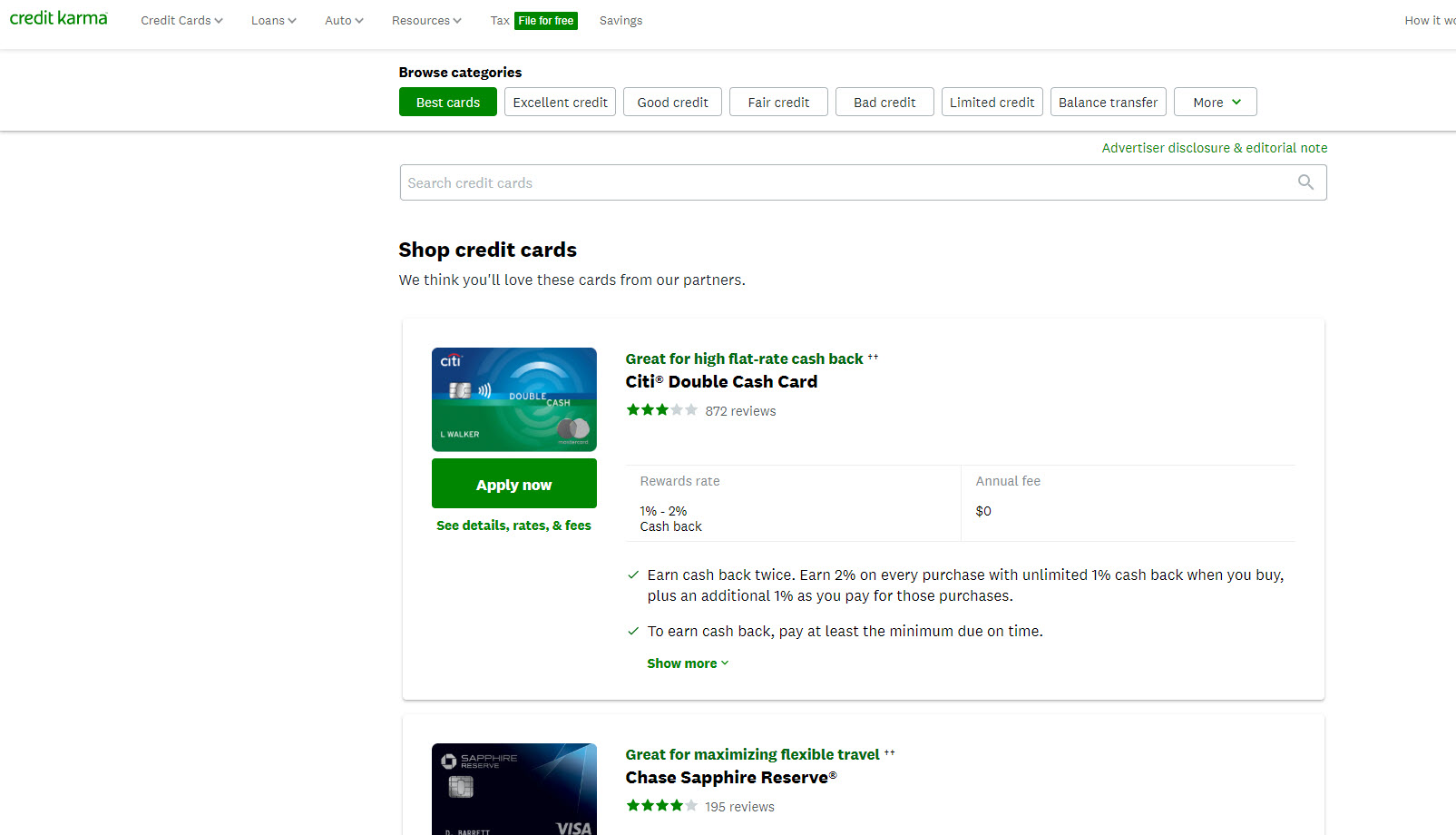

For example, prior to the update, Credit Karma ranked #8 but fell to #12 with the below page for the keyword what is the top credit card:

Clearly, there is content that speaks to the query itself above the fold. However, there is no strictly informational content on the page. There is just the list of cards pushing the affiliates. I very much suspect that this is why the site had such a hard time during the May update… even for its informational pages and blog posts (i.e., spillover effect in action).

