Posted by

Mordy Oberstein

Each and every year we’re humbled by the additions we’re able to offer to the SEO industry’s understanding of the “search environment.” Whether it be a deep dive into a Google algorithm update or a case study on Google’s use of SERP features, we feel honored to offer a bit of insight into how Google is treating the SERP and so forth. With the year coming to a close, here’s a review of the original research Rank Ranger has brought to the forefront of SEO consciousness.

Before I get into the studies themselves, I want to take a moment to thank the team. None of the research pieces we put out, despite my name being at the top of the page, is a one-person effort. Each and every piece is the work of an entire team of really fantastic people. So, I want to give a sincere shoutout to the development team whose ingenuity has helped make the data used in our studies accessible as well as to the content and SEO teams who have worked tirelessly to ensure the material we put out is clear and engaging (as well as free of all my grammar mistakes)!

e-Commerce Sites Take a Ranking Hit in Early 2018

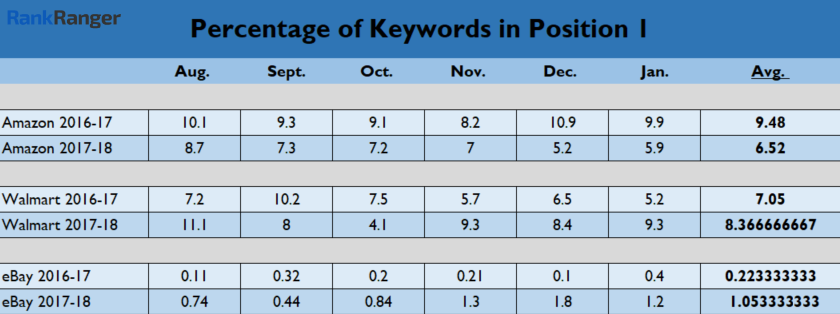

In February 2018, we put out a study which looked at the rank stability of some of online retail’s biggest sites. Studying data over two separate six month periods, we found that Google had been altering the traditional paths of sites like Amazon, Walmart, and eBay.

In specific, we found the average number of positions these sites tended to fluctuate increased in 2017-2018 as compared to 2016-2017 (the study covered the months of Aug. 2016 – Jan. 2017 as compared to Aug. 2017 – Jan. 2018). For example, Walmart saw their average position jump 29%, while Amazon saw a 25% increase. eBay saw a smaller, yet still significant, 10% increase in position movement. In plain terms, these sites had become a bit less stable.

There was a bit of parting of ways between the three sites, as evidenced by the lesser degree of rank instability seen with eBay. In fact, Amazon was hit particularly hard as the site lost a significant number of position 1 keywords.

Both Amazon and Walmart lost a significant amount of keywords that ranked #1 on the SERP

Similar patterns were seen at the 2nd and 3rd ranking positions as Amazon lost keywords within both of these slots while eBay gained keywords at both the 2nd and 3rd spots on the SERP.

The movement of these sites came amid an overall increase in rank instability (which is why you have eBay improving at the #1 position but also showing a 10% increase in the average number of positions the site’s pages move when fluctuating on the SERP).

The average number of positions sites tend to fluctuate increases over time across multiple niches

Learn more about how Google has altered the rankings of some eCommerce sites.

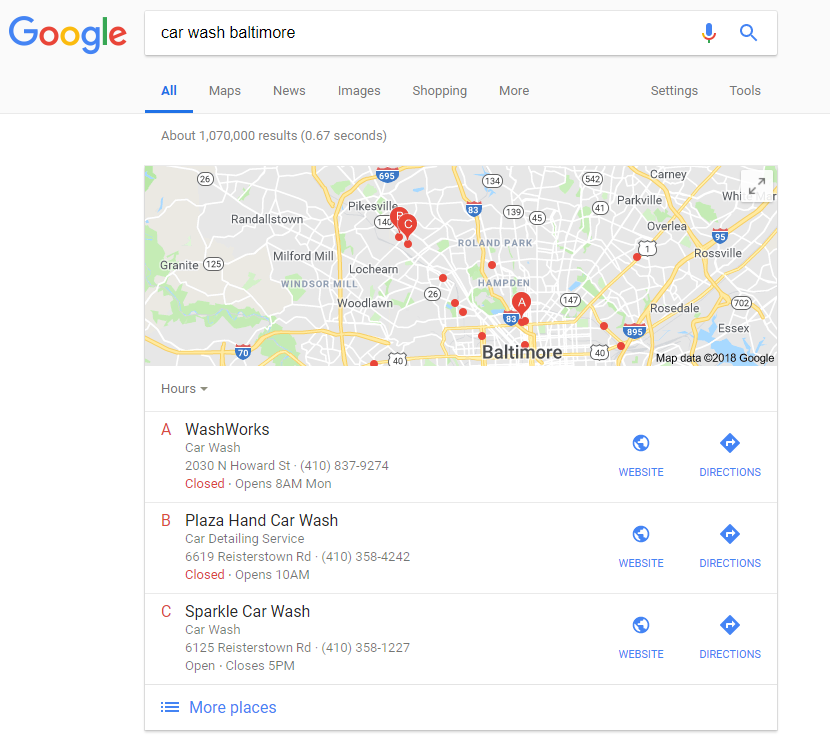

A Local Pack Distance Pattern

This was probably the most novel study we ran this year. It all started when we noticed that the maps within the Local Pack were displaying a clustering pattern, showing two listings in close proximity and one a further distance away. We dubbed it a 2:1 clustering pattern (i.e., two results are clustered, are in close proximity, with the last Local Pack listing being relatively further away).

