A carefully designed pricing model is the cornerstone of SEO agency’s success. Agencies need it to secure a steady flow of clients and promote sustainable growth.

That’s why SE Ranking ran a marketing and SEO agency pricing ****** survey in November 2023. In it, we defined dominant pricing ******, average rates, factors causing agencies to raise their prices, and more. Simply put, we wanted to help SEO agencies better understand the state of the industry.

Key Survey Takeaways

- Monthly retainers are the most popular agency pricing model. Roughly one-third of respondents only offer this pricing model and provide no other pricing options. In the US and Canada, the number is even higher. A considerable 48% of respondents from these regions prefer to charge their clients monthly.

- The median monthly retainer is $1,200, while the minimum reported amount is $90. The maximum amount goes up to $10,000.

- 19% of the survey participants, on average, charge their customers more than $3,000 per month.

- Many of the survey participants prefer to keep their pricing flexible. 48% of respondents use a mix of different pricing ******. 22% of the surveyed agencies use all three popular pricing ******; this includes the hourly, project-based, and monthly retainer, depending on the client’s needs. Agencies often try to appeal to different types of clients by offering low entry pricing points with higher maximum caps.

- 70% of the surveyed agencies either increased their pricing recently or plan to in 2024. Compelling outside factors that force agencies to increase their rates include higher operational costs, inflation, increased cost of living, and competitors raising their rates. Internal factors for this include more services added to the stack, greater employee expertise, higher quality of services provided by the agency as well as higher demand for the agency’s services.

- Larger agencies charge higher monthly retainers. The median monthly retainer for smaller agencies (with under five employees) is $913. Agencies with five to 10 people on board on average charge $1,913 per month. Larger agencies with more than 11 employees offer a median monthly retainer of $3,050.

- Agencies that tend to succeed at retaining their clients also have higher monthly retainer fees. Agencies, whose clients stay with them for over three years, charge twice as much ($1,863 median monthly retainer) as agencies who run client projects for under 12 months ($912 median monthly retainer).

- Small agencies with under five employees charge slightly less per month as the number of projects they manage increases. The median monthly retainer for this group of agencies that run under five projects is $1,086. Small agencies managing five to 10 projects on average charge $950 per month. Small agencies that run more than 11 projects at once have an even smaller median monthly retainer ($891).

The most popular pricing ******

52% of the survey respondents use at least one of the three most popular pricing ******: monthly retainers, project-based fees, and hourly rates. While the monthly retainer model is the most popular, 45% of agencies prefer combining the monthly retainer option with other pricing systems. 22% of the agencies we surveyed gave clients the option to choose between these three popular pricing ******.

Only 6% of the survey participants said that they use performance-based pricing next to other pricing ******. Some less popular pricing ****** mentioned by respondents included commission on ad spend and charge per page. Both of these options are used in combination with more popular pricing systems.

Overall pricing ****** distribution chart

Popular pricing ******: regional specifics

While monthly retainer and some hybrid combination of hourly, project-based, and monthly rates make up the two most popular pricing ****** across all analyzed regions, we still noticed some regionally specific patterns. For example, we found that the monthly retainer fee is a dominant model in the USA and Canada, while in Europe it’s closer in popularity to the combination of the three major ******.

The USA and Canada pricing ****** distribution chart

The UK, Ireland and continental Europe pricing ****** distribution chart

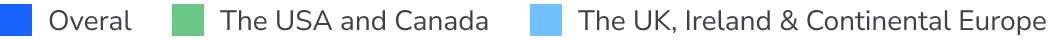

Overall median pricing rates and regional specifics

We calculated median pricing rates for each of the three major pricing ****** (hourly fee, project-based fee, and monthly retainer). These calculations included quoted rates both by agencies using a singular pricing model and agencies using a combination of pricing systems. The overall median pricing rates came out at $96 per hour, $3,250 per project, and $1,200 per month. The rates are higher in the USA and Canada region, with an hourly rate of $112, a project-based fee of $3,625, and a monthly retainer of $1,863. The median rates in the European region are lower, with European agencies, on average, charging $88 per hour, $2,938 per project, and $841 per month.