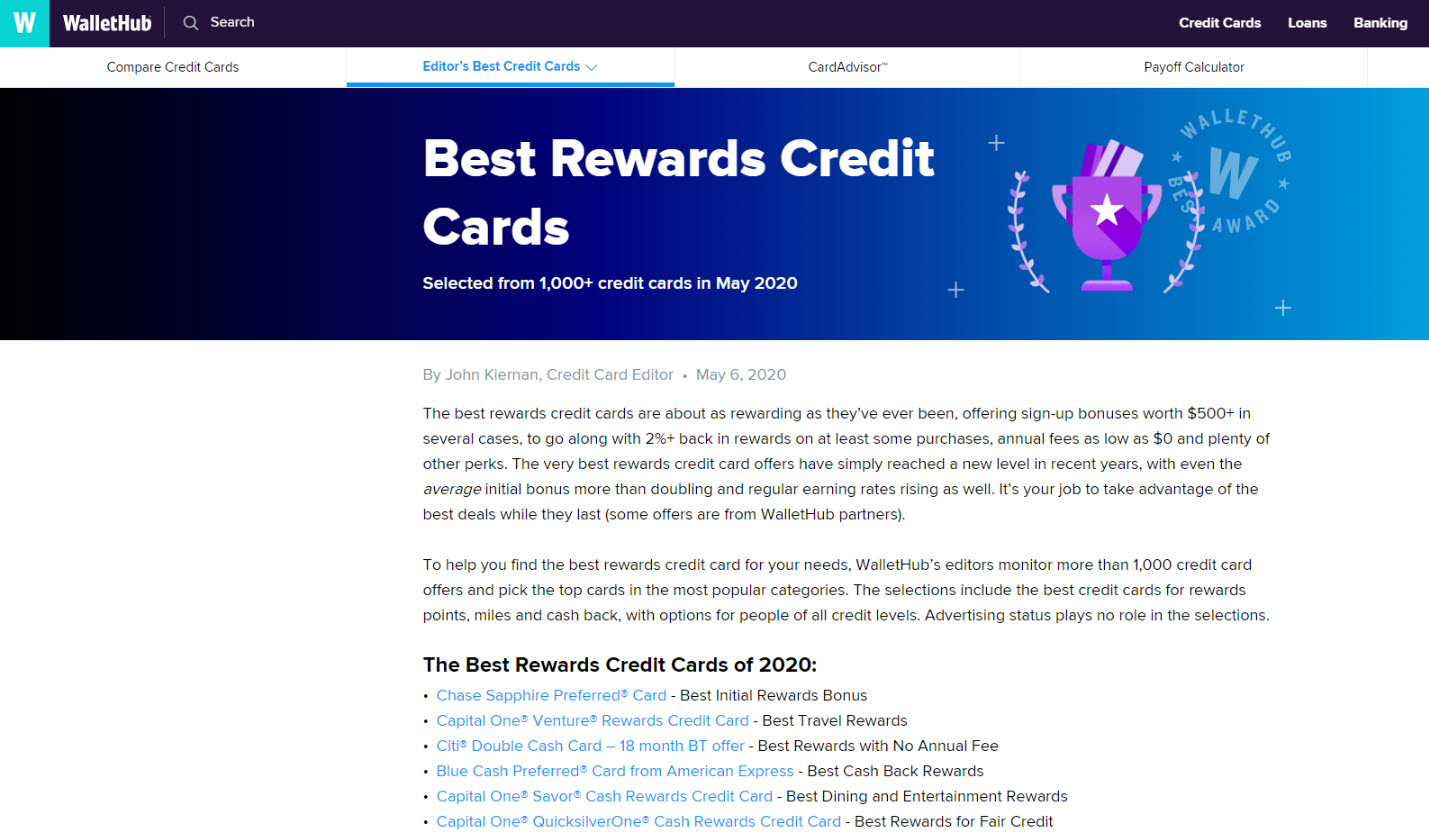

In contrast, compare the above to this page from WalletHub:

Notice a difference?

Pages in this space that jumped into their “affiliate content” without first offering strictly informational and “helpful” content often saw their pages swapped with those that did do so.

That dynamic, might I add, does not mean that the sites that saw ranking upticks offer the best and most informative content. Have a look back at the WalletHub page above. It’s certainly a bit fuller than what some sites in the same category offer at the top of the page. However, that does not mean the sites that don’t initially offer that super-informative content at the onset don’t do a great job putting such content on the page.

Here’s what a typical page from The Fool’s Ascent looks like below its various lists of credit cards:

That content you see under the lists of cards here is arguably far more helpful than the content offered by some of the pages that present informative content above the fold. However, despite this fact, the trend was for pages with that informative content above the fold to take the place of many of those pages that don’t do as such and save the purely informative content for later (i.e., after showcasing affiliate opportunities).