A Local Pack showing the 2:1 clustering pattern with listings B and C being grouped together on the map

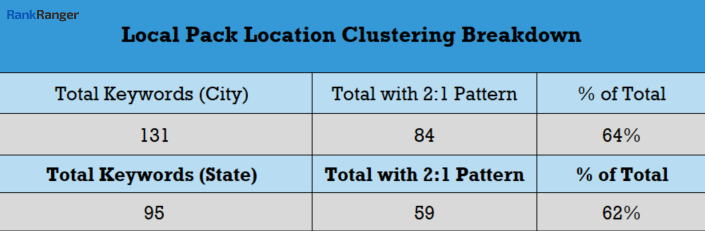

We looked into how pervasive this 2:1 clustering pattern is and found that 64% of the keywords we looked at brought up Local Packs that clustered two listings together. The working theory was that Google wants to show results that are highly relevant to the searcher’s proximity, hence it shows two results clustered close to the location of the search. That’s nice, except I executed these searches hundreds of miles away from any of the locations used within the study.

This made me wonder if Google was applying a local search algorithm that did not fit the needs of users running local searches from a distance. Also, it made me think that perhaps Google was too focused on proximity. There are certainly instances where a user does not want their location to influence results, nor does it even make sense for Google to show results clustered within one section of a city for such instances. Take for example a tourist from another country or a search for the best doctor or specialist. Certainly, in the latter, expertise is more important than the utmost closeness to the user’s location?

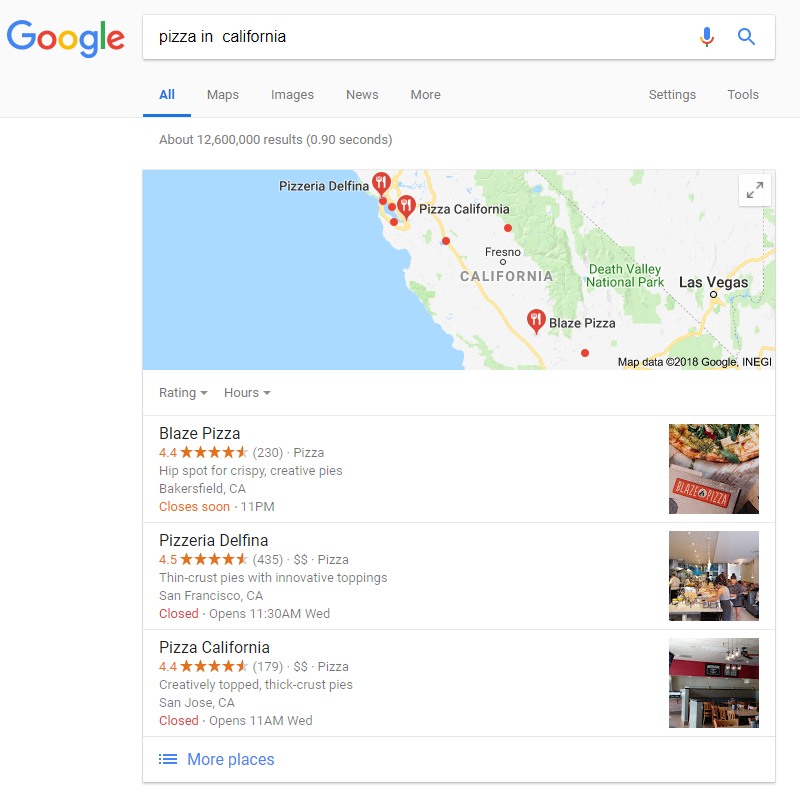

To highlight this overemphasis, I ran an additional 95 queries at the state level. The idea being that such queries, by their very nature, do not favor one geographic area over another, nor is the query (again by its nature) intent on proximity. That is, how can proximity come into play when the searcher is specifically looking to cover a geographic area that consists of thousands upon thousands of square miles?

The Local Pack clustering pattern showing at the state level

Interestingly, at the state level we found the same 2:1 clustering pattern seen at the city level with 62% of these keywords producing the pattern:

The data thus

Read the full study on the Local Pack clustering pattern.

The Case Study That Points to Machine Learning Driving Featured Snippets

2018 saw the advent of all-new forms of Featured Snippets. Some of these new formats got a bit more publicity than others. Multifaceted Featured Snippets were a big-ticket news story, while snippets with bubble filters went slightly below the radar. In May 2018, we surveyed some of the new forms of Featured Snippets that Google was supplying us with.