Pricing rates distribution

We singled out the most popular pricing ranges for hourly, project-based, and monthly retainer pricing ******. Before grouping the quoted rates into ranges, we computed an average for each agency that participated in the survey. Note that most agencies avoid charging all clients the same exact hourly/project/monthly fees. Instead, they offer different fees based on the number of provided services, client’s project complexity, and more.

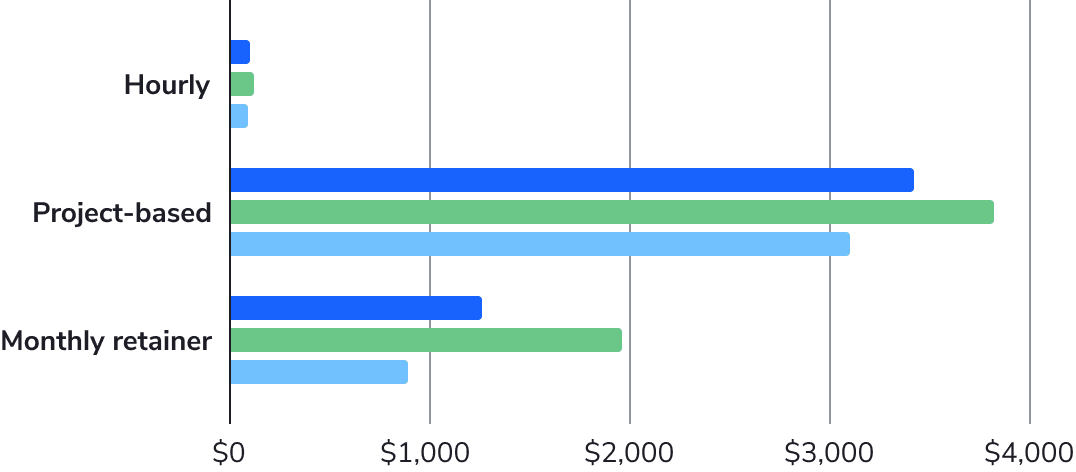

Hourly pricing ranges

While charging customers by the hour isn’t the most popular pricing strategy, 7.4% of our survey participants made this their sole pricing option. More respondents use hourly fees in combination with other pricing ******. As you can see in the chart below, the most popular range is $76-100 per hour.

We calculated each agency’s average hourly fee and then placed it into one of the ranges. Mind that many participants offer flexible hourly rates, (e.g. $30-75 or $70-100).

64% of respondents price their entry-level hourly fee below $100.

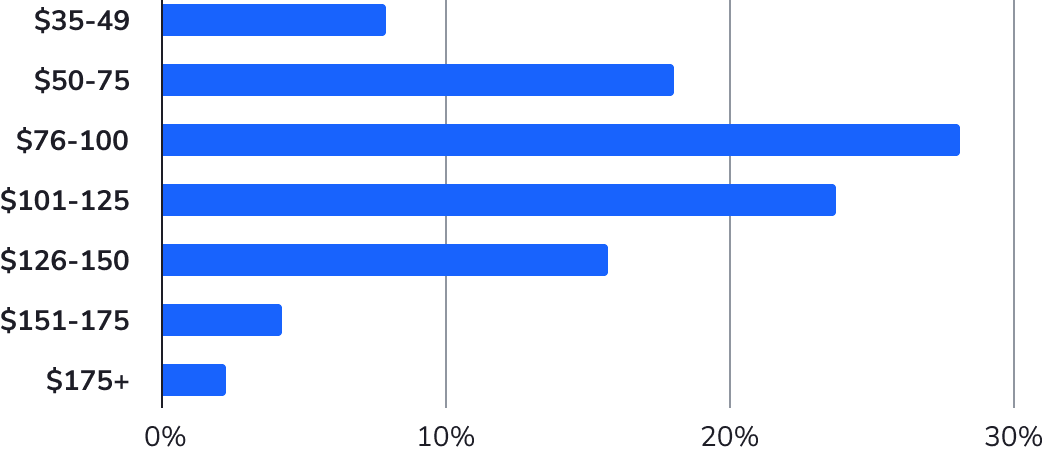

Project pricing ranges

The per-project pricing model sets a commitment for both sides. An agency commits to solving the client’s problem or bringing their ideas to life, and they expect to get a negotiated remuneration in return for their services.