In other words, Google wants the user to be able to access helpful and informative content right away. Thus, sites that place that sort of content after its various “lists” in connection with their affiliates, etc… just like sites that offered navigation to other pages before the main content to the extent that the functionality dominated the page above the fold… tended to see ranking losses.

The Evolution of Google’s Site Profiling

The May update seems to indicate Google’s preference for a page to start strong with its informational content when there are other forms of content on the page. When there is both strictly informative content and semi-informative content (such as a list of best credit cards that contain affiliate links), Google may want that pure information to come first. (Clearly, this may not apply to queries where the intent is entirely transactional.) This desire seems to be so strong that Google is rewarding pages that do so even when their informational content is not as deep as a page that presents “strictly informational content” under their “quasi-informational content.”

Indeed, that might seem peculiar. However, Google’s actions here do align with its tendency to determine site authority and safety via site profiling.

That is, in the cases analyzed here Google could be saying, “we understand that the informational content you have could be great content, but the fact that you don’t place it at the top of the page… the fact that you first place your affiliate opportunities at the forefront when the query is of an informational intent, means we might not be able to trust your page as we can not be certain of your intentions.”

Think about it like this:

A user is undertaking an informational query when they search for best credit cards. They want to know what are the best credit cards to apply for and why. Part of that means understanding what these cards are and how they work. Having access to apply for these cards on the page is a secondary benefit. Offering the main informational content under content that is geared towards card application does not speak to user intent (all things being equal). Since it does not speak to the user’s core intent, we have to ask why sites do as such. Well, it’s because they need to make money (for the record, this is not a bad thing. I very much feel for many sites in this space). So basically we have a site saying (in a way) that they’re going to put their financial interests ahead of the user and user intent. This might very well send Google a signal that the page is not fully aligned to the user’s best interests which calls the page’s (and site’s) authoritativeness and trustworthiness into question.

COVID-19 and the May 2020 Core Update

Was the May 2020 Core Update about COVID-19?

While a core update is not about a single factor, COVID-19 did play a unique role in the May 2020 Core Update. From the timing of the update to the way certain pages were treated and impacted, COVID-19 did put its thumb on the scale that was the May 2020 Core Update.

There were a few unique ways that it seems COVID-19 played a role in May’s algorithm change:

The Update’s Timing

Many SEOs were expecting a core update back in March. That’s because for the past two years Google has done just that during the month of March. However, March was a particularly difficult month for the search engine. March 11th saw the WHO name COVID-19 a pandemic and since then Google has been trying to orient itself to a new world of topical information and user behavior.

I don’t see Google running a core update back in March as being possible. Google was just trying to get a grasp on things back then. How could it have run a core update? It would have to run another one soon after just to correct its course! The movement in the rankings back in March testify to Google working very hard to calibrate itself to the new reality. Running a core update based on an outdated paradigm is not only illogical but would have proven harmful.

With that, I very much think that the update we usually see in March was pushed off and became what is now the May 2020 Core Update.

The Role of Super-Authorities on the SERP

Ever since COVID-19 became an official pandemic Google has given super-authorities within the space preference on the SERP, as well it should. These sites include the likes of the CDC, the WHO, etc. And while Google has at times moved such sites up and down the SERP over the course of the past two months, the May 2020 Core Update has seen some of these sites lose more ranking positions than they had in the recent past.