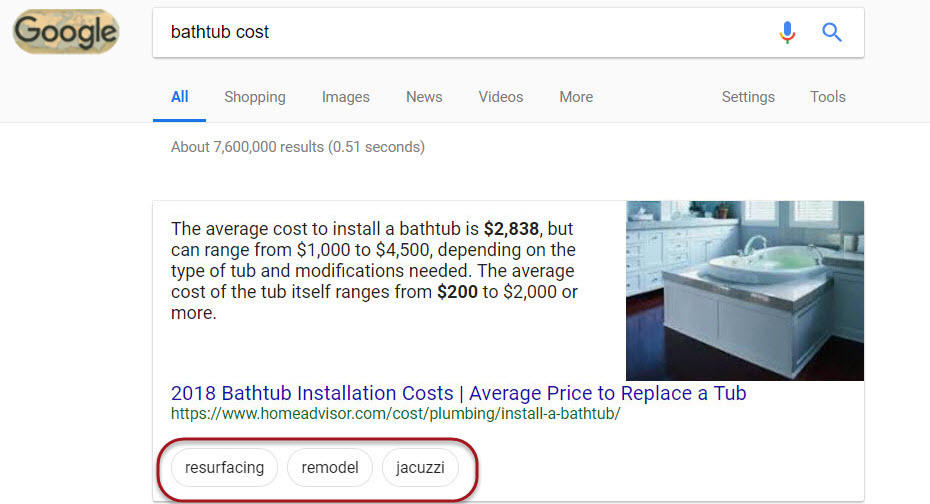

A Featured Snippet that contains the bubble filter

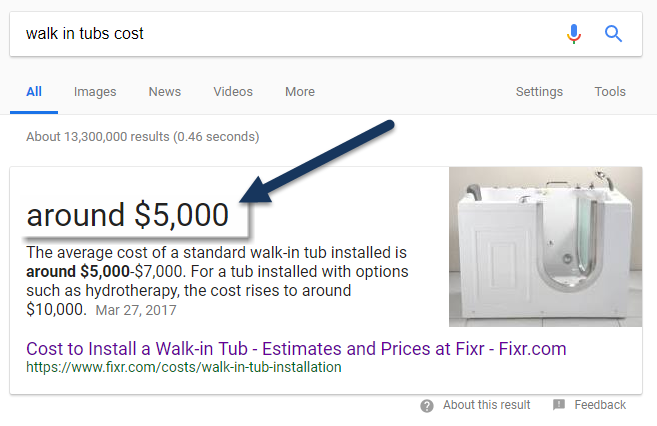

One of the most interesting finds were Featured Snippets with headers. That is, Google began showing snippets that functioned almost like a Direct Answer. In these instances, Google pulled a line from within the Snippet and showed it as a header of sorts above the summary and URL. What’s more is that we found Google to be quite adept at knowing when to or not to show this form of Featured Snippet.

A Featured Snippet shows a bolded heading that effectively turns it into a Direct Answer

Having seen these, as well as a few other types of Featured Snippets, was a clear indication that Google was highly targeting user intent, even multiple user intents. With a newly profound ability to target users via Featured Snippets, it became apparent that machine learning has been able to exert a heavier influence over the SERP feature.

Continue learning about how Google is making greater use of machine learning when showing Featured Snippets.