In our survey, the most popular average by-project fee ranges are $1,501-$3,000 and $3,001-$5,000. The minimum quoted fee was $250 by an agency charging their clients $250-$1,000 per project. The maximum reported fee was $35,000 by an agency that on average charges $5,000-$35,000 per project.

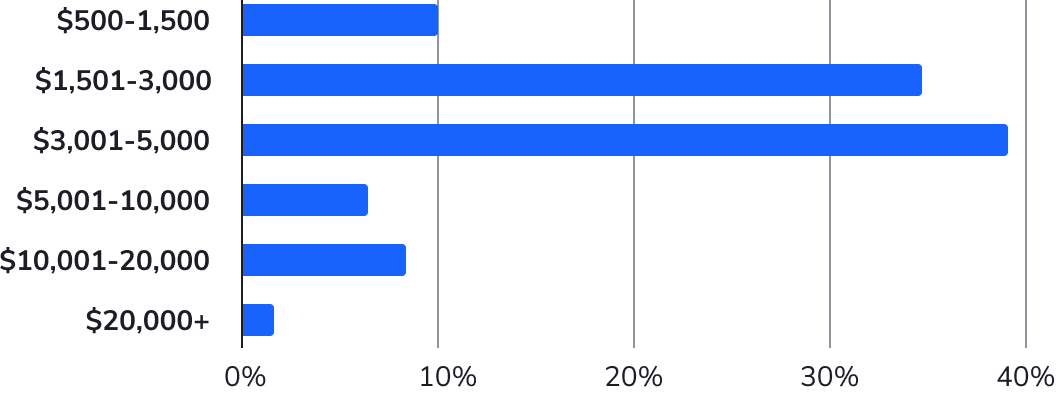

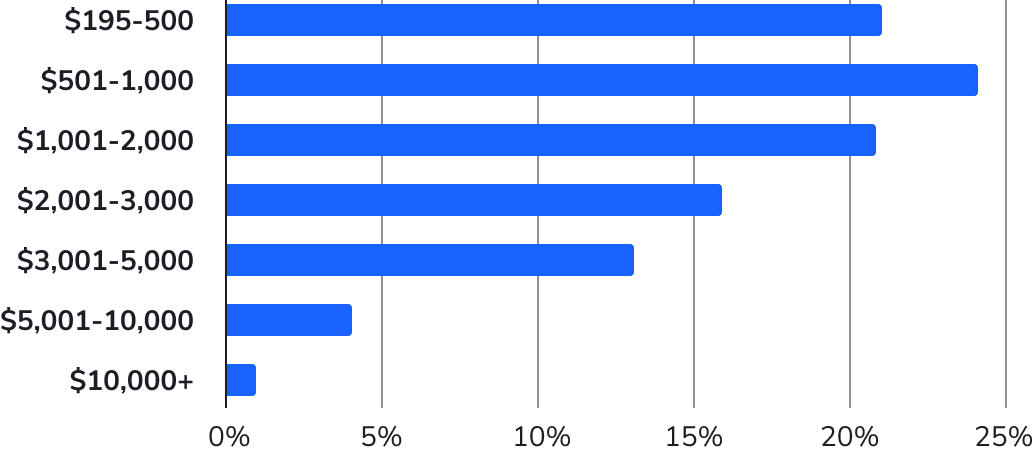

Monthly pricing ranges

Monthly retainer is the most popular pricing model in this survey. Around 33% of all respondents use this pricing model exclusively, with even more surveyed participants resorting to monthly retainer fees along with other popular pricing systems.

21% of respondents on average charge their customers less than $500 per month and 45% of survey participants charge less than $1,000.

19% of respondents have an average monthly retainer of $3,000 and only 5% of respondents charge their clients more than $5,000.

By closely analyzing the monthly rates, we were able to parse out the following insights:

- 81% of the respondents who use the monthly retainer pricing model offer flexible monthly rates, (e.g., $500-$2,000 per month or $2000-5000/month).

- 20% of the agencies surveyed offer a relatively low entry price, below $1000 per month, but simultaneously charge larger clients up to $3000. The median difference between the lowest and highest retainer rates quoted by a single agency is $1500. In some cases, the difference is even more drastic, with one agency charging their client $500-$7,500/month.