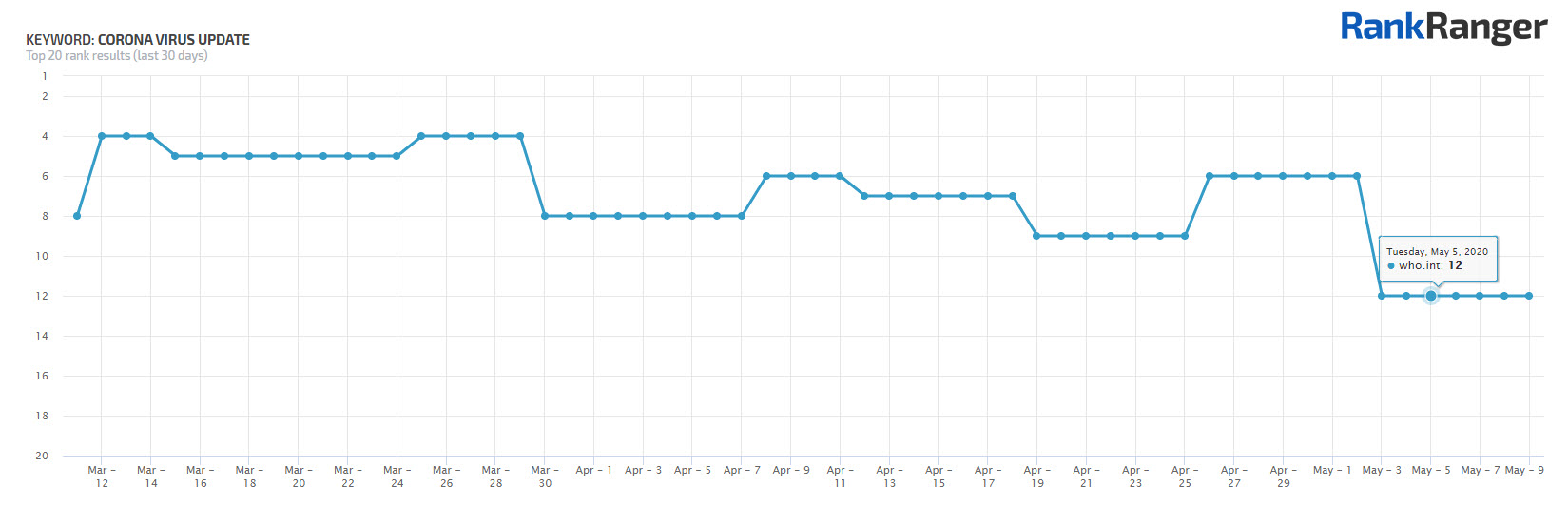

For example, for the keyword corona virus update the WHO can be seen hitting a new ranking low with some consistency:

Accordingly, sites like the CDC and the WHO, have seen visibility losses of anywhere between 4-7%. To be accurate, the losses span not only the May 2020 Core Update but also some unconfirmed updates Google had released in April.

I think this speaks to both Google’s understanding of COVID-19 and how the pandemic has evolved. Seeing Google scale back the super-authorities points to Google feeling it no longer needs to rely on them to the same extent. That can be because Google has a better understanding of the topic as well as user intent. It could also be because what was once unique is now the new normal. That is, COVID-19 has played itself out on the SERP like a news topic where extreme volatility is the norm as the topic matter is quite transient. Google scaling back on the super-authorities could speak to the topic itself being less transient in which case “overreliance” on a super-authority may not be as necessary.

Overall, I’ve seen Google get a better grasp of COVID-19-related queries with both the unconfirmed updates in April as well as May’s core update.

How Commerce Sites Were Treated

During my deep dive into the update, I came across a few appliance sites that were both positively and negatively impacted by the update. While I only analyzed five sites, making what I am about to share far from conclusive, I do find the pattern here noteworthy and therefore worth sharing.

In specific, I found that the sites ajmadison.com and goedekers.com saw noticeable rank increases as a result of the update. At the same time, appliance sites abt.com, warnersstellian.com, and appliancesconnection.com all saw ranking losses.

I spent hours trying to figure out why AJ Madison and Goedekers won while the other sites lost.