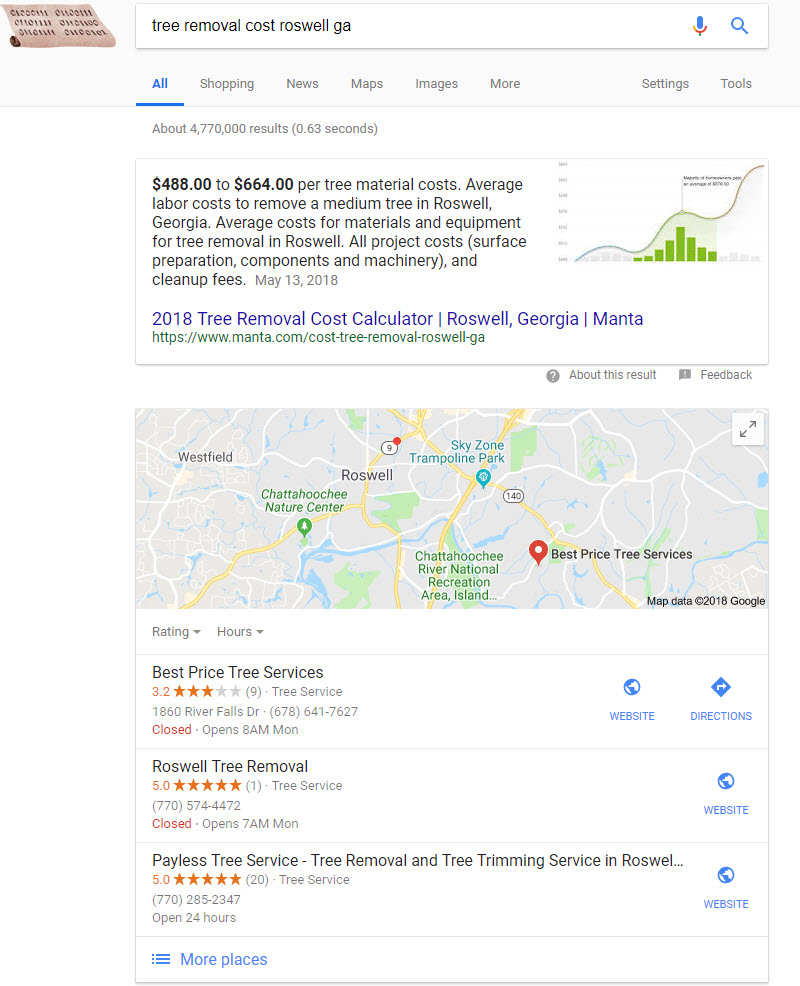

Local Packs and Featured Snippets More Common on the Same SERP

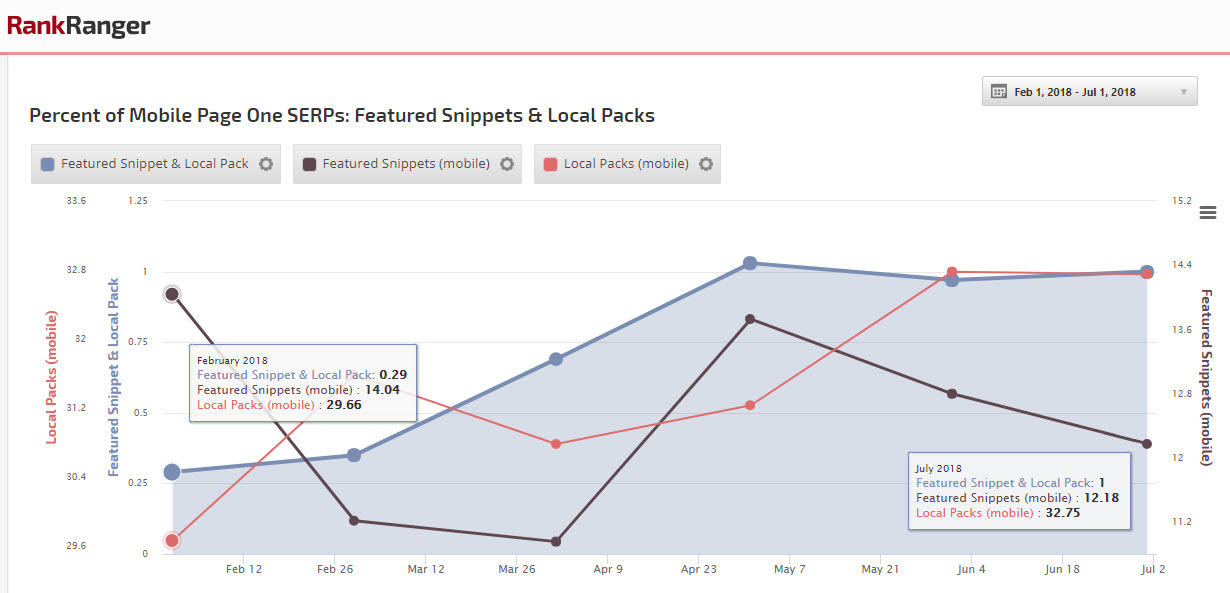

In July 2018, we were on a SERP feature quest. The general sense I had was that something had changed, or more likely, more than one thing had changed. Something just seemed different about Google and its SERP features. One of the many changes we found was in the very bidding system itself. Per our data dive, we found there was a peculiar uptick in the percentage of SERPs that contained both a Local Pack and Featured Snippet.

A SERP containing both a Featured Snippet and Local Pack

While the SERP feature combination only showed on

The propensity for Local Packs and Featured Snippets to appear on the same SERP increases on mobile

Get more data on Local Packs appearing on the same SERP as Featured Snippets.

