The Arena Group, behind popular brands like Sports Illustrated, The Street, Parade and Men’s Journal today posted revenues of $58.8M for the second quarter of 2023. A 9% increase compared to the previous year.

Digital revenue alone accounted for $38.4M, a 10% increase on the same quarter of 2022. Print revenue increased 9% to $20.4M, helped by Sports Illustrated Swimsuit’s 2023 launch.

While the average number of monthly pageviews across their networks of sites were down 12%, they were able to grow their overall income as revenue per pageview increased by 35%.

Their finance vertical – with their most popular site in the space being The Street – had a record quarter with 38 million monthly average pageviews. This is from their own Google Analytics data, showing numbers were up 31% compared to the prior-year quarter.

Other sites in their finance vertical include ToughNickel and Dealbreaker.

The Arena Group, then TheMaven acquired TheStreet back in 2019 in a $16.5M cash deal, so they’ll be relieved the site is continuing to perform well.

Similarweb estimates the site gets around 31.4% of its 37M monthly visits from organic search, trailing referral traffic which sits at 49.7%.

Did Parade Grow Despite Spinning Off A Lot of Its Content?

Another brand that saw increased traffic was Parade, an entertainment, lifestyle and health brand that started life as a print magazine back in 1941. The last edition of the magazine was published in 2022.

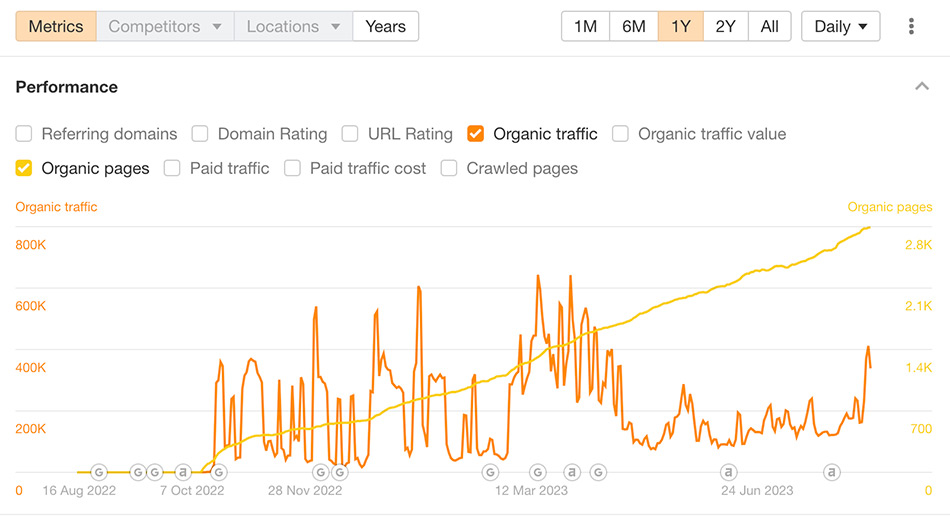

The Arena Group noted that Parade saw a 33% increase in monthly average pageviews compared to the same quarter in the prior year. Again this is measured in Google Analytics, rather than a third-party estimate.

What’s interesting is that in my 16 companies dominating Google article, on point #38 I revealed how they redirected a lot of their pet-related content to a brand new domain at ParadePets.com.

If they are only counting Parade.com in the analytics here, it’s really impressive it has continued to grow by a significant amount despite essentially losing a lot of content.

For the Parade.com website alone, neither Semrush nor Ahrefs corroborates that reported increase, though they’re just focused on traffic from search. (Ahrefs is steady, while Semrush shows a pretty big drop).

Sadly we only have three months of data with a free Similarweb plan, so I can’t see how they compare. Either way, it’s great to see they’re seeing increases on some specific brands.

They Continue to Grow Our Brands on the Sports Illustrated Domain, Now Dominating the Formula 1 Niche

In recent months Sports Illustrated launched a Formula 1 news section on the SI.com domain at /fannation/racing/f1briefings/.

In their earnings report they stated it’s “now the second largest F1-focused site after just eight months, according to data from Comscore and MRI-Simmons.”

I wouldn’t personally call this another ‘site’ but I guess that’s standard terminology in this space.

Semrush does not have any data at all for this folder on their site, and while Ahrefs does have data, it’s about as erratic as you can get:

They certainly haven’t been slow about publishing content there.

I’m a little bit surprised that this section of the site even exists since they already have a dedicated F1 area on the much cleaner URL at https://www.si.com/formula1.

I’m guessing different teams are working on the main SI.com content compared to the teams working under the ‘FanNation’ brand but I won’t pretend to have any insights there.

The main highlight of their earning call was actually the announcement that they are joining forces with Bridge Media Networks. It’s a very TV-focused deal so I don’t feel it’s too relevant to get into here, but I’ll make sure I separate their digital revenues going forward, as they’re set to massively increase overall revenues in future quarters.

We’re a small bootstrapped team, trying to share some of the best SEO insights and niche opportunities on the internet. Clicking the heart tells us what you enjoy reading. Social sharing is appreciated (and always noticed). – Glen Allsopp