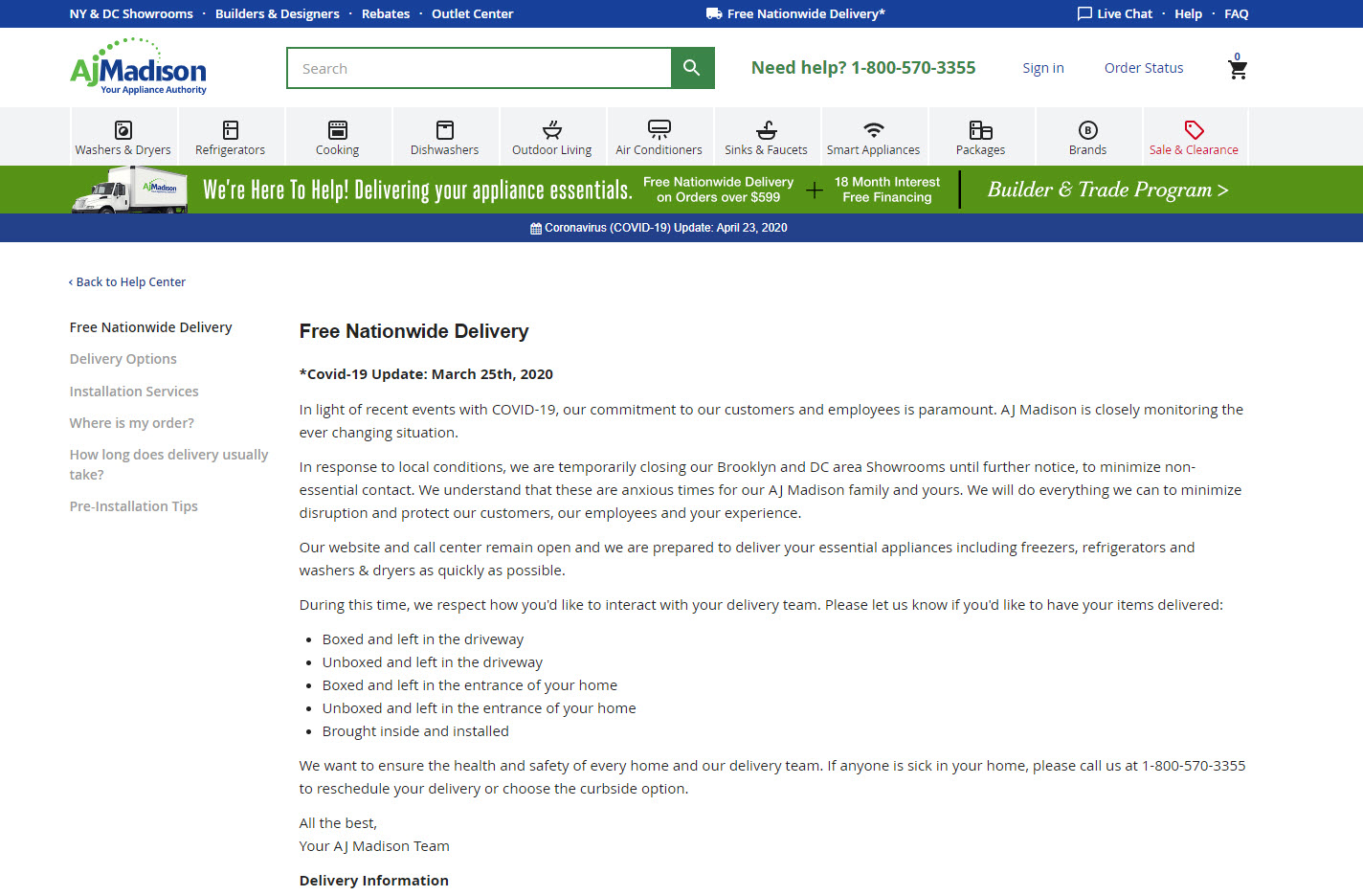

After combing over these sites I found that both AJ Madison and Goedekers treated COVID-19 differently on their sites. While all five sites, of course, have a message about the pandemic on their homepages, AJ Madison and Goedekers dealt with the topic specifically on their delivery pages.

For example, the shipping page for AJ Madison looks as follows:

The page goes into great detail about how the company is handling deliveries safely during COVID-19.

This stands in contradistinction to a site like abt.com (who, to be fair, does have one line buried in there about a specific delivery service being suspended due to COVID-19).

Here is what the shipping page for wenersstellian.com looks like:

The above appears to portray the site’s delivery procedures to be business as usual (which, I highly doubt is the actual case).

While the analysis here is more of a case study than a conclusive set of data or patterns, it is compelling. We know Google can be very specific in how it approaches, profiles, and analyzes a site. We know that Google is looking for businesses to be very specific in the COVID-19 information they offer. Were this not the case, Google would not update properties like GMB listings and Local Service Ads to present businesses the opportunity to offer highly-specific COVID-19 information.

I don’t think it’s a stretch for Google to get so specific in what it wants sites to do with the information they offer on COVID-19 in regards to shipping specifically. At a minimum, updating pages like these with the appropriate COVID-19 information bolsters user confidence and ultimately conversions which makes taking the time to update the content worthwhile in any event.

Google Just Keeps Digging Deeper & Deeper with Its Core Updates

The May 2020 Core Update was most certainly a novel update. It had to be being it was released during one of the most singular events of our lifetime, COVID-19. Still, what resonates with me is Google’s evolution. There seems to be almost no limit to Google’s ability to grow and advance in its understanding of web content and the sites that host it.

With the May 2020 Core Update, all signs point to Google continuing to dig deeper into how sites align to user intent and what signals are used to make that determination. The narrative of all these core updates seems to revolve around the innovative ways Google is able to analyze pages and sites in order to understand if the way they treat the user via their content is appropriate.

What’s next? We can only wonder…