Google Gets More Energetic with Its SERP Features

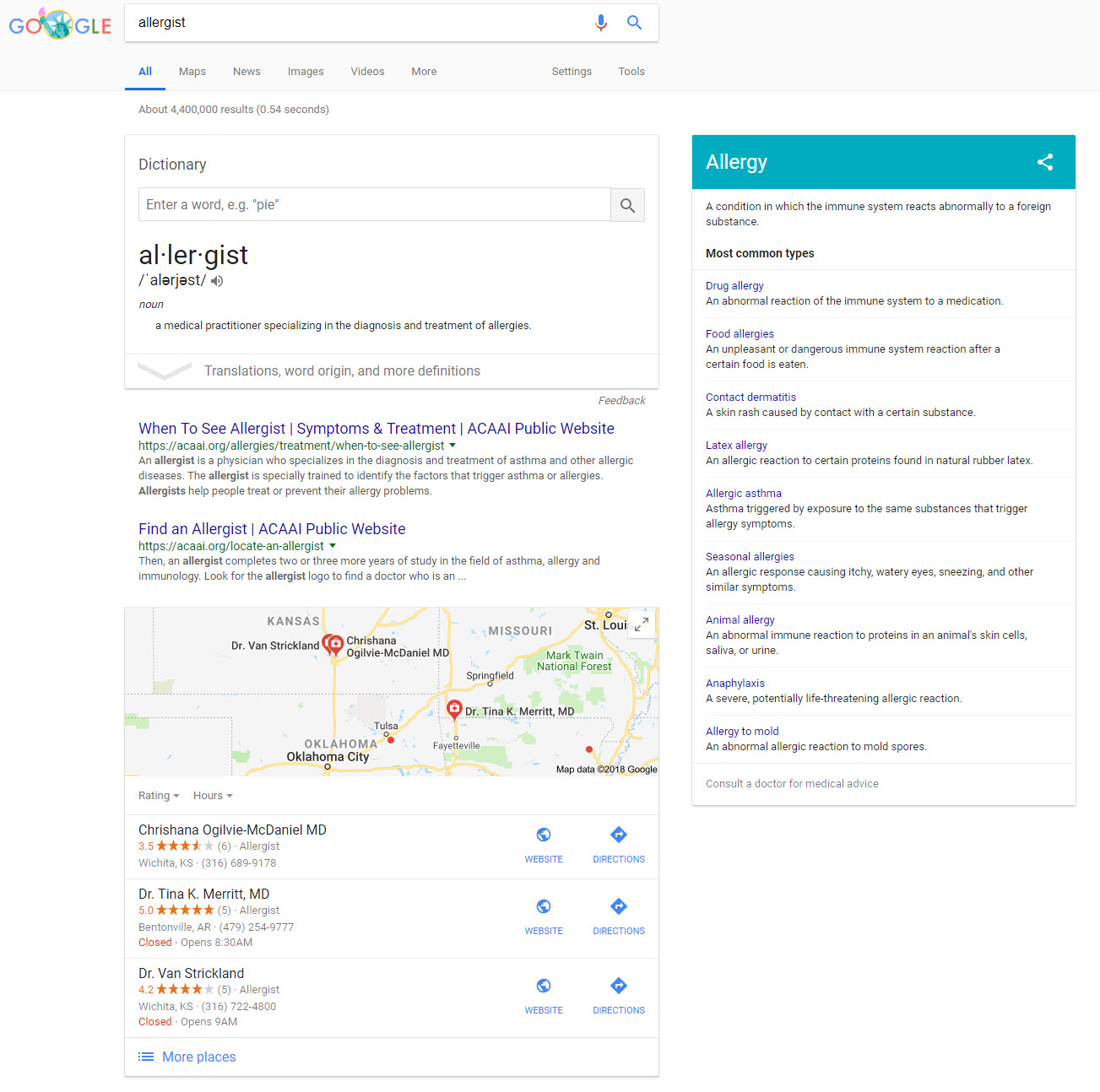

As part of our dive into the ‘shifting SERP feature sands’, we surveyed the new ways in which Google is now targeting user intent with its SERP features. To this extent, we looked at how Google is pairing multiple SERP features together in order to target multiple intents.

The keyword ‘allergist’ now brings up three SERP features that appear above the fold whereas in the past this was not the case

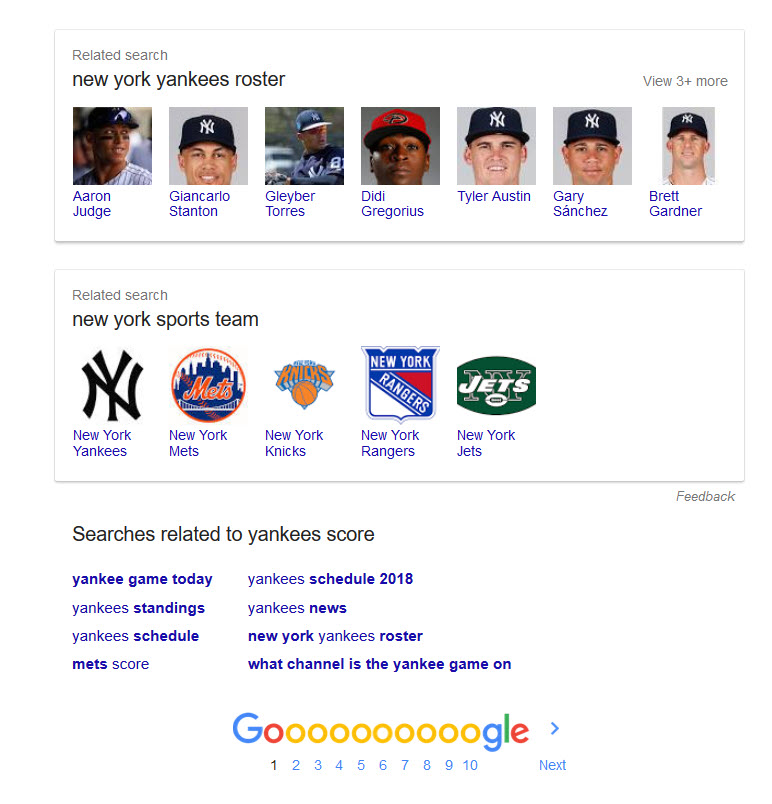

Google is not only using multiple SERP features to target multiple intents but numerous incarnations of the same feature on the same SERP. Specifically, Google has begun to show multiple Related Search boxes, each clearly targeting a unique user intent.

Multiple Related Search boxes to target various user intents

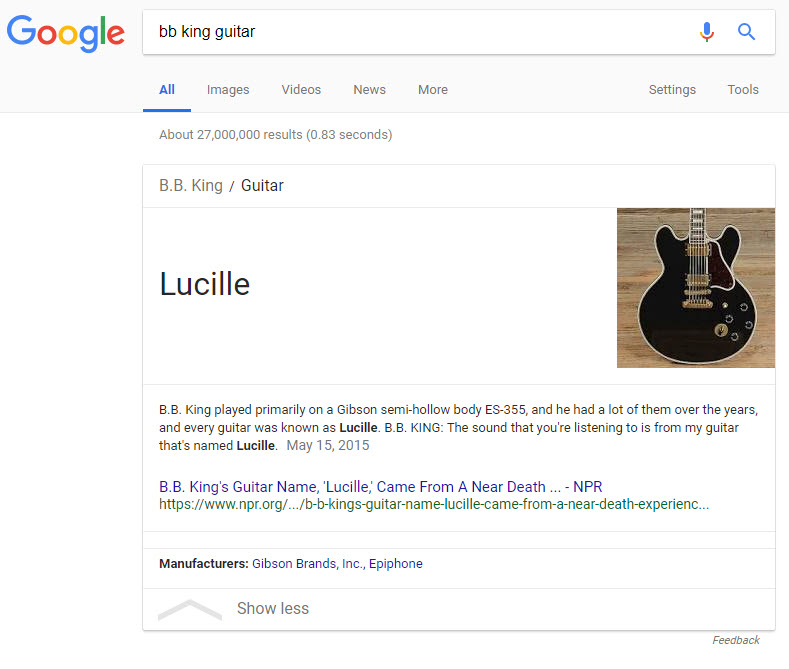

Moreover, Google has started heavily incorporating what I’ve referred to as hybrid features into the search results. One of the most fascinating advents of Google’s more energetic approach to using SERP features to meet numerous intents is a merger of multiple SERP features into one. For example, Google now shows an

A ‘hybrid’ Featured Snippet that combines both Direct Answer and Featured Snippet elements

After running this SERP feature survey, two things were clear to me: Google is far more energetic in how it uses its SERP features and it is all but certain to be using machine learning to meet intent at this level.

