Google search advertising spend in the U.S. rose by 17% year-on-year in the first quarter of 2024. Click growth continued to slow, hitting 4% YoY (compared to 8% in Q4 2023).

Cost-per-click continues to increase – up 13% YoY (compared to a 9% year-on-year increase in Q4 2023).

CPC increase. This was most affected overall by an increase in Shopping ads CPC (both standard and PMax).

- CPC increased by 13%, a big jump from the 6% year-on-year increase in CPC of Q4 2023.

- That led to a 21% increase in ad spend year-on-year in Q1 2024, compared to the 13% increase year-on-year in Q1 2024.

Google Search. CPCs are up 40-50% for retailers in the past five years.

- The typical retail brand running Google search ads has seen its average CPC rise by 40-50% compared to five years ago.

- From Q1 2023 to Q1 2024, Google retail search ad CPCs rose about 20% for the median advertiser.

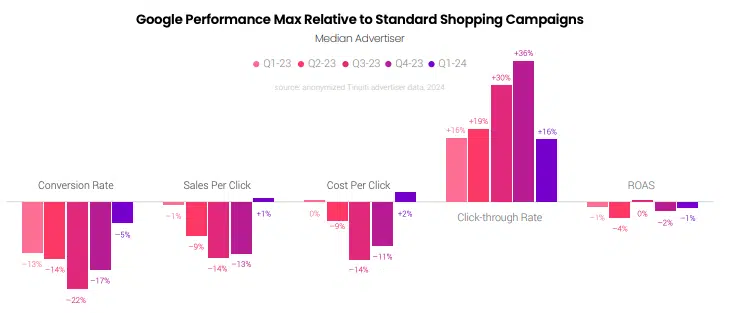

PMax. Performance Max campaigns improve from quarter to quarter.

- The relative performance of PMax campaigns compared to standard Shopping campaigns (SSCs) improved across most key metrics from quarter to quarter.

- Conversion rate was only 5% less than that of SSCs, compared to it being 13% worse last year, and 17% worse in Q4 2023.

- PMax cost per click is 2% better than SSCs CPC, compared to it being 11% worse in Q4 2023.

PMax continues to play a prominent role in advertising on Google:

- During the height of the Q4 2023 holiday shopping season, 91% of retailers placing shopping ads with Google were running PMax campaigns, which remained stable over Q1 2024

- On average, 89% of Google shopping advertisers were running PMax campaigns during Q1 2024, up from the 82% average in Q1 2023.

Why we care: CPCs are increasing while clicks are decreasing. This is bad news all around for advertisers. Especially since Google reportedly had been increasing ad prices to meet targets.

Report methodology. The Tinuiti Digital Ads Benchmark Report utilizes anonymized performance data from advertising programs managed by Tinuiti. The data is based on active programs with consistent strategies. All figures represent same-client growth and are not meant to officially reflect any specific advertising platform’s performance or the experiences of every advertiser.

About Tinuiti. Tinuiti is a large independent performance marketing firm with over 1,000 employees that manages $4 billion in digital media.

New on Search Engine Land

Source link : Searchengineland.com