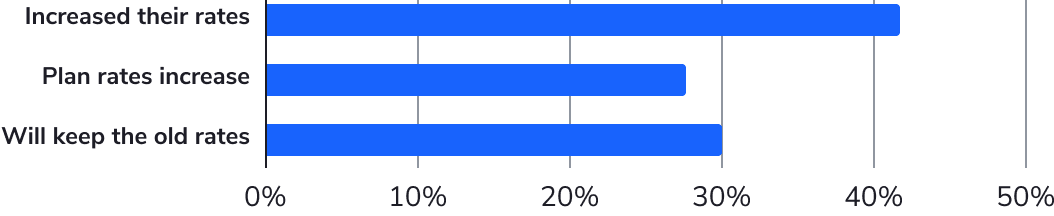

Price hikes: trends and reasons

We asked survey participants if they had increased their rates within the past 12 months. And if not, we asked them if they planned to in the future. We also asked them to share their reasons for their decisions.

43% of respondents recently increased their pricing, and 27% said they were planning to raise their current rates in 2024. 30% of respondents said they preferred to keep their rates the same.

Reasons for increasing rates:

- Agencies are forced to increase their rates as a result of higher operational costs, increased subcontractor rates, inflation, and higher costs of living.

- Some agencies keep a close eye on their competitors’ rates and try to price-match.

- Others note that their improved expertise allows them to begin delivering at higher levels and hence compete at higher market rates.

- Multiple agencies report that their decision to increase rates is backed by a growing demand for their services.

- Other factors spurred by the agency’s growth and development include the addition of more services to their stacks, the adoption of a more niche approach, and the adoption of a clear selling point.

- Some survey participants said they hadn’t increased their prices in years, and that this was long due. One respondent noted that they “kept prices the same since before the pandemic to help clients while they navigated what’s next.”

Some major reasons for not increasing pricing include competitive pressure, difficulties associated with attracting new clients, and already charging clients at the higher end of the scale. Some agencies noted that they are new in the industry and need to establish their brand first before increasing their rates. Finally, some of the agencies unwilling to increase their rates attempt to tackle increased operational costs by introducing new pricing ******, being more flexible, and cutting their budgets (specifically on tools).

SE Ranking: a budget-friendly SEO suite designed for small and mid-sized agencies

No matter how much you choose to charge your clients, it’s always a good idea to have a premium SEO toolset at a fair price. SE Ranking offers:

- A complete toolkit capable of automating every major SEO task, from keyword research and content creation to technical SEO and backlink analysis.

- Unique datasets that deliver reliable insights: constant improvement of data quality is SE Ranking’s top priority.

- Free data migration for annual subscriptions.

- 3 to 5 manager seats are already included in the Pro and Business plans.

- Flexible pricing tiers to match different data needs.

- Special Agency Pack add-on that caters to the needs of SEO agencies by offering unlimited WL reporting, a lead generation widget, an extra client seat, exclusive placement in the curated agency catalog, and more.

SE Ranking pricing survey: participants, methodology, and more

The survey included 135 agencies from the US, Canada, Australia, New Zealand, Singapore, the UK, Ireland, and continental Europe.

The results demonstrated that agencies from these regions have similar pricing model preferences, close pricing ranges, and only minor regional differences. With 44% of respondents originating from continental Europe, the survey may demonstrate a certain bias toward this region. There are separate blocks in this survey that analyze regional specifics within the US and Canada vs the UK, Ireland, and continental Europe.

A good chunk (57%) of the respondents represented small agencies with under five people on board. Another majority (27%) of respondents came from agencies comprising five to 10 specialists. Larger agencies with 11 to 25 and 25+ employees comprised 9% and 7% of the respondents, respectively. This skewed our survey data toward smaller SEO agencies. Even so, the digital agency landscape is dominated by small agencies. Evidence for this lies in an older survey on SEO pricing by Moz, where 69.8% of participants were from agencies with up to 10 employees. Also, a 2022 agency pricing report by Sprout Social found that 52% of the agencies they surveyed had less than 10 employees.

We used a currency converter to convert pricing quotes in euros, British pounds, and other local currencies to dollars.

When calculating the percentage, we rounded the results to the nearest whole number.

Our final disclaimer: We only received 135 responses, which isn’t enough to reach statistical significance. Still, we believe that this survey overview can offer valuable insights for SEO agencies seeking to benchmark their pricing model against those of their peers.