Delve into how Google is is more energetically using its SERP Features.

Surveying Google’s Medic Update

Without a doubt, one of the biggest SEO stories of the year has to be the Medic Update which rolled-out in early August. What made the algorithm update one of, if not the, most notable event of the year was that the update was one of the biggest SERP shakeups the industry has seen.

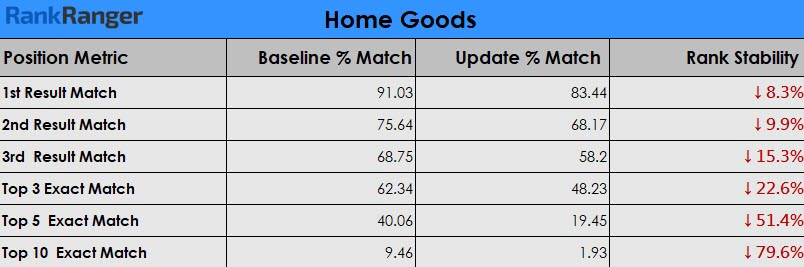

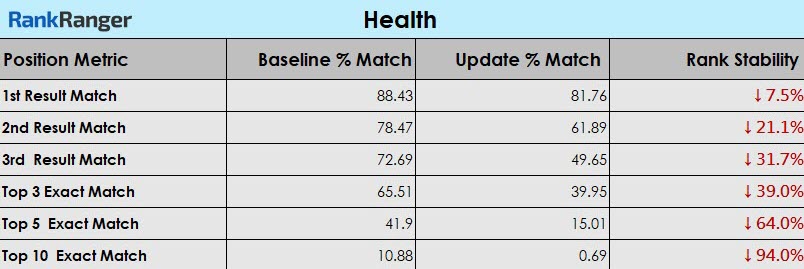

We surveyed the data on the Medic Update and saw a clear difference between this update and most others. Namely, the first and second positions were greatly affected across multiple niches. A typical Google update tends to leave those sites within the 1st and 2nd ranking positions alone, relatively speaking. In the case of the medic update, we saw huge decreases in rank stability at those positions.

Rank stability losses for the home goods niche during the Medic Update includes the top result on the SERP

While all niches were deeply impacted by the August update, there was a noticeable difference between those niches that reflected YMYL (Your Money Your Life) sites and those that did not. Whereas the travel niche saw a 4% decrease in rank stability as a result of the update, the finance industry underwent an 18% stability loss. Similarly, whereas the food & drink niche underwent an 88% rank stability loss among the top 10 results that exactly matched pre and post update, the health niche posted a 94% decrease for the same metric. For this reason, the August update became known as the Medic Update.

YMYL based niches, such as the health niche, showed larger amounts of rank instability during the Medic Update

Access the full set of data surveying the Medic Update.

Google’s New Site Profiling Ability Hits Sites Hard

One of the major themes that came out of the Medic update was a renewed focus on Google’s Search Quality Rater Guidelines. Prior to the update, and in close proximity to its roll-out, Google had made a series of changes to the guidelines, changes that seemed to mirror some of the things we were seeing post update. That is, the changes made to the guidelines focused heavily on YMYL sites and their quality, which was what we saw the Medic Update itself honing in on.

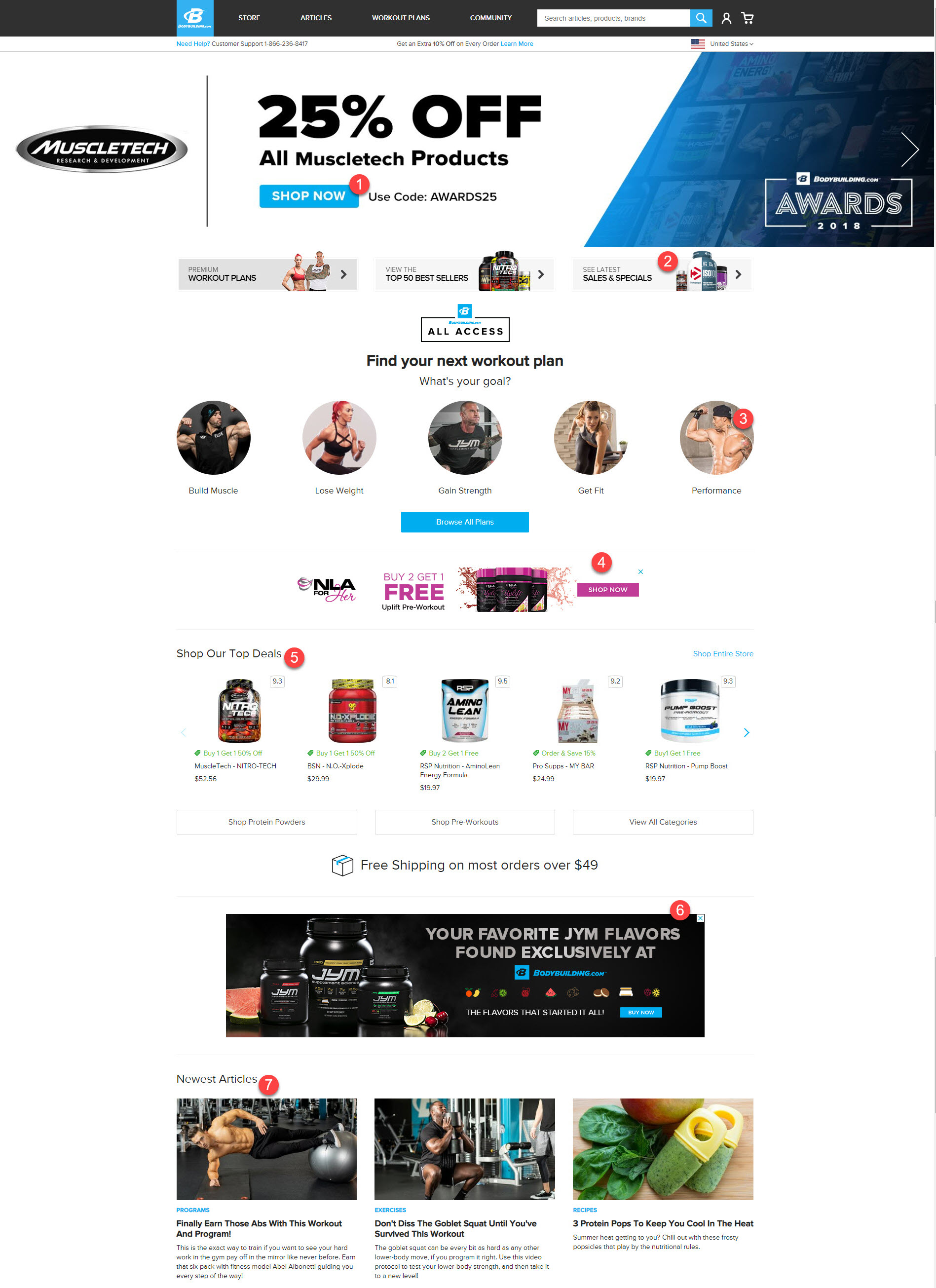

As we started to look at some of the sites hit hard by the Medic Update, it became apparent that Google was most likely algorithmically executing some of the new methods of site review now outlined in the Search Quality Rater Guidelines. To that extent we found that:

- Sites that did not adhere to their core intent profile, did not fare well during the Medic Update.

- Sites that concealed their eCommerce nature, did not fare well during the Medic Update.

- Sites that had experts review their content, did fare well during the Medic Update.

A site shows six paid/advertising elements before getting to its content

The essential takeaway was that Google had developed (seemingly) the ability to profile sites according to some of the newest guidelines related to YMYL sites.

Review the full set of sites studied and highlighting Google’s ability to profile sites.

Google Desktop Video Carousel vs. YouTube Rankings

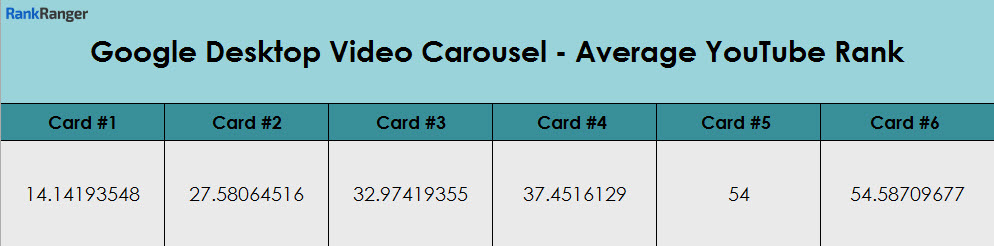

In mid-June, Google began showing a video carousel on desktop. Google all but did away with desktop Video Thumbnails, and threw the YouTube URLs attached to those thumbnails into the new carousel. This opened up the organic results to sites other than YouTube and made ranking within the first few carousel cards, quite important.

I was curious though, was Google merely taking the top results from YouTube and placing them within the video carousel? What was the correlation, if any, to ranking well inside YouTube to being placed within those first few carousel cards?

Of course, YouTube has its own algorithm. For example, YouTube is fond of longer videos. That said, I was seeing plenty of longer videos inside the video carousel. What’s more, there

Seeing all of this, we jumped into the data and found that the gap between where a video was placed within the carousel and where it ranked inside of YouTube was larger than we initially expected it to be. For example, on average, the URL inside the first carousel card is the 14th video YouTube shows you while the 6th card comes up at the 54th position inside of YouTube:

See the full results of our study on YouTube and Google video carousel rank correlations.

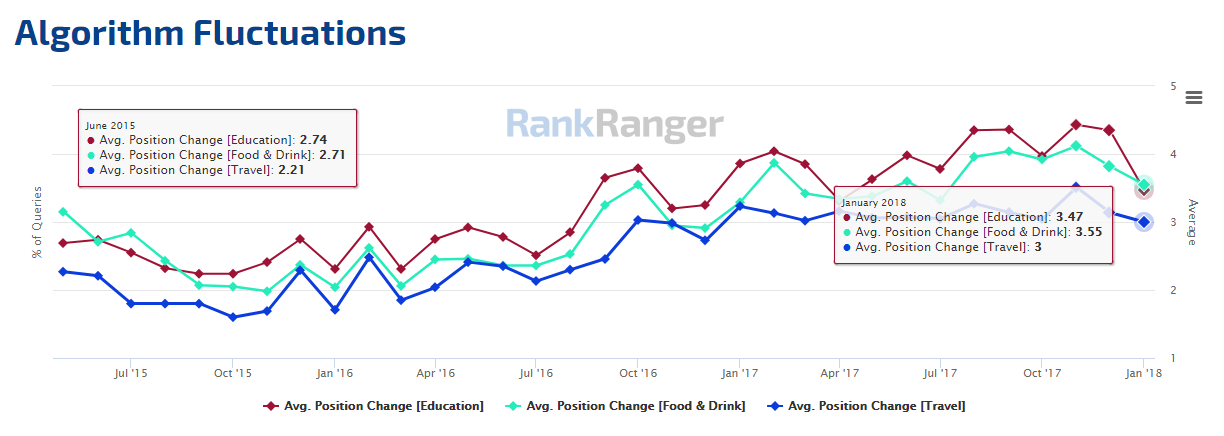

A Historical Look at Rank Stability Over Time

That rank is more volatile than it once was is a common sentiment within the industry. However, we wanted to put some teeth on that notion by looking at how much more volatile rank is today than it was in the past.

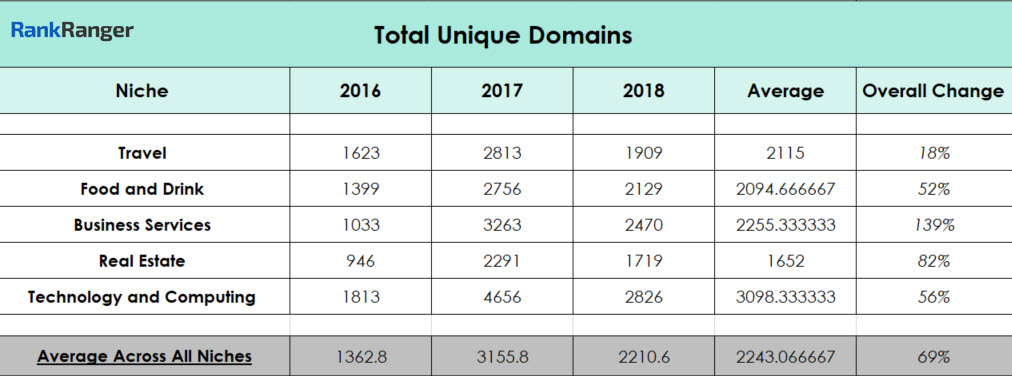

We looked at data going back to 2016 and found that Google is showing far more unique domains for each search in 2018:

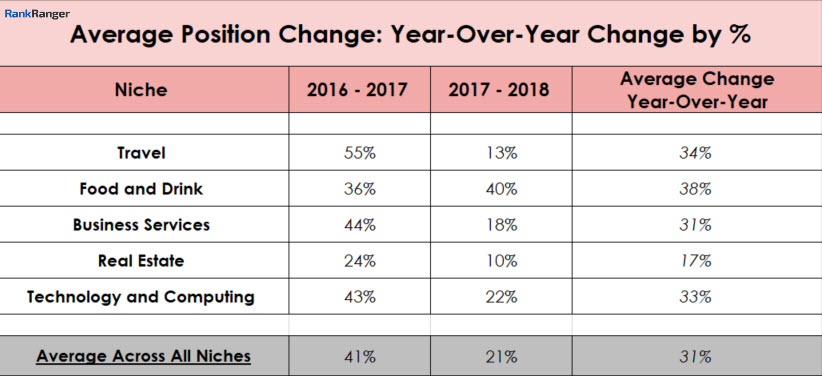

Moreover, we saw a clear increase in the average number of positions Google has been moving sites up/down the SERP:

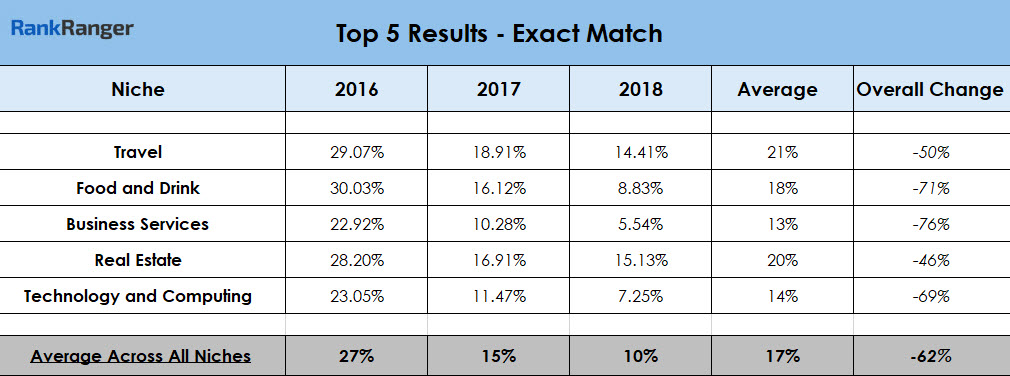

As for ranking, the percentage of queries that produced the same top 5 results in the same order from one month to the next has dropped sharply each year since 2016:

Access the full set of data in our study on historical rank fluctuation levels.

Calling All Research Requests

We know that you, the

That’s why I want to end off by asking: What do you want us to research this coming year?

If you have a topic that would be particularly helpful to you to have researched, let us know. Please reach out to me on Twitter and I’d be happy to see if we can help you out!